Reviewing the 2021 highlights of both a final quarter and a year that saw Travelers deliver double-digit returns-on-equity, the company’s chief executive focused on technology investments aimed at building for future during an earnings call yesterday.

“Our scale, profitability and cash flow support our ability to invest well over a billion dollars annually on technology,” Alan Schnitzer said, during his opening remarks.

Analysts were most interested in finding out whether market conditions and loss and exposure growth trends would continue to support historically good results in commercial lines, and whether forthcoming rate filings in personal auto would turn around the only business segment that showed combined ratio deterioration—personal lines—during the Q&A portion of the call. But Schnitzer focused almost half of his 12 minutes of introductory comments on the call on the Hartford-based company’s technology and AI initiatives, and the benefits to shareholders and boosts to customer satisfaction that are flowing from them.

“We’re delivering great experiences for our customers and a more efficient outcome for our shareholders,” he said several times as he described the company’s tech investments.

“Through our focus on optimizing productivity and efficiency, we have been able to meaningfully increase our overall technology spend over the last five years while at the same time, significantly reducing our expense ratio,” he said.

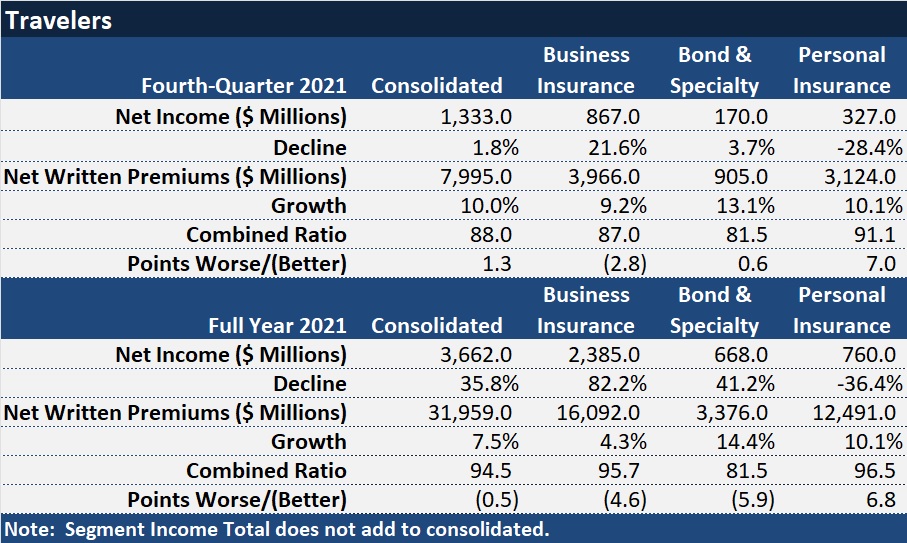

Chief Financial Officer Daniel Frey later reported on expense ratio improvement that drove an overall combined ratio improvement of 0.5 points to 94.5 in 2021. Frey said the company reported a historically low 29.4 expense ratio for the full-year, down from 29.9 in 2020, and down 2 points from five years ago.

In spite of incurring $1.5 billion in catastrophe losses in 2021, which added 6.0 points to the Travelers overall loss ratio, the loss ratio component of Travelers’ combined stayed flat at 65.1 in 2021 and 2020 ratio.

For the fourth quarter, the combined ratio deteriorated 1.3 points to 88.0 in 2021, compared to 86.7 in fourth-quarter 2020, with the loss ratio worsening 2.2 points and the expense ratio improving 0.9 points.

On the top line, net written premiums jumped 10 percent in the fourth-quarter and 7.5 percent for the full year.

Putting everything together, Schnitzer said the underlying underwriting profit of $2.9 billion (excluding the impact of cats and favorable prior-year loss development) for the full year last year—a record for the company—together with outstanding investment returns, produced $3.5 billion in core income, corresponding to an ROE of 13.7 percent. “In short, we’re firing on all cylinders,” he said.

(The chart below displays net income including the impacts of cats and prior-year loss development rather than “core” income)

Wildfires, Roofs and Roboticists

Drilling down on Travelers’ investments in technology, Schnitzer emphasized the customer and efficiency benefits during his introductory remarks.

“We’re digitizing the value chain, leveraging cloud technology, leaning into artificial intelligence for everything from simple automation to deep learning, tapping into new data sources and building increasingly accurate predictive models.”

Giving a specific example of cost savings, he said, “We have increased our spending on strategic technology initiatives by 50 percent while reducing routine but necessary expenditures,” he said, referring specifically to the 2021 completion of a strategic three-year plan known as “Right Touch” in the claims function of Travelers. “That effort resulted in more than $125 million of annual run-rate savings, which is reflected in our results,” he said.

Travelers has a size advantage in being able to build and leverage technology applications, he stressed. “With meaningful opportunities to transform the way business is done, scale is going to be an increasingly important differentiator,” he said.

But why not acquire technology instead of building it, an analyst asked the CEO during the Q&A portion of the earnings call.

Schnitzer responded that Travelers executives approach the buy vs. build question “agnostically,” sometimes buying, other times licensing, and still others building. “In virtually every significant investment we make, we take a step back and we [ask] what are the capabilities we need and what’s the fastest, most cost-effective, least risky way to get it….

“If it’s proprietary, we want to own it or control it or buy it or develop it. If it’s not, we’re happy to go get it in other ways,” he said.

Describing improved customer experiences created as a result of Travelers investments in digital capabilities that started before the pandemic, Schnitzer noted that insurer’s timing was spot on in anticipating higher rates of digital adoption. “When the pandemic accelerated the trend, we were prepared to meet the need,” he said, reporting that Travelers using virtual claim handling capabilities on most auto appraisals and wind-hail claims.

Giving a specific example of the use of artificial intelligence, Schnitzer described Travelers’ use of “aerial imagery, coupled with proprietary deep-machine learning to accelerate damage assessment and claim resolution in the wake of catastrophes.” In particular, he noted that during the recent Colorado wildfire, Travelers was able to serve customers before they even returned to their homes.

All together, technology investments are allowing Travelers to meet a goal of closing 90 percent of its catastrophe claims within 30 days—”and exclusively with Travelers claim professionals, instead of also relying on independent adjusters.”

The CEO also spoke about “data and models” that support decision making throughout the enterprise, noting that the carrier has more than 60 million data records related to businesses, individuals and distributors, “including virtually every business in the U.S.”

Travelers leverages internal data records and more than 2,000 external data sets, which fuel 1,000-plus advanced analytical models, he said.

“Our models support, risk selection and segmentation, pricing, reserving, claim response, and more.”

“Our tech data and analytics advantage is significant and hard to replicate,” he said, going on to describe how the company has developed and trained AI to evaluate roofing characteristics using aerial imagery— integrating that intelligence into property underwriting segmentation and pricing.

Travelers has made a related talent investment, too, he said. “We start with world-class expertise and traditional insurance-related disciplines, and enhance that with leading computer data, [as well as] industrial engineers, design professionals, geophysicists, behavioral scientists, AI experts, roboticists, meteorologists, specialized healthcare professionals, and so on.”

Segment By Segment

Schnitzer, Frey and the leaders of the business insurance, specialty and bond, and personal lines segments gave detailed reports on drivers of premium growth and bottom-line results, with references to record-breaking levels of profit and volume mentioned frequently.

While related commentary about rate changes in various segments, such as business insurance, indicated some declines in comparisons with prior quarters, Schnitzer delivered upbeat news about exposure growth, which combines with rate hikes to drive premiums higher.

Specifically, Schnitzer said that exposure growth for the business insurance segment was roughly 4.5 points—the highest level in 15 years. “That’s a very encouraging sign, both in terms of economic activity and its contribution to written margin expansion,” he said.

For Travelers, renewal rate change for business insurance excluding the workers comp line was 7 percent. Even workers comp, a line for which rate “was a little more negative than we’ve seen over the past year,” had positive exposure growth. And the negative rate change was “consistent with the strong profitability of the line,” Schnitzer said.

Citing information from the U.S. Bureau of Labor Statistics, Schnitzer reported that average hourly earnings about 6 percent annualized rate over the past six months, nearly double the 3.5 percent rate reported for the first six months of the year. “Wage inflation is a benefit in terms of margin contribution,” he said.

In terms of profit by segment, Schnitzer said that the business insurance and specialty insurance segments together had an underlying 2021 combined ratio of 90.4, improving nearly 4 points from 94.1 in 2020.

Only the personal lines segment had a worse combined ratio in 2021 than 2020 for Travelers. More than 8 points of deterioration in the personal auto line contributed to the result.

Michael Klein, president of the personal insurance segment, reported that the fourth-quarter 2021 combined ratio of 104.1 for auto was up about 18 points, compared to the fourth-quarter 2020. The 2020 result, he said, reflected low loss activity during the pandemic, while 2021 loss levels rose as miles driven and claim frequency rebounded to pre-pandemic levels. The carrier also saw higher loss severity in line with rising vehicle replacement and repair costs.

In order to repair personal auto’s underwriting results, Travelers has started filing for rate increases, with rate hikes taking effect in 11 states already in the second half of 2021. He said the carrier anticipates putting through additional rate increases in 25 more states in 2022.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark