Tom Vykruta, chief executive officer and co-founder at InsurTech EvolutionIQ, is no stranger to solving hard problems.

Problem solver was essentially the job description for the relative newcomer to the insurance industry in one of his previous roles at Google.

Executive Summary

Former Google engineer Tomas Vykruta is used to solving difficult problems, but the one that insurance claims adjusters face every day when they’re reviewing bodily injury claims is one that strikes him as “impossibly hard.” Recently, he told Carrier Management about how he is bringing machine learning approaches to the problem and replacing an interval-based approach to handling these claims with one guided by AI.“They would have some massive data problems, some real large problems [being tackled] using older-style heuristics and rules-based methods, and my job was to see if I could transition them into a more modern approach,” said Vykruta, a commercial airline pilot and former Google engineer who arrived on the scene at the multinational technology giant when Google first started using machine learning techniques.

“I did it a lot. Every six months I would go in a new group,” he said, noting that problems he worked on included fighting fraud and abuse and spam in Indian Google map listings with AI, as well as bringing machine learning to autonomous cars.

But the hardest problems he’s ever seen are those solved by workers compensation, disability and liability claims adjusters dealing with bodily injury claims every day.

“There are 70,000 different medical diagnoses described in ICD [International Classification of Diseases] dataset. The claims are changing constantly. One update will completely change the outcome of that patient’s health. It’s just been an impossible problem for the examiners to solve in their heads. And they’re juggling 200 claims at a time and given new claims every month,” Vykruta told Carrier Management during a recent interview, describing how he went from being a Google engineer to founding an InsurTech that offers a claim guidance platform helping adjusters working with bodily injury claims to prioritize claims.

Insurance Finds a Google Engineer

After several years of rotating through the difficult problems that Google charged him to work through, “I started being curious about what else in the world has this pattern: a big industry with a massive dataset using older style rules-based systems, where we could just make a huge improvement by moving them to a modern AI system,” said Vykruta, retelling the story of the birth of EvolutionIQ.

“The biggest takeaway was their job is really, really impossibly hard.”

“The biggest takeaway was their job is really, really impossibly hard.”

Tomas Vykruta, EvolutionIQ

“Eventually I found insurance, or rather it found me,” he said, recalling that the discovery came during a dinner with his then fiancé, now his wife. One of the friends at dinner was the chief operating officer of a major special investigations company that worked with workers comp fraud.

“They’re old school. They would follow people around with a camera, stalk outside the house and try to see if they were actually physically fit and lying about their condition,” Vykruta said, without identifying the SIU. “From him, I realized that this is an industry with a massive dataset. They have all these claims data and they’re not using it for analytics in the way that it could be” used.

Vykruta grabbed a napkin, jotting down “this idea of creating like a ‘Minority Report’ system that could prevent these kinds of crimes from happening,” he said (referencing the title of a 2002 movie in which a “Precrime” police unit prevents homicides through a mixture of advanced technology and the use of clairvoyant humans that visualize impending crimes). “We could identify where [comp fraud] is likely to happen and move away from following people,” using data instead, he said, summarizing the back-of-the-napkin idea.

Vykruta went on to build a prototype to set his first problem-solving idea for insurance in motion. “I built a demo to talk through how it would work and started shopping it to carriers. They liked it. So, then we started talking to investors; they loved it,” he said, reporting that the company raised a seed funding round in 2019 from First Round Capital, FirstMark and Foundation Capital.

Launching the product a few months later, “we realized that this technology wasn’t just useful for identifying fraud. It was actually a system that was able to guide the entire claims organization to know where to focus their time—where to spend their time, where to not spend their time,” he said, describing the basic idea of subsequent product modules that segment first-notice-of-loss claims using the same underlying technology and help examiners to know when it’s time to revisit a claim and take action later on.

All the product modules of the EvolutionIQ platform have a specialty focus on bodily injury claims at their core. Such claims “are really incredibly complicated because you’ve got these narratives that are open for many years. Some of these claims are 15 or 20 years old. They have as many as 30 to 40 medical diagnoses,” he said.

He continued, “What the [insurance] industry has done is said, ‘Look, this problem is so hard, you can’t solve this comprehensively.” Instead, they take an “interval-based approach,” he said, referring to the fact that examiners “just visit every claim once a year.”

He continued, “What the [insurance] industry has done is said, ‘Look, this problem is so hard, you can’t solve this comprehensively.” Instead, they take an “interval-based approach,” he said, referring to the fact that examiners “just visit every claim once a year.”

“What this has led to is just incredible waste in unnecessary payments. Examiners [may] look at the last couple of pages of notes and generally, they don’t take any action at all. They just put it back,” he said.

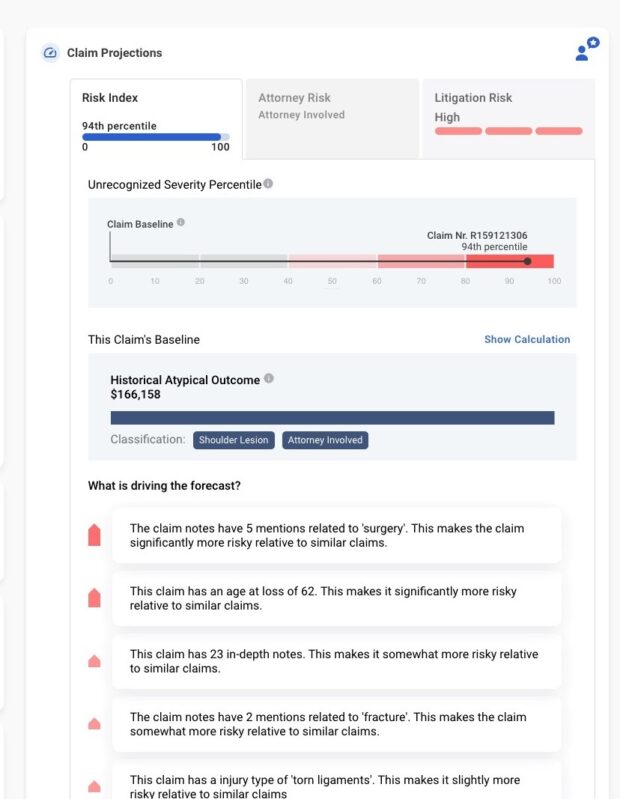

This is where EvolutionIQ brings AI guidance into the picture. “Our AI evaluates the full history of every claim up until today and makes a prediction: ‘Is this a claim on which we can take action? Is there going to be an outcome that makes sense?”

“And then from [the insurer’s] 50,000 claims or whatever they have, we are able to select the 10, 20 or 30 claims on that particular day that, if they take action, will lead to the greatest outcome to the claimant and the carrier and the client,” he said.

Vykruta later explained that, in practice, carriers take different approaches to how they assign the claims to individual adjusters based on EvolutionIQ’s AI-generated scores. “It’s like a credit score from 0 to 750. And the score indicates how resolution-ready or action-ready that claim is today,” he said, noting that someone at the carrier who understands the staff capabilities can review the top claims of the day and then make assignments. Alternatively, the examiners themselves will go in and select the claims that match their specialty, he said, noting that once an examiner double-clicks on an assigned claim, they see the likely outcome and duration with recommended actions to take.

“We are able to use AI to do a deep explanation and pick out the bits that really matter. Was there some change recently in a medical prognosis? Is there some combination of comorbidities in the health that indicates this patient will never recover?” he said, noting that the latter scenario means the best action is to offer a settlement.

“We’re moving from the interval-based approach” used by insurers today “to this new guided approach,” he said. In fact, that’s the shorthand description of the company that appears on some of its marketing materials: “EvolutionIQ builds data-driven claims guidance platforms” for carriers.

“We think in the next five years, it’s a no-brainer that the whole industry is going to move from this old methodology to the new one,” Vykruta said.

Some of the platform modules also specifically flag “lurker claims.” Explains Vykruta, “The reserve is incorrect and it needs to be reviewed by somebody because there’s something happening inside that claim that we’ve identified and is inconsistent with what [the carrier] identified; they think it’s a very small minor claim, and our system believes that it’s potentially very serious.”

“We don’t actually make any decisions. Our system is guiding them and helping them understand where to spend their time,” he said.

With artificial intelligence guiding time management, is there still room for the institutional knowledge of veteran claims adjusters?

“This is one of the surprises that we had. There’s this big movement into auto adjudication, reducing staff. Our view is we don’t want to reduce the examiner staff,” Vykruta said, noting that each examiner at a carrier using EvolutionIQ is able to do more productive work.

“Hiring has been really hard for carriers, but that’s not the news we hear. Our early carriers are actually growing the team sizes because now they can see that the team’s just becoming far more productive.”

While adoption of AI in a traditional industry can be challenging, in LinkedIn posts about the evolution of EvolutionIQ, Vykruta and Co-Founder Michael Saltzman say they have overcome this hurdle by building “explainable AI” systems in tight collaboration with the users.

There are essentially two systems, Vykruta told Carrier Management: one that makes predictions and one that explains the forecasted outcomes in the language of claims examiners. “We spend a lot of time with them. We sit with them, we go through claims, we look at our predictions and we understand what signals they’re looking for…”

“We’re not just taking the raw weight from the model…We translate [predictions] into a system that makes sense to them. We’re only showing them [items] that are actionable,” he said, offering the example of a combination of these two medical diagnoses for workers between the ages of 30 and 40 that has often led to a dramatic increase in duration. “They will never recover. So, we describe this little nugget of knowledge, and they can then take that and they can verify it looking at other examples or they can talk to the doctor.”

“It gives them a really strong starting point to understand what’s happening inside the claim. Before this, they had to read through potentially 150 pages of notes and try to make sense of it all,” he said.

While EvolutionIQ uses a lot of the structured data, the unstructured data, specifically notes written by examiners on their internal systems, contain more useful information about what’s happening inside each claim to train the AI models. “Our system reads those notes like a human, and that typically gets us to a very accurate system,” Vykruta said.

An AI-First Model

Although the fraud module for workers comp was the earliest prototype created by the company, on the prioritization side, EvolutionIQ’s most mature product is focused on disability insurance, Vykruta confirmed, noting that a workers comp guidance module is set to launch soon. The InsurTech also has a live casualty insurance product, guiding examiners on medical cost payments related to slip-and-fall claims, for example. EvolutionIQ is also launching a new product for the midcycle of the long-term disability claims, identifying opportunities for vocational retraining.

Asked about expanding into other areas, Vykruta confirmed that products focused on personal and commercial auto insurance bodily injury claims are in development for this year.

Vykruta said that product pricing is based around the claim volume and there’s an annual subscription fee, adding that the InsurTech does one-year and multiple-year contracts. He also noted that “there’s very little lift” on the carrier IT side. The carrier simply has to “take a dump of their data that’s changed since the previous day and upload it raw into a secure cloud bucket. We do the rest from there,” he said. “We don’t need to integrate back into their own core claims systems” unless a carrier wants that to happen.

As for what sets his company apart, Vykruta said that EvolutionIQ started off as purely an AI team that added insurance DNA later on. Insurance industry veterans include Chief Insurance Officer Rooney Gleason, a former president for Argo Insurance’s U.S. Grocery and Retail business, and Alex Young, executive vice president of sales, who once served as chief financial officer for Sun Life’s disability subsidiary, Massachusetts Casualty. On the engineering side, Vykruta notes that some of the top AI folks at Google followed him to EvolutionIQ. “We have a mini Google now. The things we didn’t like were left behind. So, we have a really strong, journey-enduring culture,” he said, when asked about high employee satisfaction ratings that the InsurTech garners online.

The employer rating platform Glassdoor indicated that the highest rating—5 stars—was given by all 26 reviewers from the company in mid-February. “We picked a really interesting, challenging problem,” Vykruta said, suggesting another factor beyond the best-of-Google culture.

“People really believe in the mission. [And] it’s fun to be working on a true first principles problem. Nobody has solved this before. We are inventing this key methodology that never existed…We’re not iterating on some solution and making it better. We’re inventing this artificial intelligence guidance for carriers that nobody has done before.”

Vykruta said that the closest competitor InsurTechs he could think of started with insurance knowledge and added engineering. “We have a very technical product. Our approach is different. We’re not rules-based. We are taking a deep learning approach. We are able to understand every nuance of every claim. We are able to predict the overall outcome.”

“They’re focused more on identifying specific types of flags, is my understanding,” he said, referring to fraud signals as an example. “Or they’re searching the news online for mentions of [something] that might be worthwhile for the examiners to review.”

In contrast, “we act like an expert doctor, expert senior claims leader who is looking into the claim, understanding what’s happening and being able to make a decision on whether or not it’s actionable, and doing it across every claim and the carrier every single day.”

For Vykruta, who reports that he started a gaming team when he was 13 or 14, bringing really smart people together and giving them direction and tools to solve impossible problems doesn’t seem like a new experience. “I’ve been doing this my whole life,” he said.

But learning the insurance claims process took some hard work.

Vykruta said he personally read through hundreds, “maybe thousands” of claims. “The biggest takeaway was their job is really, really impossibly hard,” he said, referring to claims examiners. “There’s so much nuance in these claims. You have to understand the age and the overall health of the individual. The recovery for an ankle injury for a healthy person might be like a month. For somebody who’s obese, it might be two, three years or five years, or they might never recover.”

“That was a big learning curve of just how much these comorbidities can impact the outcomes. And there’s so many different medical diagnoses, so many different body parts and tissues and organs and diseases that we’ve never heard of, and they haven’t either.”

“We did a lot of time researching…We bring medical dictionaries and taxonomies into our system, and we are able to read through the historical notes where most of this data is stored…”

“My takeaway was that I didn’t realize how hard this job was, making these predictions on bodily injury. On auto and property, it’s an easier problem. The human body is just incredibly complicated. It’s the most complicated machine in the universe.”

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll