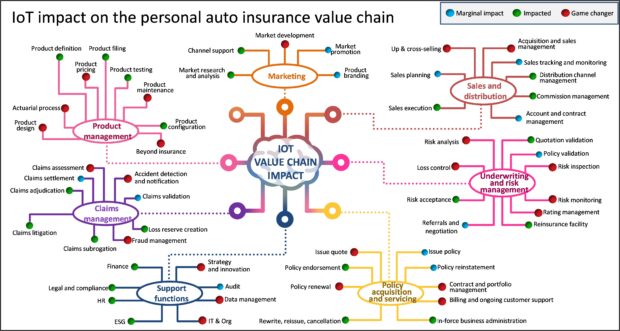

When looking at the impact of telematics capabilities on insurance activities, we see the emergence of the transformative potential of this InsurTech innovation.

There is a relevant number of activities in the personal auto insurance value chain that can be improved using telematics.

- Product management. The design and maintenance of a telematics product that provides more frequent interaction with policyholders is completely new compared to the traditional insurance model, which uses static rating features. The days of the “one-policy-fits-all” approach to auto insurance are over. As consumer needs evolve, they will seek carriers capable of tailoring auto insurance coverage to align with the unique needs of all the drivers in their household.

- Marketing. As these programs become more innovative, shifting how we market the value proposition to customers will be vital. Marketing activities need to focus on customer engagement through improved communication and transparency.

- Policy acquisition and servicing. Telematics data is changing the entire customer journey from issuing a quote to the policy contract, how the policy is serviced, including billing, and finally, the impact on renewals.

- Underwriting and risk management. Risk analysis, inspection, monitoring and loss control—typically core and addressed at the policy level in middle and large commercial risks—can be performed at scale on the personal auto book, applying algorithms to the telematics data. Loss control already has been a core in Nationwide’s telematics journey focused on changing driver behaviors and is an area of further investments. (Related article: “Nationwide Insurance: Using a Decade of Learnings to Create Next Generation Telematics Solutions“)

- Sales and distribution. As mentioned in the accompanying article describing Nationwide’s approach, telematics offers new ways to acquire customers, such as using the driving score at point of sale. Pre-existing data allows companies to offer the most accurate rating/discount upfront, replacing the need to capture driving data during the introductory period. The insight collected about policyholders and their risks has the potential to unlock further opportunities for upselling and cross-selling.

- Claims management. Claims activity is ripe for a deep redesign fueled by using telematics-based insights to detect crashes and proactively reach out to policyholders, assessing the crash dynamic and the overall anti-fraud process.

- Support functions. From an IT, organizational and data management perspective, the amount of data received with telematics is new for most insurance companies, and the skills required will be broader than the traditional insurance skillset. Investing in the right infrastructure, data foundation and people is vital because nothing happens in telematics without data. The better a carrier is at managing this dataset throughout the customer value chain, the greater their chances of success—as this fuels the pricing models that determine if a discount is warranted, powers the customer experiences, impacts future strategies and innovations, and ultimately unlocks the larger benefits.

Other activities—highlighted in blue or green in the accompanying illustration—have an impact. However, the use of telematics data does not transform the activity; it will be mainly an extension of the current approach.

While not identified as a game-changer, agents are the trusted advisor to many consumers. As such, they are key stakeholders in the speed of adoption and long-term success of some of these new capabilities.

Nationwide aspires to modernize insurance protection through these telematics capabilities, delivering advanced product offerings accompanied by innovative experiences that will define the insurance landscape for decades to come.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard