The 2015 roundup of the top U.S. domestic surplus lines carriers is more of the same, blended with a key element – consolidation – that could portend greater changes in the roster to come.

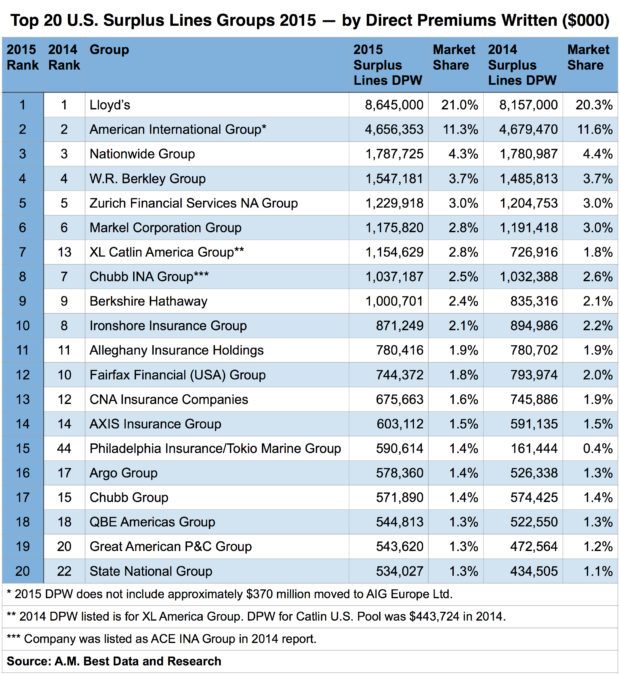

A.M. Best’s special report looking at the surplus lines market, notes, for example, that Lloyd’s and American International Group are once again the top two carriers, respectively, operating in the space. AIG remains the biggest U.S. domestic surplus lines writer.

Both entities have a smaller percentage share of the business than they used to. But combined, they collectively handled 32 percent of the direct premium total for the U.S. surplus lines market in 2015, A.M. Best said. Lloyd’s handled $8.6 billion in direct premiums written for the sector as of the end of 2015, a 21 percent market share. AIG took on more than $4.65 billion, or an 11.3 percent slice of the total.

Both entities have a smaller percentage share of the business than they used to. But combined, they collectively handled 32 percent of the direct premium total for the U.S. surplus lines market in 2015, A.M. Best said. Lloyd’s handled $8.6 billion in direct premiums written for the sector as of the end of 2015, a 21 percent market share. AIG took on more than $4.65 billion, or an 11.3 percent slice of the total.

Also, the top U.S. surplus lines businesses in 2015 continued to be more of the same, including Berkshire Hathaway (no.9), Markel (no. 6), W.R. Berkley Group (no. 4), and Nationwide (no. 3).

Industry consolidation added some new elements, however. Tokio Marine’s U.S. subsidiaries consolidated, a reality that A.M. Best pointed out put them on the top 25 listing in 2015 for the first time. Counted as Philadelphia Insurance/Tokio Marine, the division placed at no. 15 on the list for 2015, with $590.6 million in direct premiums written, versus No. 44 in 2014, and $161.4 million.

Post-merger XL Catlin‘s America division placed at no. 7 for 2015, with more than $1.15 billion in surplus lines direct premiums written. XL’s American arm alone was at no. 13 for 2014, with $726.9 million in direct premiums written; Catlin’s US Pool was at $443.7 million.

A.M. Best said it expects another big shift for Chubb when it tallies 2016 direct premiums written for the surplus lines sector, thanks to the ACE/Chubb merger that closed in early 2016. Consolidated results will make them a major player on the top list.

In its broader report, A.M. Best predicts further surplus lines carrier and broker consolidations to come, as the market confronts issues such as heavy competition and economic challenges.

Source: A.M. Best

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits