In a report on the Bermuda reinsurance market released Tuesday, Standard & Poor’s Rating Services raised the prospect the Bermuda reinsurers could ultimately become middlemen between companies seeking to transfer risk and the capital markets.

“In the extreme, Bermudian reinsurers risk becoming mere conduits to the capital markets and not the primary risk bearers,” writes S&P Credit Analyst Taoufik Gharib. The analyst quickly dismisses the prospect as “unlikely,” but still goes on to note that “the push in that direction can’t be denied.”

“The net effect of third-party capital is negative” for Bermuda reinsurers, the S&P report says.

“The net effect of third-party capital is negative” for Bermuda reinsurers, the S&P report says.

After outlining ways in which Bermudian reinsurers are addressing the competition, S&P says that in spite of these efforts, “they will have difficulty adjusting” when their most profitable line of business—property-catastrophe reinsurance—”rapidly loses pricing power and becomes increasingly commoditized,” the report says.

According to S&P, the current influx of capital into the reinsurance market from third-parties, such as pension funds and endowments, is worrisome because it is “supply-driven, unlike the demand-fueled growth a few years earlier.”

One way Bermuda reinsurers are dealing with the newer wave of competition is by tapping into the capital sources to buy retrocessional cover. But S&P even sees a problem with this trend. “Increased use of retrocession may lure reinsurers into arbitraging the rate gaps between incoming catastrophe premiums and outgoing retrocession. This could create situations where reinsurers rely too much on potentially flighty retrocession capital,” the report suggests.

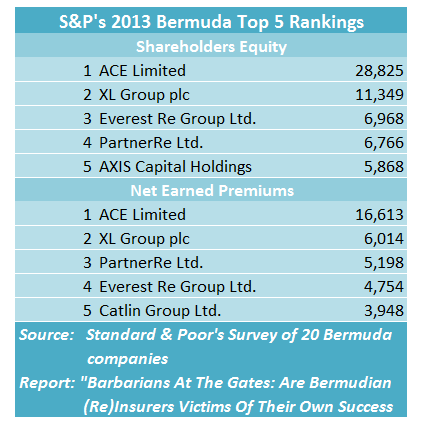

The report titled, “Barbarians At The Gate: Are Bermudian (Re)Insurance Victims Of Their Own Success,” also recaps a year of strong earnings in 2013 for 20 Bermuda market participants and lists top 10 players ranked by various financial measures—shareholders equity, net earned premiums, assets and net income.

All together, the 20 groups had a combined ratio of 85.6 in 2013, down from 91.3 in 2012. In aggregate, they also recorded a 12.9 percent return on average equity last year.

But S&P says the good times may be over, and that growing competition will likely to dent profitability soon—a prospect that caused S&P to change its outlook on the global reinsurance sector to negative from stable earlier this year.

Competition from the capital markets is not entirely to blame for current landscape, however, S&P points out—it is “only adding fuel to the fire.”

“Traditional reinsurers are already competing in an attempt to deploy their excess capital.” In addition, large cedents increasingly making reinsurance buying decisions at the group level rather than at individual operating units, and as they streamline reinsurance programs, they reduce the number of reinsurers used for protection.

“As a result, we believe that competition among the Bermudian reinsurers would be fierce even without the surge in third-party capital,” S&P says.

Explaining the January outlook change again in the April report, Gharib writes: “The tipping point came in early January, when we observed increasingly competitive underwriting behavior among reinsurers that we believe will weaken their profitability in 2014 and 2015.”

“We do not foresee an end to the downward trend in prices over the next two years,” S&P says, recapping January rate declines of 15 percent or more for U.S. property-catastrophe reinsurance and double-digit drops for Asian cedents at April 1.

Commenting on the April renewals, the report says: “The sharp increases on various Japanese programs following the 2011 Tohoku earthquake provide some rationale for the more recent declines. However, the magnitude of rate decreases surprised some market observers, who expected the more relationship-oriented Asian markets to be more stable.”

As for U.S. wind coverage, which comes up for renewal at midyear, “we expect meaningful rate declines,” S&P says.

“We think only drastic changes in capital markets, adverse reserve development, or a very large catastrophe loss would be sufficient to reverse the current negative pricing trend.”

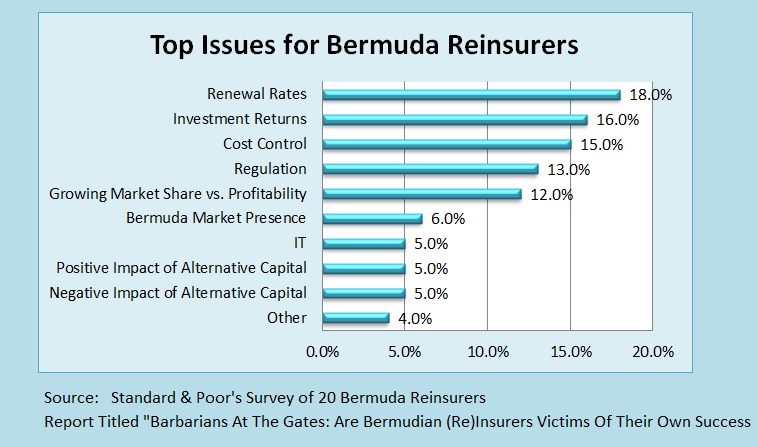

What are the Bermudians worried about?

Not surprisingly, representatives of the 20 groups whose results are compiled in the report ranked renewal rates as the top business issue when queried for the annual Standard & Poor’s/Deloitte Bermuda Insurance Survey. The responses are tallied on the accompanying graph.

First-Quarter Update

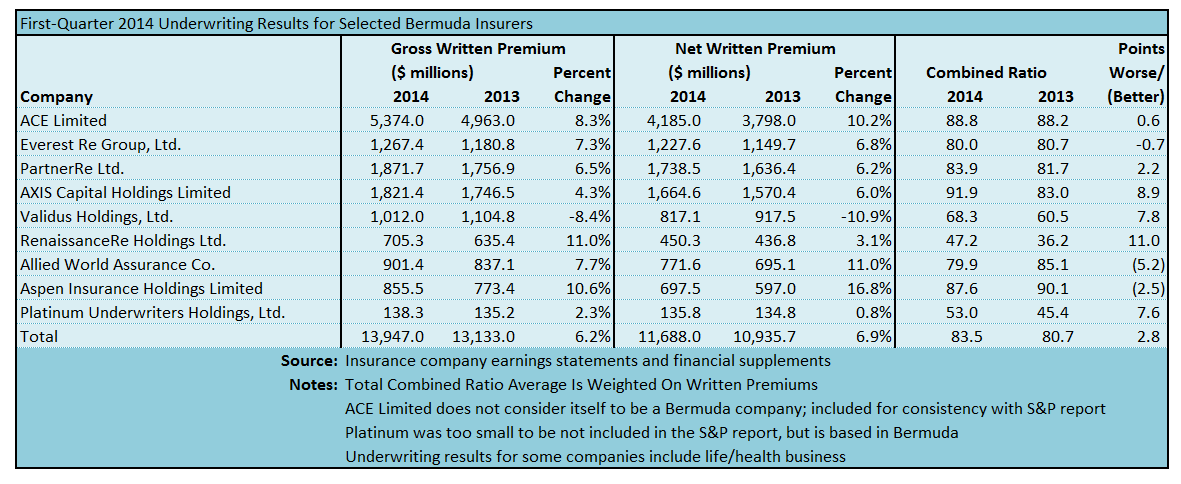

Bermuda companies that reported first-quarter earnings so far in April saw a double-digit decline in net income as a group, although top lines continued to rise and combined ratios all remained well below breakeven.

A compilation of results by Carrier Management reveals that:

- First-quarter net income fell 17.4 percent for nine companies reporting results in April.

- The average combined ratio came in at about 83.5, compared to 80.7 for the same companies in first-quarter 2013.

- Lower levels of favorable development explained some of the combined ratio deterioration, with favorable development shaving roughly 4.9 points off the first-quarter 2014 ratio for the group, compared to 6.3 points in the same quarter last year.

- Gross written premiums rose 6.2 percent for the group, with only Validus reporting a premium decline. Top lines for some groups were lifted by insurance business. Overall, gross premiums for insurance rose 6.7 percent for the groups in aggregate, while reinsurance gross premiums grew by 5.8 percent.

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies