Even though Endurance Specialty Holdings will operate in a “neutral-to-challenging” insurance market over the next few years, the refocused organization will be able to compete on “relevance” rather than price, the company’s CEO said Tuesday.

Speaking on an earnings conference call to announce third-quarter net income of $75.2 million, compared to $31.9 million in a 2012 third quarter that saw crop insurance losses dent overall results, Endurance Chair and CEO John Charman said that the company had a good 2013 third quarter both financially and strategically.

On the strategic front, Charman said that since he joined the company in May, the management team has been completely restructured, the underwriting culture has been refocused, and underwriting talent has greatly expanded while total headcount and corporate costs have been slashed.

“In short, we’ve been really busy,” he said.

“We reset our culture with greater emphasis on the long-term cycle management of our insurance portfolio,” he said, referencing the refocusing effort taking shape in the insurance segment of Endurance’s business.

The strategic changes are taking place against the backdrop of market conditions that Charman sees leveling out or worsening in the next two-to-three years.

“From our point of view, absent the large loss event or other dislocation, we expect market conditions to remain neutral-to-challenging over the next few years,” he said.

“What we are doing is bringing in industry-leading executives who are very relevant to the market. We are not competing substantially on price.”

“What we are doing is bringing in industry-leading executives who are very relevant to the market. We are not competing substantially on price.”While two recent loss events—European storm Christian and Spanish surety losses—have the potential to impact the market, and while “signs of stress are beginning to emerge from weaker players and within certain classes of historically challenging business,” he said that any opportunities opened up by these disruptions are short-lived.

“Capital remains abundant and is quickly replacing damaged capacity,” he said.

“We are at a point in the underwriting cycle that would increasingly favor the highest-quality underwriters with the best products and most efficient infrastructures,” he said during prepared remarks, explaining the reason for strategies to refocus underwriting and build talent.

Later, expanding on the thought in response to an analyst who asked about next steps in the transformation taking shape at Endurance, Charman said: “What we are doing is bringing in industry-leading executives—underwriting executives—who are very relevant to the market, and we will be able to take market share from the market. We are not competing substantially on price.

“We’re bringing capability to the market that the market needs, and we’re bringing relevance to the market.”

Expanding on his market commentary, Charman said that while primary insurance rates in many areas are still increasing, the rate of that increase is moderating.

He said that reinsurers are not fully benefiting from primary rate increases but instead are offering higher ceding commissions and expanded coverage.

“In addition, alternative capital formation chasing catastrophe risk continues to dampen property reinsurance markets,” he said, noting that insurers are also increasingly retaining larger portions of their exposures to the detriment of reinsurers.

“Our strategy over the next several years will be driven by a relentless focus on improved underwriting, risk selection and portfolio management while driving efficiency throughout our operations. In this market, our expansion is focused on the profitable products and geographies that I have been in for my entire career and where we have the best underwriting talent and relationships.”

During a second-quarter conference call, Charman identified specialty insurance and professional lines and counted Asia insurance and reinsurance platforms among his preferred lines and geographies.

“2013 is in many ways a year of transition for Endurance. We are already beginning to see the positive impact in the fourth quarter of high-quality premium growth across both segments,” he said, referring to Endurance’s insurance and reinsurance businesses.

Where Did the Premiums Go?

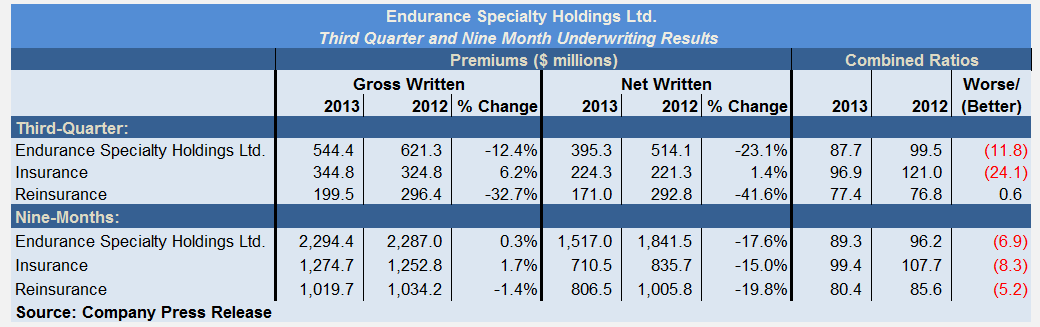

Charman and CFO Michael McGuire conceded that those top-line gains, which they say will be visible in the fourth quarter, were not evident in the third quarter or through the first nine months. In fact, the latest numbers reveal marked declines in gross and net reinsurance premiums—in excess of 40 percent for the quarter on a net basis—and double-digit drops for both the insurance and reinsurance segments through nine months.

Explaining the reinsurance drops, McGuire said that Endurance has “significantly rebalanced” its reinsurance portfolio, reducing participation on a handful of large property reinsurance contracts, purchasing more retrocessional protection on its catastrophe reinsurance book and nonrenewing some casualty reinsurance business.

During the second-quarter conference call, McGuire had previewed the changes, noting that decisions to take reductions on the July 1 property contracts took into account recent catastrophe loss experience on the contracts and the fact that the risks did not improve enough to justify continuing capital deployment at the same levels.

Speaking on Tuesday’s third-quarter call, McGuire said, “Our objective in rebalancing our insurance and reinsurance portfolios is to lower volatility and improve profitability through reunderwriting, product and geographic expansion, and more effective utilization of reinsurance and retrocessional capacity.”

Endurance’s increased use of reinsurance is evidenced by higher year-to-date net-to-gross premium ratios in 2013. Through the first nine months, the net-to-gross ratio on the reinsurance book is now 79.1 percent, compared to 97.3 percent for the same period in 2012. On the insurance book, the nine-month 2013 net-to-gross ratio is 55.7 percent, compared to 66.7 percent through the first nine months of 2012.

Talent Growth Continues

Endurance is accomplishing its product and geographic expansion through a talent push repeatedly referenced by Charman in his remarks. He highlighted talent acquisitions in professional liability, excess casualty, inland and ocean marine classes in the United States made over the last nine months and noted that leading underwriters in the London market are poised to join Endurance in the coming months.

“These individuals are recognized leaders [who] will enable us to build our positions in the international professional liability, property and energy markets in 2014,” he said.

Charman also added the name Doug Worman to the list of notable hires during the early morning conference call, previewing an official announcement that came later in the day.

Worman, a veteran of the industry with more than 20 years of experience, will join the company on Nov. 11, 2013 as executive vice president and CEO of U.S. Insurance.

Worman will be responsible for a broad range of professional, casualty, property and specialty lines offered through the company’s extensive U.S. producer network, according to a media statement, which also said he will be based in the company’s New York City office, reporting to Jack Kuhn, CEO of Global Insurance.

Worman joins Endurance from Alterra Capital, where he was executive vice president and CEO of Alterra U.S. Insurance.

Prior to joining Alterra in 2010, he served as managing director of Sharebridge Holdings and as president and CEO of Sharebridge Underwriting Group.

From 1992 through 2008, Worman held various underwriting and management positions at AIG, including president and CEO of AIG Excess Casualty Group, formerly known as American Home.

The announcement comes just a few weeks after Endurance announced that Christopher Donelan would join the company as president and chief underwriting officer for Endurance Re U.S, along with two underwriters and two reinsurance pricing actuaries.

The mid-October announcement noted that Donelan has almost 25 years of experience in the reinsurance market, having most recently built the reinsurance portfolio for Axis Re U.S.

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits