The best perk of working at a global company is talking to customers in various countries about their operational challenges and best practices, and the ability to compare their figures. Let’s look at some lessons learned from comparing two years of actual FRISS data.

Executive Summary

As a worldwide provider of AI-powered fraud and risk detection for the property/casualty insurance industry, FRISS was uniquely positioned to examine an anticipated uptick in fraudulent insurance claims during the pandemic. It didn’t show up in the numbers. Here, Andrew Enoch, a product marketing manager at FRISS, who is also a former claims adjuster, gives his take on what happened and provides action steps for combatting fraud going forward.Most major life events are fairly predictable and happen as a regular part of someone’s life: marriage, babies, divorce, buying a home. Most sound nice, yet from an insurance perspective they could be seen as financial stressors. Obviously in the past years, a lot of stress hit us. So, in looking at the data, what happens when the whole world is thrown into uncertainty? What effect does it have on fraud? Let me guide you through our data and investigate some answers. Having stood in the adjuster’s shoes, at the end I also provide you with some actions I would take.

Changes in Fraud Cases

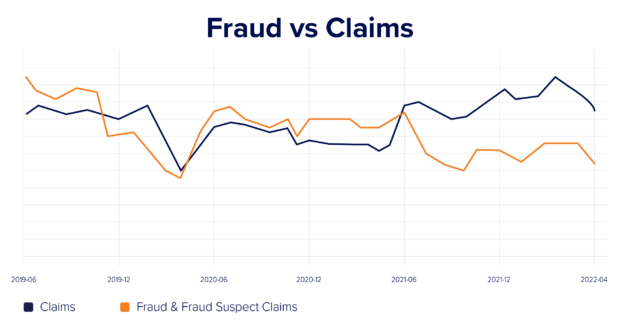

As the world was shutting down due to the pandemic, FRISS saw a drop in the number of claims being processed globally. Fraud cases dropped right with it.

If you think back to those first few months of the shutdown, there was a lot of uncertainty. There was a question of how governments would react—how would they support people as industry came to a halt? During that uncertainty we would expect a large spike in fraud. There could be a dozen reasons and we may never know, but two reasons do come to mind: Either the change in Claims/SIU operations caused some fraud to slip through the cracks, or the fraudsters were focused elsewhere.

COVID Changes to Operations and the Effect on Investigations

We all remember some of the changes that occurred to operations when COVID hit. KPMG research shows that 85 percent of insurance CEOs believe COVID-19 has accelerated the digitization of their operations and the creation of next-generation operating models.

One of the most notable was special investigations units going virtual. This didn’t happen at every carrier; however, it seemed to be fairly widespread. Some might argue that this change meant fraudulent cases were missed—or investigations were not as effective as they could have been. This makes sense when we think about being face to face with someone and the extra pressure that would put on a claimant who may have misrepresented their claim. However, there were tradeoffs; these carriers were saving money on travel expenses, and in theory investigators could handle more cases when they were virtual than in person.

Since the world began to open up, something has shifted. As the global stats indicate, claims volume has continued to rise while the fraud volume has fallen.

We can only guess at the conversations leaders were having about this new model. They seemed to be having the same fraud mitigation impact without the travel. Since the world began to open up, something has shifted. As the global stats indicate, claims volume has continued to rise while the fraud volume has fallen. The question then becomes whether there is less fraud in the industry, or is there fraud slipping through the cracks? The stats only show us what we catch.

Where There Was Fraud

I remember my former co-worker telling me about a wildfire catastrophe he was working and how he caught a man on drone video setting fire to his home. I would like to say this is an isolated incident, but we all know that when catastrophes occur, fraud skyrockets. According to the University of Portsmouth, we should have experienced a spike in fraud during COVID. So, why didn’t we?

Well, the same article goes on to state a 400 percent increase in COVID and cyber-related fraud. This makes perfect sense. One major part of the fraud triangle is opportunity—fraudsters will always go where the opportunity is greatest with the least amount of risk. In this case that was into the new market of COVID testing, where money was running freely with very few checks for authenticity. Perhaps our usual suspects were busy elsewhere.

So, What Now?

In reality, both operational changes and COVID-related factors played a role in the recent P/C fraud arena. There are many other factors playing a role. Regardless, the question is: What now? P/C is again a big target for opportunistic fraudsters, so now is a good time evaluate a few things:

- Review your SIU referral, fraud and suspected fraud rates and see if there have been drastic changes.

- Review your pre- and post-COVID operations and see if you need to adjust.

- Provide your adjusters with tools and training to make higher-quality referrals that lead to better, more efficient SIU investigations.

These are all starting points toward impactful changes to your organization.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits