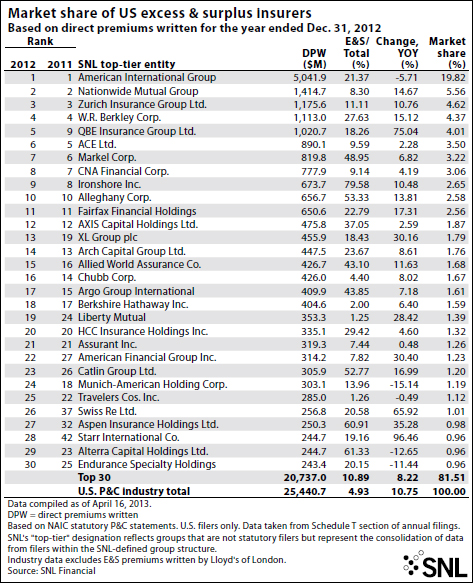

Excess and surplus lines premiums in the U.S. were up for a second consecutive year in 2012, rising 10.8 percent to $25.44 billion, and grew at a faster rate than in 2011, according to SNL Financial.

Not too long ago — in 2009 and 2010 — premiums were on the decline.

American International Group Inc. remains the market leader, with more than three times as many direct premiums written as the next closest competitor, Nationwide Mutual Group. While premiums were down about 5.7 percent for AIG in 2012, it still had about the same portion of its property/casualty business in E&S in 2012 as it did in 2011.

Warren Buffett’s Berkshire Hathaway recently hired away four executives from AIG, including the president of AIG’s main E&S unit Lexington Insurance as it prepares to grow its E&S business. Lexington accounted for the vast majority of AIG’s E&S premiums in 2012, at about $4.23 billion, according to SNL.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies