Executives at Endurance Specialty Holdings said they will continue to try to engage Aspen Insurance Holdings in negotiations related to Endurance’s bid to acquire Aspen—a dialogue that Endurance says shareholders of both companies want to happen.

“It remains our strong desire to complete this transaction on a friendly basis, and we continue to work on ways to more strongly encourage Aspen to engage,” John Charman, chairman and chief executive officer of Endurance, said during a conference call with analysts earlier this week, referring to a $3.2 billion bid for its Bermuda-based competitor made public last month.

He continued: “In our detailed and individual discussions with shareholders, it is very clear to us that they support the strategic and financial merits of the proposed transaction and very strongly desire Aspen to engage in good faith negotiations with us.

“It remains our firm belief that Aspen’s board and management should not allow personal preferences for a ‘go-it-alone’ strategy to stand in the way of what is clearly in the best interests of their shareholders.

“We will continue to take all the necessary steps that we feel are appropriate to achieve a successful transaction,” Charman said.

Chief Financial Officer Michael McGuire said, “We’ll make those next steps known soon,” declining to give further information about what those might be.

“We remain determined to complete this transaction,” McGuire said. “We have a lot of tools in our toolkit that we can bring to bear to encourage engagement and ultimately lead to a successful transaction.”

The two executives made their comments during a first-quarter earnings conference call on Tuesday, after reporting a 15 percent annualized operating return-on-equity for the quarter for Endurance—virtually the same result that Aspen separately reported for its operations in April.

McGuire reiterated some of the benefits of the proposed deal for Aspen shareholders, citing premiums to various prior Aspen share prices from the valuation and the potential future of a bigger, more diversified combined company with $100 million of synergy opportunities—benefits that he has communicated in past media announcements. He also clarified exactly what Endurance executives believe Aspen shareholders want to happen next.

“We have canvassed a substantial majority [of both Aspen and Endurance shareholder bases], and the unanimous view was they firmly believe that Aspen should engage in good-faith negotiations with Endurance,” McGuire said. “We did not find any shareholders that were not supportive of Aspen entering into discussions and negotiations with us.”

The polling result, however, seemed at odds with what one analyst read in a media report of an interview with Aspen CEO Chris O’Kane. The analyst quoted O’Kane’s view from the article, stating that not a single shareholder canvassed by Aspen “had even come close to encouraging him to accept Endurance’s offer.”

McGuire responded: “Accepting the proposal and entering into good-faith negotiations with us are two very different things,” suggesting that the words from the interview quoted were chosen “very carefully” by Aspen’s executive.

What if negotiations don’t take place or a deal doesn’t happen? One analyst questioned whether Endurance will seek another target given the management team’s belief that scale and diversity are important in the current competitive market.

Reviewing Endurance’s recent history and, in particular, its transformation since Charman joined the company in late May 2013 with a goal of creating a global leader in historically profitable specialty classes, McGuire said: “We have gotten bigger. We have expanded. Our portfolios are more diverse. We have a very strong organic plan that we are executing.”

He added that even while executives at the corporate level focus on making the Aspen deal come to fruition, “we are not allowing that to impede our underwriters from executing on our business plan—and executing quite well, as you can see from the gross written premiums that we have been able to develop in the areas that we want to target.”

Specifically addressing the idea of another target, McGuire added, “We’re always open to M&A as a way to accelerate our business plans,” noting, however, that in Aspen, Endurance executives feel they have spotted “a very unique opportunity to do that.”

Tapping ‘Untapped Potential’ to Create ‘Relevance’

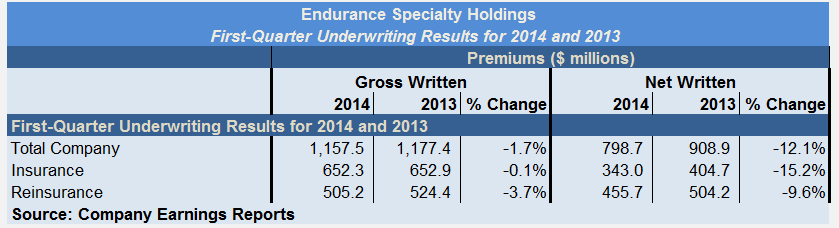

A high-level view of Endurance’s gross written premium figures for first-quarter 2014 doesn’t immediately bear out McGuire’s assertion about growth at the company.

In the aggregate, gross premiums for the insurance segment were nearly unchanged from last year’s first quarter. Underlying the overall figure, however, McGuire highlighted two relevant developments:

- Excluding Endurance’s agriculture insurance book, premiums soared 41 percent, driven by 85 percent growth in professional lines and 33 percent growth in casualty and other specialty.

- Policy counts grew 6 percent in the agriculture segment, but premium levels were impacted by commodity prices that were 12 percent lower than last year.

On the reinsurance side, a 3.7 percent drop in gross premiums reflected rebalancing efforts, including:

- Selective nonrenewals of less profitable business, such as U.K. motor treaties and other unattractive casualty accounts.

- Growth in professional and specialty lines written by new business teams in Bermuda, New York, Zurich and Singapore.

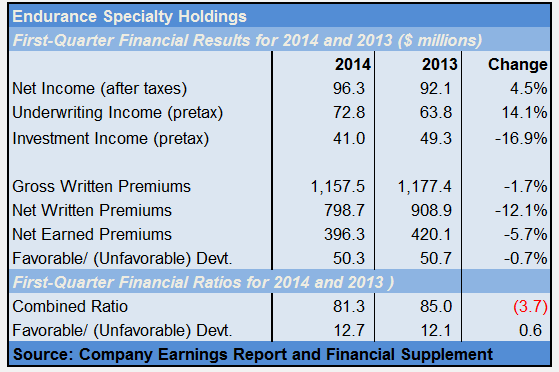

On the bottom line, Charman and McGuire recounted financial highlights of a quarter that saw income grow roughly 5 percent to $96.3 million and the overall combined ratio improve 3.7 points to 81.3.

The executives repeatedly suggested that all the financial metrics taken together are a testament to the fact that the transformation Charman set in motion last year has taken hold. “Strategically, we have positioned Endurance to outperform in every respect against an industry backdrop of a highly competitive underwriting market and continued low [investment] yields,” Charman said.

“Endurance is now a strong, determined, capable and relevant company on the global insurance and reinsurance stage,” he said, noting that specialty lines premium growth in the U.S. had been fueled by the addition of more than 60 “highly regarded senior underwriters.”

“Endurance’s broad and deep market expertise, leadership and relevance are now being very well-received by clients and brokers,” he said. “We have been able to compete on product knowledge, client focus and long-standing relationships rather than pricing and terms alone.”

Similarly, the launch of London-based insurance operations and the build-out of an international senior underwriting team of nearly 20 “market leaders” are nearly complete, positioning Endurance in the London energy, property and professional lines markets.”

In addition to all the underwriting hires, “we remain focused on achieving greater cost efficiencies throughout our organization,” he said. “While competitors are content to continue to ignore their expense levels, we are determined to significantly enhance margins through more disciplined expense management.”

Turning his attention to discuss the merits of the Aspen deal, Charman began his argument in favor of the combination by recounting the outcome of his efforts at Endurance.

“I arrived at Endurance nearly one year ago, after a 43-year career successfully running major businesses in the Lloyd’s market and at ACE and AXIS. I found a company with fundamental strengths but great untapped potential [and] spent the last 11 months working with my colleagues…to unleash that potential…

“We quickly put in place a transformation strategy that we have executed with speed, precision and success,” Charman said, adding that Aspen is “a company we believe can benefit from some of the same transformational changes.”

“A combined Endurance and Aspen offers a unique competitive proposition [and] benefits the shareholders of both companies while responding to the needs of an increasingly competitive global marketplace.

“Larger size will significantly enhance the ability to provide global customers with the products, capacity and geographic diversity they require. Together we will be one of the strongest, most determined, diversified businesses in our industry,” he said.

“The industrial logic and strategic benefit of the proposed transaction are both obvious and more than compelling,” he concluded, noting the even greater relevance of a combined company with over $5 billion in annual premium.

Emphasizing the strategic nature of the deal, Charman later said: “To me, this is the first strategic transaction since Brian Duperreault bought CIGNA [at ACE] back in 1999. Most of the other transactions for one reason or another have been balance sheet transactions.

“This is why this is so compelling—because it is the most strategic one out in the industry today.”

On the Defensive

While many of Charman’s remarks repeated arguments he and McGuire already set out in recent media statements, there were several criticisms from Aspen that he took pains to address during the earnings call: that he has some disdain for the Lloyd’s market; that the top-down culture of Endurance is at odds with a more collegial environment at Aspen; and that business will be lost in the combination.

“I have spent a significant portion of my career profitably managing and growing major Lloyd’s operations. I was also proud to be part of the small executive team led by Sir David Rowland, who was successful in saving and restructuring Lloyd’s during its financial crisis in the mid-90s.

“I am personally excited about the opportunity to add this capability to Endurance’s global product offering and the prospect of further expanding and diversifying the combined company’s Lloyd’s presence,” he said.

Addressing the cultural issue, Charman pointed to his success in attracting talent in significant numbers. “These individuals chose Endurance based on their positive views of our people, our collaborative underwriting culture, prior working experiences with us and the clear opportunity they see in joining a company that’s becoming a successful industry leader.”

Responding specifically to an analyst who raised the issue of cultural differences again, Charman said: “I have been in this industry for 43 years. If there’s one thing I have had as a reputation in this industry, it is actually being able to find the very best underwriters and executive managers in the business and working collaboratively alongside them for many, many years.

“And a great many of those people have followed me throughout my career.”

McGuire addressed the issue of business loss, noting that the company’s financial models of a post-transaction company assume at 5-10 percent customary attrition rate. “We would not expect any unusual loss of business,” he said.

Charman said that in conversations with major client and brokers in recent travels around the globe, he has heard nothing but positive comments about the proposed combination. “Nothing would lead me to believe anything negative would come out of this transaction,” he said.

He added, however, that there is “one fundamental difference” between Endurance and Aspen: “The senior management of Endurance is deeply embedded in day-to-day business.”

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists