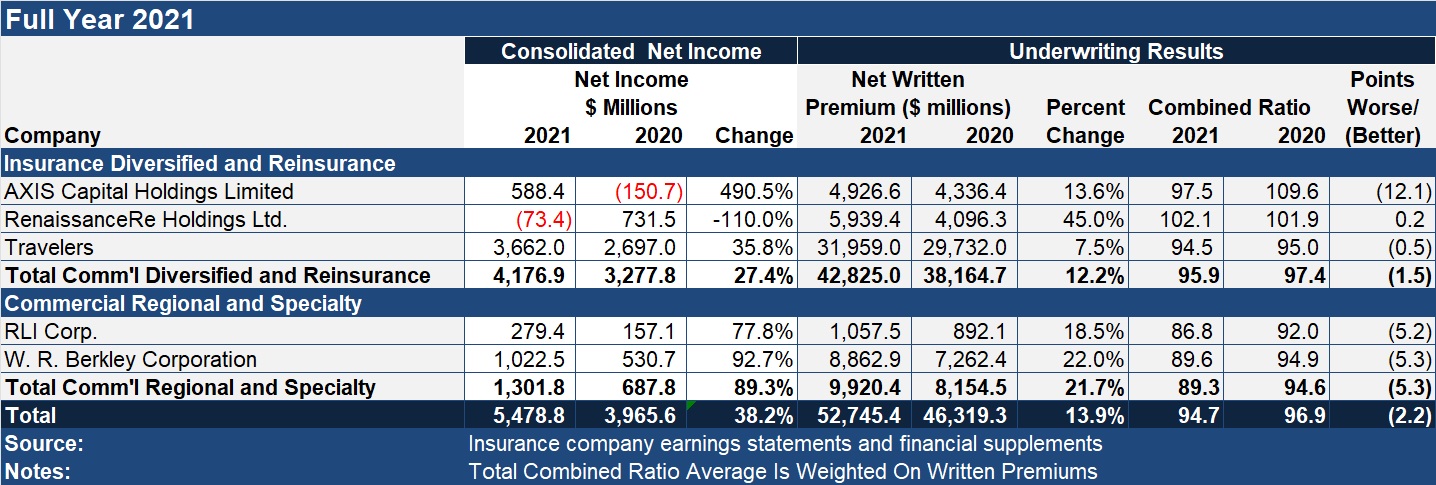

For publicly traded commercial insurers and reinsurers that reported 2021 earnings in January 2022, net income soared nearly 40 percent, with double-digit premium growth and higher levels of underwriting profit boosting bottom lines.

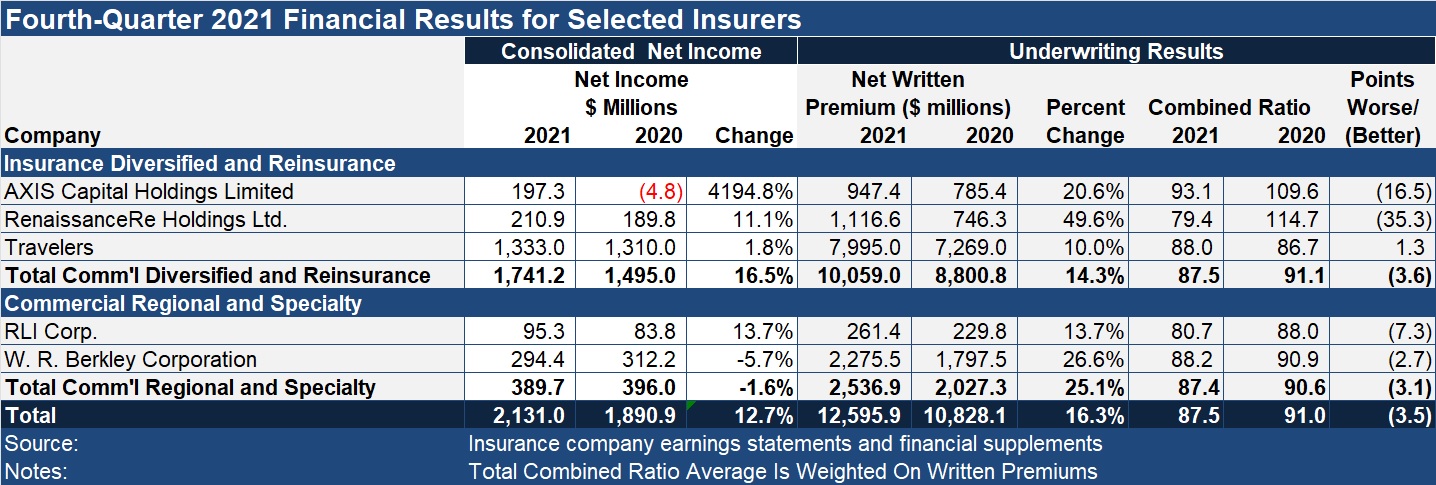

For the month of January so far, reports from five commercial lines insurers and reinsurers saw combined ratios decline almost across the board, with AXIS Capital showing the biggest combined ratio improvement of 12 points.

Executive Summary

Headline results from last week’s earnings conference calls from property/casualty commercial specialty insurers and reinsurers included reports of RLI’s 26th straight year of underwriting profits in 2021 and RenaissanceRe’s report of an operating profit in spite of incurring over $1 billion in catastrophe losses.Premium growth rates ranged from 7.5 percent for Travelers to an eye-popping 45 percent at RenaissanceRe—adding up to an average of almost 14 percent across the six-company cohort overall.

Last week’s reports came from RenaissanceRe (Jan. 26), AXIS Capital (Jan. 27), RLI Corp (Jan. 27) and W.R. Berkley Corp. (Jan. 27), with RLI and Berkley reporting sub-90 combined ratios, and AXIS reporting its best underwriting results in a decade.

At AXIS, efforts to shift the portfolio toward specialty insurance instead of reinsurance, and specific actions to reduce property and property-catastrophe reinsurance volume, were key drivers of a more than $700 million improvement in net income for 2021 over 2020.

AXIS was the only company in the group to report both red ink on its bottom line and an overall underwriting loss in 2020. RenRe was the only one to do so in 2021.

RenRe’s overall combined ratio worsened only slightly, however—by 0.2 points to 102.1, with a 7.3 point improvement in the casualty and specialty combined ratio helping to offset 7.7 points of deterioration in the property combined ratio. The reinsurer capitalized on opportunities to grow in a strong market, and in spite of incurring over $1 billion in property-catastrophe losses, managed to report an operating profit of $84 million, attributing the positive result to a diversified book of business and superior risk selection capabilities. (Editor’s Note: Together, the positive operating income figure combined with the impacts of net realized and unrealized losses on investments, net foreign exchange losses and related tax items resulted in a net loss of $73.4 million for RenRe in 2021.)

RenRe’s fourth-quarter income jumped more than 11 percent, with a property reinsurance combined ratio of 64.4, pushing the companywide combined ratio to 79.4—the best fourth-quarter combined ratio of any of the publicly traded reinsurers and commercial insurers reporting in January.

While ink colors changed for the full-year 2021 and 2020 financial reports at AXIS and RenRe, consistency was the dominant word on the lips of executives at RLI as they described the drivers of the specialty insurer’s 26th consecutive year of underwriting profitability. A casualty combined ratio of 84.9 and an overall combined ratio of 86.8 for the year were two key metrics that reveal the story of RLI’s continued financial success.

Highlights of the last week’s earnings conference calls, including market observations for 2022, discussions of two hot topics—cyber appetites and Jan. 1 reinsurance renewals—along with key growth and profit metrics for fourth-quarter and full-year 2021 are presented separate articles in today’s CM Spotlight Newsletter.

Here’s a preview of what executives said, with links to articles about their company’s results.

“Our portfolio of products is in good order, and our specialty footprint is broad. We are ready and willing to continue growing profitability where disruption and opportunities exist.”

Craig Kliethermes, RLI

Read more in “RLI: 26 Straight Years of Underwriting Profit.”

“We took decisive action and reduced our reinsurance property and property-cat premiums by 45 percent.”

Albert Benchimol, AXIS Capital

Read more in “AXIS Capital 2021: A Year of Repositioning.”

“In our property business, rate increases were sufficient to maintain our current book, but not enough to warrant significant growth.”

Kevin O’Donnell, RenaissanceRe

Read more in “RenRe: Absorbing Over $1B in Weather Cats”

“Our scale, profitability and cash flow support our ability to invest well over a billion dollars annually on technology”

Alan Schnitzer, Travelers

Read more in “Travelers Leaning Into AI, Tech as Earnings Rise.”

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies