RLI’s 2021 fourth-quarter represented Chairman Jon Michael’s last quarter at the helm of the specialty insurer as chief executive officer. Craig Kliethermes, who took the reins as president and CEO on Jan. 1, described the final quarter’s results, ending a 26th straight year of underwriting profits for the company, as “emblematic of [Michael’s] track record of success during his 21-year tenure as CEO.”

Highlighting the milestones of Michael’s tenure, Kliethermes noted that RLI:

- Produced an underwriting profit in every year that Michael was CEO.

- Reported underwriting profits in 81 out of his 84 quarters over which Michael led the company. “a remarkable 964 batting average.

- Delivered total shareholder return over his tenure of over 2,100 percent, or roughly 16 percent annually, exceeding comparable benchmarks.

“Our portfolio of products is in good order, and our specialty footprint is broad. We are ready and willing to continue growing profitability where disruption and opportunities exist.”

Craig Kliethermes, RLI

Looking ahead, Kliethermes said, “Our portfolio of products is in good order, and our specialty footprint is broad. We are ready and willing to continue growing profitability where disruption and opportunities exist.”

“Recent catastrophe activity, rising labor, material and social inflation as well as rising reinsurance costs should provide continued pressure on rate levels going forward. We believe this is a market we can thrive in as rates are still moving up broadly, but it requires good underwriting selection to differentiate and truly understand the risk-reward equation,” he said.

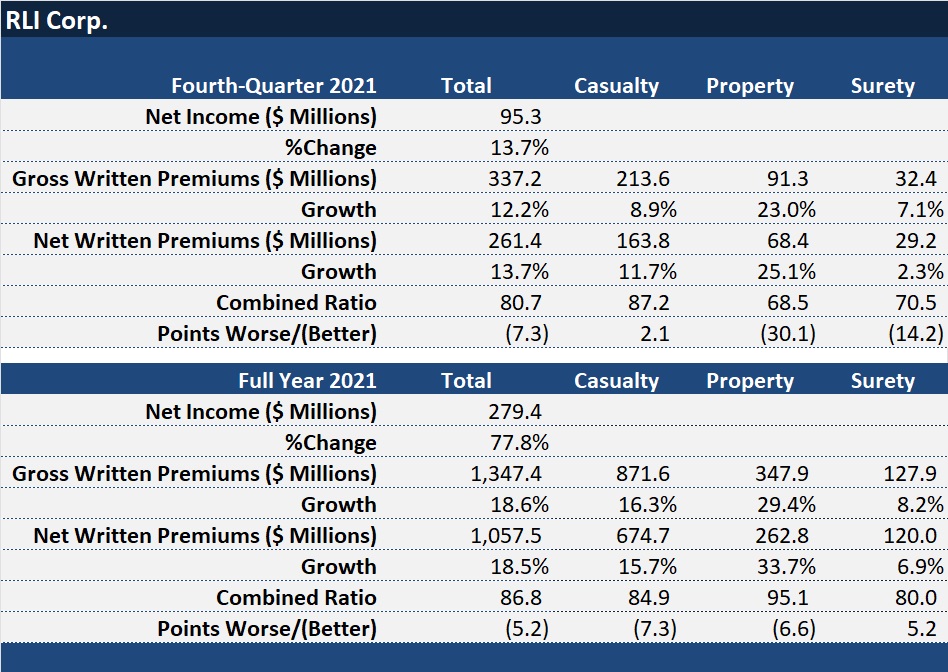

Chief Operating Officer Jennifer Klobnak provided some of the details of factors driving an 18.5 percent jump in net written premiums last year, and Chief Financial Officer Todd Bryant reviewed the components of a sub-90 combined ratio that improved five points in 2021, including a very light fourth quarter for weather-related losses.

Klobnak said that casualty rates jumped 6 percent on RLI’s book in the fourth quarter, identifying double-digit increases for the D&O book as a primary driver. “Nearly all casualty products are still achieving positive rates in the mid-single-digit range,” she added, noting that personal umbrella, excess liability focused on the construction space, and transportation lines were standouts.

RLI’s transportation book, in particular, grew 10 percent in the quarter, including a 6 percent rate change, she said, noting, however, that with exposure levels rebounding, transportation claims are also increasing. “They have not returned to 2019 levels,” she said. “This is a trend we’re watching closely.”

Like Kliethermes, Klobnak referenced the favorable impacts of market dislocations on RLI. “We are benefiting from competitors continuing to provide lower limits than in the past, which creates opportunities for us to participate.”

“The casualty portfolio is performing really well overall. We achieved 16 percent growth for the year on an 85 combined ratio,” she said, also revealing that RLI renewed reinsurance treaties support much of its casualty book at 1/1. “We saw mid-single-digit rate increases, and we characterize the reinsurance market as rational” for casualty, she said.

The real difference maker in results for the fourth quarter was a smaller part of RLI’s book—the property segment, she said, noting that a lack of catastrophe losses in fourth-quarter 2021, compared to the prior fourth quarter, pushed the segment’s combined ratio down more than 30 points to 68.5.

“The market in this segment continues to be challenged by losses, which we believe will support continued rate increases. Competitors are selling shorter limits than in the past, which creates room for us to participate on the insurance tower,” she said.

Jennifer Klobnak, RLI

RLI’s gross property premium volume rose 23 percent in the fourth quarter and 29 percent for the full year last year. “All products in this segment saw an increase in submissions this quarter and for the full year,” she said at one point, highlighting growth in E&S property premiums, in particular, which grew by 34 percent in the fourth quarter. “We realized increased rates, witnessed rising building valuations, and saw reduced capacity from our MGA and carrier competitors. All of these changes improve our opportunity in this space,” she said.

During the Q&A section of the earnings call, analysts asked Klobnak to speculate on rate trends going forward in 2022, to report on the insurer’s cyber insurance appetite and to comment on the impact that inflation could have on future results.

The COO pointed to activity during 1/1 reinsurance renewals to support her view that rate hikes will continue in 2022. “My expectation would be that property will continue to have some support because I know…we paid a little bit more, and I expect everybody else did as well,” she said.

“On the casualty side, that [reinsurance] market seems to be a little more reasonable, but yet the reinsurers are charging more, especially for auto excess coverages. So, there should be some support there as well.”

Responding to the inflation question, Klobnak spoke about rising material costs of construction projects impacting claims costs and higher building valuations figuring into upfront underwriting on the property side. For casualty, there are claims and exposure factors as well, with medical inflation rising on the claims side but higher revenues and wages pushing up premiums.

She also noted labor issues are lengthening repair times. “So, we have some business interruption both from a rental vehicle standpoint [in auto], as well as business interruption back on the property side as we’re trying to replace the location that was impacted.”

- RLI executives said they put a large account cyber book into runoff.

- AXIS Capital reduced exposure and tightened underwriting, but notes that it’s book is making an underwriting profit.

- Reinsurer RenRe said the cyber reinsurance market is “particularly dislocated,” resulting in triple-digit rate increases during 1/1 renewals.

Bottom line: the impact of inflation is “widespread, but it varies as to the impact—and it’s definitely moving,” she said. “We don’t necessarily see a numerical impact in our reserving data. So it’s a little bit more of a story at this point from the claim department, but it is something we [will] continue to monitor in 2022.”

As for the other hot topic, cyber, Klobnak revealed that while the carrier does continue to write cyber coverage at low limits for its small professionals book, RLI exited out of a cyber portfolio targeting large accounts within the executive products (D&O) group earlier this year. “It was not a large portfolio, but we are running off that part of the book,” she said.

Kliethermes added that the book put into runoff is heavily reinsured, putting the portion of the exposure reinsured at roughly 85 percent.

The Future of HR Is AI

The Future of HR Is AI  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies