Berkshire Hathaway and Ironshore were among the top 10 writers of U.S. excess and surplus lines business in 2014, according to data compiled by SNL Financial.

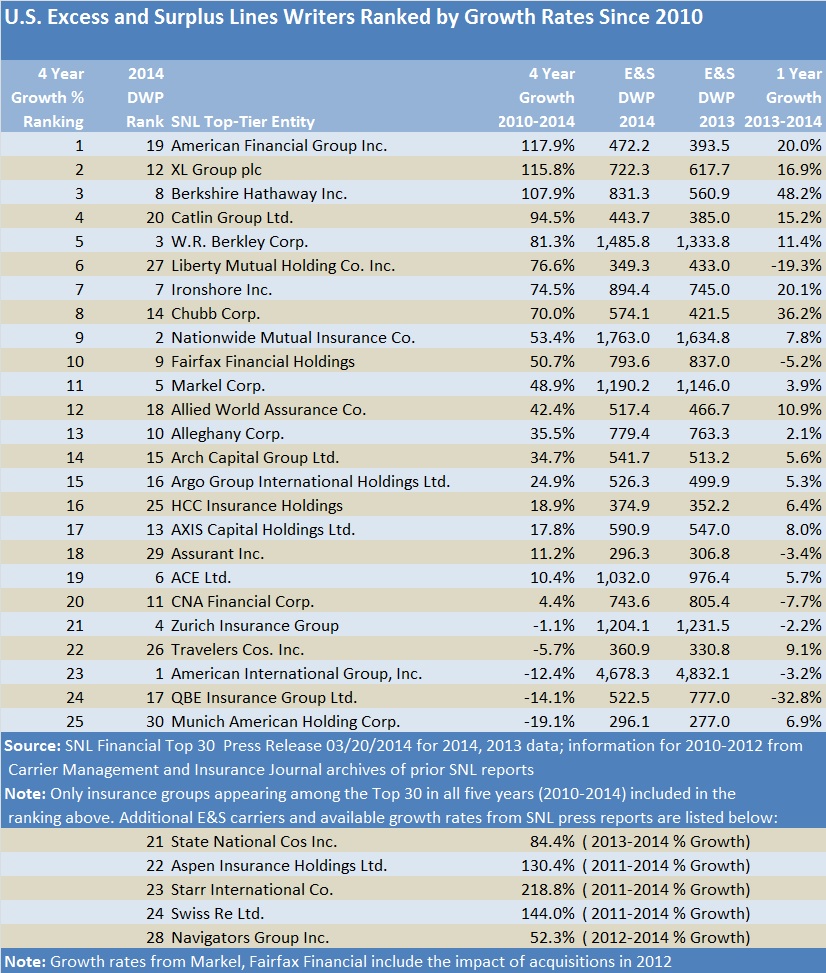

XL Group and Catlin Group haven’t made it into the top 10 yet, but with an E&S premium growth sprint actually bigger than Ironshore’s since the start of the decade, and right on the heels of Berkshire (on a percentage basis), the combination of XL Catlin may well rise into the top 10 when a deal putting XL and Catlin together closes in 2015.

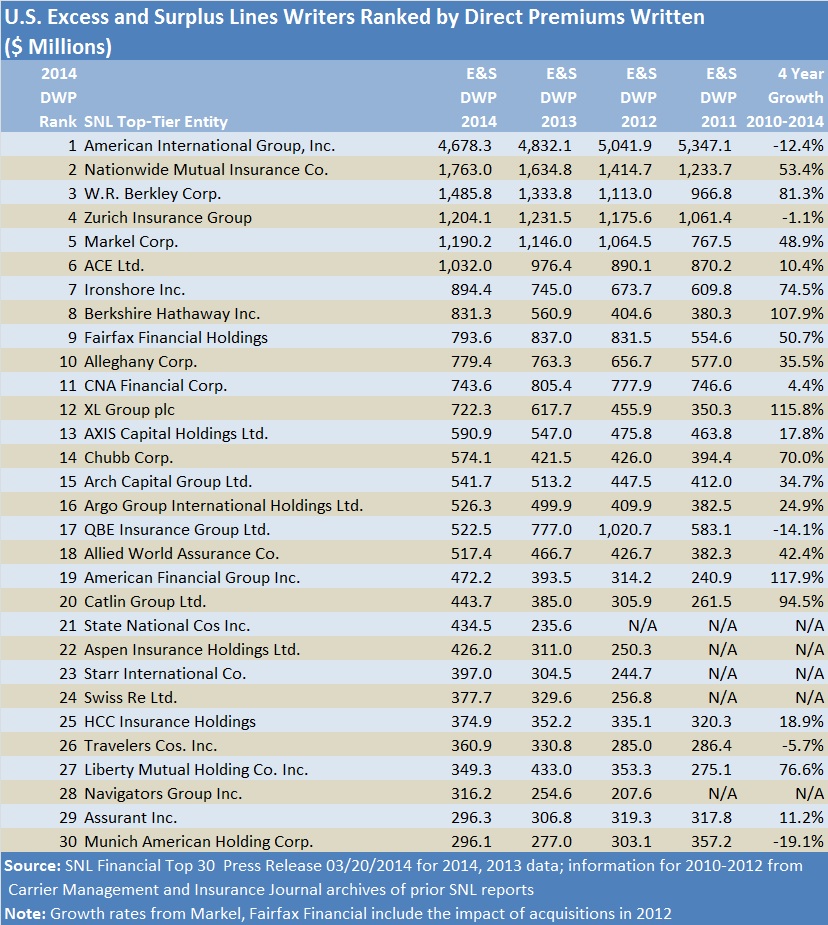

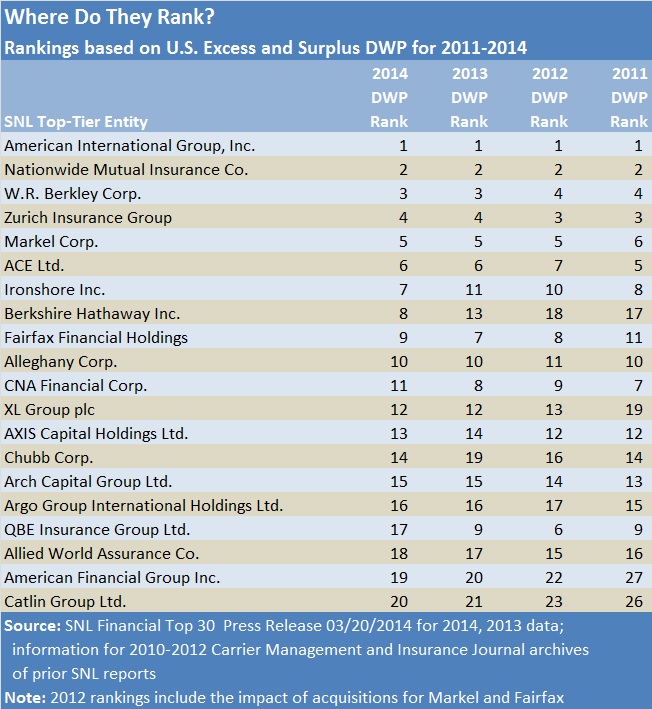

SNL’s ranking of the Top 30 U.S. E&S insurance groups, released on Friday and based on direct U.S. E&S premiums written in 2014, puts Berkshire in eighth place, up from 13th place in 2013.

Ironshore climbed to the seventh spot from 11th place in 2013, the SNL report reveals.

While this is Berkshire’s first showing among SNL’s Top 10, Carrier Management’s compilation of historical data from similar SNL Financial reports dating back to 2010 reveals that this is not the first time in the top 10 for Ironshore. Back in 2011, the Bermuda-based company had an eighth-place showing.

Since 2010, Ironshore’s U.S. E&S direct premiums have grown nearly 75 percent to $894.4 million. Premiums for XL Group and Berkshire have more than doubled, while Catlin’s premiums came close—jumping 95 percent between 2010-2014.

Together XL Catlin’s 2014 U.S. E&S direct premiums total $1.1 billion—a total that would have landed the combination in sixth place if the deal closed last year.

For competitors Markel Corp., and ACE Ltd., currently ranked fifth and sixth on SNL’s 2014 ranking, premiums grew by single digits in 2014, while XL grew nearly 17 percent and Catlin just over 15 percent. With premiums for fourth-ranked Zurich Insurance declining to $1.2 billion in 2014—a 2.2 percent drop from 2013 (and falling 1.1 percent since 2010), it’s anyone’s guess how the repositioning among the fourth-and-sixth places spots will ultimately play out by year-end 2015.

Questions about Berkshire Hathaway’s growth—in particular, the full impact of the 2013 launch of Berkshire Hathaway Specialty Insurance in $831.3 million premium total—remain largely unanswered by the SNL analysis. The analysis does reveal, however, that the bulk of the growth since 2010 came in 2013 and 2014—with premiums soaring 38.6 percent in 2013 and 48.2 percent last year.

The SNL analysis does not capture specialty admitted premiums for any of the companies. With the focus on U.S. E&S (nonadmitted premiums), premiums written outside the U.S. are also not included. A discussion of the ranking on SNL’s website notes that BHSI is writing in Canada and has set up offices in Singapore and Hong Kong.

Other Sprints and Declines

Besides Berkshire, Ironshore and XL, the only other top-10 group to record double-digit E&S premium growth last year was W.R. Berkley.

W.R. Berkley, one of the top sprinters of the decade so far with an 81 percent leap in premiums since 2010, posted double-digit growth in each year since 2010 and maintained a ranking in the top five.

Among the top 30, American Financial Group posted the biggest percentage premium gain over the period from 2010-2014 at nearly 118 percent. But even with annual jumps of 20-30 percent since 2011, American Financial’s E&S premium volume remained below half-a-billion dollars, putting it just above Catlin in the top 20 for 2014.

Chubb also posted a notably high premium growth rate over the past five years—with U.S. E&S premiums leaping 70 percent since 2010 to $574.1 million in 2014. But for Chubb, nearly half of the growth since 2010 came in 2014, with smaller gains in prior years.

At the other end of the spectrum, three groups have seen U.S. E&S premiums shrink by double-digit percentages since 2010:

- Top-ranked American International Group, with premiums falling 12.4 percent since 2010, and 3.2 percent last year to $4.7 billion.

- QBE Insurance Group, which had recorded U.S. E&S direct premiums of over $1.0 billion in 2012, according to a prior SNL report, fell out of the top 10 last year (from ninth place in 2013 to 17th place in 2014) with 2014 E&S premiums totaling $522.5 million—a 33 percent drop for the year, and just about 14 percent lower than the more than $600 million of E&S premiums QBE recorded in 2010.

- Munich Re America Group, ranked 30th on SNL’s Top 30 ranking, grew 6.9 percent in 2014. But the jump came after three consecutive declines which together amounted to a 19 percent drop since 2010.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage