Early last year, the leader of RenaissanceRe predicted that his company would put $1 billion more net written premium on the books in 2021 than it did in 2020.

RenRe’s President and CEO Kevin O’Donnell was wrong.

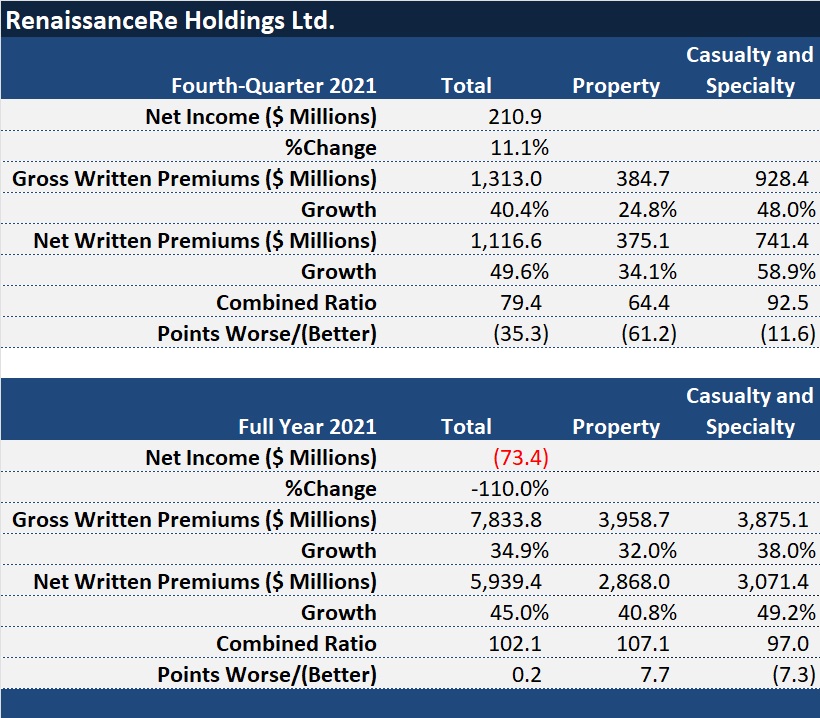

The reinsurer actually booked $5.9 billion of net written premiums in 2021—$1.8 billion more than the $4.1 billion total for 2021. And with several years of growth behind it, the company will seek to maintain its current book, O’Donnell told analysts during an earnings call last week as he reported on the reinsurer’s ability to weather significant catastrophe losses in 2021 and recapped activities during Jan. 1 reinsurance renewals.

“2021 was the second highest loss year for natural catastrophes in our industry’s history, which are estimated to exceed $100 billion. In a year like this, you can see the power of the platform we have built,” said Chief Financial Officer Robert Qutub, noting that RenRe reported a modest operating profit, absorbing the net negative impact from catastrophe losses of more than $1 billion.

RenRe reported an operating profit of $84 million for all of 2021, which the two executives attributed to the advantages of a large, diversified book of business and superior risk selection capabilities.

(Editor’s Note: Together, the positive operating income figure combined with the impacts of net realized and unrealized losses on investments, net foreign exchange losses and related tax items resulted in a net loss of $73.4 million for RenRe in 2021, shown in the table above.)

RenRe’s overall combined ratio worsened just slightly in 2021—by 0.2 points to 102.1. A 7.3 point improvement in the casualty and specialty combined ratio helped to offset 7.7 points of deterioration in the property combined ratio.

RenRe’s fourth-quarter income jumped more than 11 percent, with a property reinsurance combined ratio of 64.4, pushing the companywide combined ratio to 79.4—the best fourth-quarter combined ratio of any of the publicly traded reinsurers and commercial insurers reporting in January.

On RenRe’s 2021 top line, growth was evident across the book, with net property reinsurance premiums rising 40.8 percent and casualty and specialty premiums jumping 49.2 percent in 2021 compared to 2020.

RenRe’s gross property reinsurance premiums grew 32 percent overall, but property-catastrophe premiums only grew 18.5 percent. Premium volume for “other property” rose 54.9 percent.

Despite the lower level of growth on the property-cat side, $1.4 billion in weather-related large losses added 58.6 points to the property reinsurance combined ratio in 2021.

Said President and CEO Kevin O’Donnell: “It was a difficult year where three out of four quarters were impacted by weather-related catastrophic losses and interest rates remained near record lows.”

Noting that RenRe’s full-year operating return on equity was just 1.3 percent, the CEO characterized the result as disappointing. Still, he expressed confidence that RenRe has the right strategy to deliver superior returns over the long term. Like Qutub, he supported the view by noting that a diversified book of business helped the reinsurer to post an operating ROE of 14.4 percent in the final quarter of the year, in spite of $50 million of net negative impact from fourth-quarter large catastrophic events.

Not shown on the chart above, RenRe also continues to benefit from fee income coming from its third-party capital management business, RenaissanceRe Capital Partners. Total fee income was $30 million in the fourth quarter and $129 million for the year.

Stable net investment income of $319.5 million also boosted operating results, but this was partially offset by $218 million of realized and unrealized losses, resulting in total investment returns for 2021 of $101 million, down from $1.2 billion in 2020.

Turning his attention to 2022, O’Donnell said, “In contrast to the [2021] year’s catastrophe losses—and in part due to them, we had a strong January 1 [2022] renewal….”

“In our property business, rate increases were sufficient to maintain our current book, but not enough to warrant significant growth.”

Kevin O’Donnell, RenaissanceRe

“The market trend in 2021 was to move away from property cat risk due to fears of climate change, social and monetary inflation, as well as a lack of confidence in cat modeling. However, our expertise and experience gave us the confidence to know when we were being paid adequately to assume this risk which we are uniquely positioned to understand and price…”

The CEO noted that RenRe achieved several important goals for its property book at the 1/1 renewal—getting more rate, improving terms and conditions, adjusting for an increased view of risk, decreasing exposure to aggregate deals, and keeping probable maximum losses flat.

“In our property business, rate increases were sufficient to maintain our current book, but not enough to warrant significant growth,” he said.

Later, he said, “Looking forward to the midyear renewals, we anticipate the positive trends in this market to persist and should remain first call on any opportunities that arise.”

Overall, considering property and casualty together, RenRe reduced its growth rate at the 1/1 renewal, O’Donnell said, without providing an overall figure. He did note that the reinsurer is already a lot bigger than it was a few years ago, and Qutub quantified that, stating that RenRe’s net premiums written have jumped 75 percent since the beginning of 2020.

“A significant amount of growth in our property premiums over the last few years has been in other property due largely to the substantial rate increases in the U.S. property E&S market,” O’Donnell noted at one point.

In 2021, RenRe’s gross property reinsurance premiums grew 32 percent overall, but property-catastrophe premiums only grew 18.5 percent. Premium volume for “other property” rose 54.9 percent.

Providing another highlight of RenRe’s 1/1 renewals, the CEO noted growth in the specialty portfolio, focused on cyber. “Cyber is particularly dislocated with very strong demand and limited supply, resulting in triple-digit rate increases and tightening terms and conditions,” he said.

The Future of HR Is AI

The Future of HR Is AI  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered