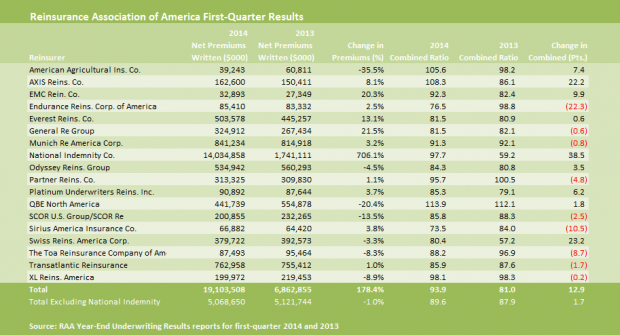

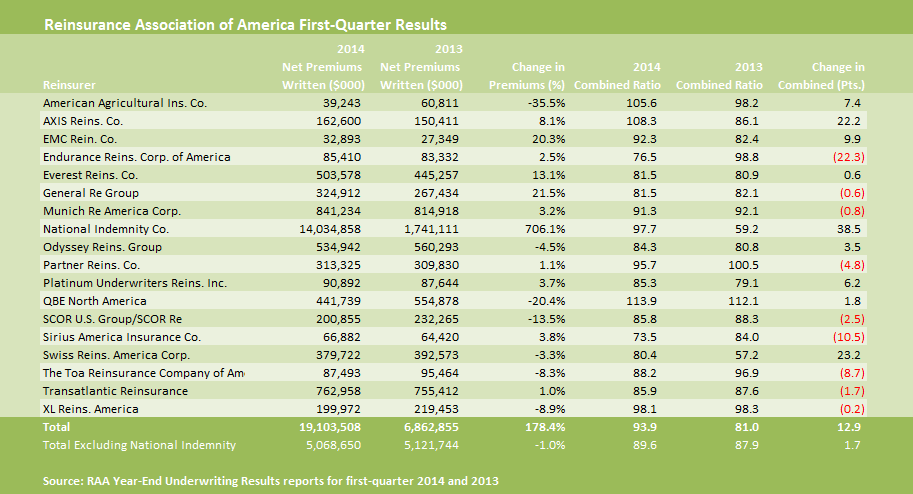

The Reinsurance Association of America’s latest quarterly survey of statutory underwriting results for U.S. property/casualty reinsurers reveals that first-quarter 2014 net written premiums came in at $19.1 billion, with Berkshire Hathaway’s National Indemnity contributing over $14.0 billion to the total.

Excluding National Indemnity, overall net premiums for the remaining 17 reinsurers was $5.1 billion, roughly unchanged from first-quarter 2013.

The aggregate combined ratio, excluding National Indemnity again, was also fairly stable—deteriorating 1.7 points to 89.6 for first-quarter 2014, compared to 87.9 for first-quarter 2013.

Individually, premium growth and combined ratio changes varied.

While only seven of the remaining 17 reinsurers reported premium declines, double-digit declines for QBE and SCOR, together with low-single-digit jumps for some of the bigger players, contributed to a 1 percent decline in premiums for the group.

In contrast, the 17 reinsurers (the RAA group excluding National Indemnity) reported a overall premium increase of 10.8 percent in first-quarter 2013 compared to first-quarter 2012.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard