As the market softens, should insurers and reinsurers keep more of their business net, or should they buy more reinsurance and retrocessional cover while there are lower prices and better terms?

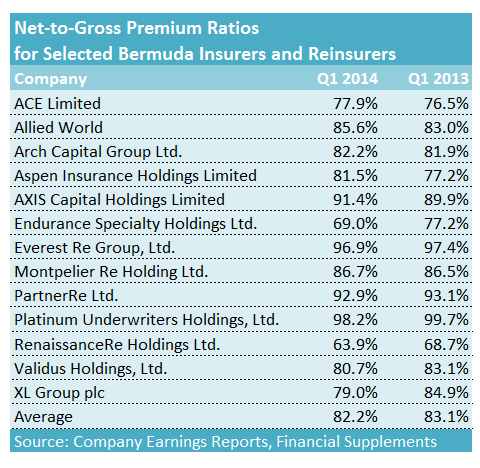

A rough comparison of first-quarter 2014 net-to-gross written premium ratios to similar ratios for first-quarter 2013 suggests that opinions are split almost down the middle for Bermuda market participants. Seven of 13 companies tracked by Carrier Management show lower ratios in 2014, suggesting they bought more reinsurance and retrocessional coverage, while the remaining six reported higher ratios in 2014.

John Charman, chairman and chief executive officer of Endurance Specialty Holdings, casts a strong vote in favor of ceding more business. “I have never known companies that have substantially reduced their reinsurance buying going into the softest part of the cycle to outperform,” Charman said during an earnings conference call Tuesday, noting that he has witnessed four market cycles over the course of 43 years in the industry.

John Charman, chairman and chief executive officer of Endurance Specialty Holdings, casts a strong vote in favor of ceding more business. “I have never known companies that have substantially reduced their reinsurance buying going into the softest part of the cycle to outperform,” Charman said during an earnings conference call Tuesday, noting that he has witnessed four market cycles over the course of 43 years in the industry.

First-quarter premium numbers for Endurance are particularly striking evidence that Charman and his management team are acting on that view. While gross written premiums fell 1.7 percent for the company overall, net premiums plummeted 12.1 percent. The difference—which moved the net-to-gross ratio down to 69 percent for first-quarter 2014 compared to 77.2 percent in first-quarter 2013—reflects a deliberate reinsurance strategy, Charman said.

Chief Financial Officer Michael McGuire outlined several components of the “strategic purchases” of reinsurance and retrocessional coverage, including:

- Increased quota-share reinsurance for individual insurance lines.

- A 10 percent multiyear whole account quota-share covering the entire insurance segment.

- Stop-loss protection for the agriculture insurance line.

- Increased levels of retro protection within the catastrophe line of business, including a global aggregate excess-of-loss treaty and increased proportional retrocession.

“The collective impact of these reinsurance purchases meaningfully improves our net risk profile across our portfolio while providing capacity to prudently grow our business in a challenging market,” McGuire said.

While Charman gave cycle management as one general reason for increased reinsurance purchasing in a softening market, there are also circumstances unique to Endurance that drove the strategic decision to cede more business in 2014.

Since Charman joined the company in late May 2013, Endurance has hired some 60 new underwriting experts in U.S. specialty insurance lines and another 20 outside the United States to jumpstart a transformation of Endurance into a global specialty lines powerhouse, similar to those Charman previously built in London and at AXIS Capital, a Bermuda competitor he founded in 2002.

McGuire said that gross written premiums for insurance in specialty lines other than crop soared 41 percent in the quarter. Gross written premiums in Endurance’s insurance segment overall were flat at $652.3 million, while net premiums shrank 15 percent to $343 million.

Reinsurance, therefore, is a tool for “new product management” at Endurance, Charman said, also going on to list capital management and limits management as reasons that apply to Endurance and competitors alike.

An analyst, particularly intrigued by the multiyear whole account quota-share Endurance was able to obtain, pressed Charman and McGuire for more details, noting that such deals are typically designed for capital relief—something the analyst noted that Endurance doesn’t need.

“If the market were to suddenly move, we would still have that capability to very quickly flex our gross underwriting writings without any capital concerns. It is part of our business planning strategy. It is important to us. That’s why we have done it on a multiyear basis,” said Charman.

“Two years is not what I would consider multiyear,” Charman said, responding to another analyst who pressed for the length of the deal.

At other points in the call, Charman noted that he believes market competition would continue—and heat up—over the next three years.

“When you get to the bottom of a pricing cycle, when you think that things should logically be turning [off], people tend to panic and drive competition even more in their desperation. So you tend to get another couple of years of pretty competitive market conditions, which is where I think we’re at now,” he said.

Charman declined to reveal the identity of its whole account quota-share partner. “It is a strategic reinsurance for us with strategic carriers,” he said.

McGuire said that the rating of the reinsurer was higher than that of Endurance.

On Tuesday, after the earnings announcement, A.M. Best affirmed the financial strength ratings of Endurance Specialty Insurance Ltd. and its affiliates at “A” with a stable outlook, noting that strong risk-adjusted capitalization, a specialty-focused diversified business profile, relatively solid operating performance, an experienced management team and a solid enterprise risk management program all support the ratings.

“Endurance continues to execute its strategy of providing specialty insurance and reinsurance, while the management team works toward transforming the company by increasing its scale and market presence. However, there continue to be market challenges that will need to be overcome, as casualty rates remain soft, capacity is abundant, investment yields are low, and global economic uncertainty remains part of the landscape,” the Best announcement said.

Other Views

Like Charman at Endurance, Ed Noonan, chair and CEO of Validus Holdings Ltd., also spoke about buying more reinsurance and retro protection for the group’s Talbot Underwriters and Validus Reinsurance operations during a first-quarter earnings call last month.

“We’re executing on the strategy we laid out the day we started the company: that as the pool of acceptably priced risk shrinks, we reduce our writing and hedge our portfolio to protect our balance sheet,” he said.

“A key dynamic of the quarter [is] what we’ve been able to achieve through the use of retrocession and reinsurance,” he said, noting that the result has been “a meaningful shift in Validus’ risk position.”

Citing figures on declining probable maximum losses to illustrate the shift, he said Validus Re now has the “most comprehensive retrocessional program” that it has “ever had as a company.” Coverage includes $450 million of retro limit available on an ultimate net loss basis rather than an indexed basis, he said.

“Four or five years ago, we were happy to run PMLs that were 23-24 percent of equity as we felt we were well paid for the risk. As catastrophe rates have weakened, our willingness to retain risk on our balance sheet has decreased,” Noonan said, noting that the 1-in-100-year PML is now 17 percent of equity.

“We have maintained our importance in the market while taking a much more defensive posture on risk,” he concluded.

Moving in the opposite direction is Aspen Insurance Holdings, the competitor that Endurance is seeking to acquire through a $3.2 billion hostile bid. While Aspen’s net-to-gross ratio of 77.2 percent was the same as Endurance’s in first-quarter 2013, the first-quarter 2014 ratio has risen to nearly 82 percent.

During the company’s earnings call last month, Aspen CEO Chris O’Kane, said that restructured ceded reinsurance and retrocessional arrangements will generate $25 million in incremental net income in 2014 and an additional benefit of $20 million in 2015.

This equates to a total annual net income benefit of $45 million per annum from 2015 onward, he said. While only a few million dollars of this year’s $25 million savings flowed through profit-and-loss statements in the first quarter of 2014, “due to seasonality,” O’Kane said the bulk of the benefit will be realized during the remainder of 2014.

The Future of HR Is AI

The Future of HR Is AI  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly