The hyperconnection between people, machines and organizations is a pervasive megatrend that characterizes our society in any aspects, at any level, in any part of the world.

Executive Summary

If a carrier assumes that a telematics proposition is the same for personal auto customers as it is for commercial, or the same for all shapes and sizes of commercial customers, they run a high risk of failure in launching telematics capabilities, according to Nationwide AVP Pete Frey and CM Guest Editor Matteo Carbone.After giving some background on the slow growth of connected devices generally, Frey and Carbone describe what’s needed for successful execution of telematics programs—leadership commitment to building a business capability, not a program—and an organizational effort of shared learnings. This is what Nationwide Insurance is doing in leveraging knowledge from personal auto insurance successes to a commercial auto insurance business transformation, while also being mindful of differences in customer and distribution channels to marry value propositions to specific customer needs.

The Internet of Things (IoT)—or smart connected products that connect people and objects to the Internet, allowing remote transmission and usage of the information about these things and people—is one of the key technologies in this evolution.

Sociologist Barry Wellman made the first observation about personalized networking in his writings in the early years of the millennium. (See, for example, “Physical Place and Cyber Place: The Rise of Networked Individualism,” Wellman, 2001, International Journal of Urban and Regional Research)

Over a decade later, Harvard Business Professor Michael E. Porter and James E. Heppelmann, CEO of industrial software maker PTC, wrote about how information technology was revolutionizing products from cars to industrial equipment, with “smart connected products” forcing companies to rethink how they compete to win customers and deliver value. (“How Smart Connected Products Are Transforming Competition,” by Porter and Hepplemann, Harvard Business Review, 2014)

Where are we now?

There are many different statistics about the IoT market size—each with different criteria and methodology—ranging from 10 billion and 22 billion connected devices present at the end of 2020. These are impressive numbers, but they are less than half of the 50 billion connected devices for 2020 predicted by CISCO and Ericsson 10 years ago. There have been important success stories, but the business transformation necessary to obtain value from IoT at a general level by a large portion of the players in any industry is much more difficult than originally imagined.

For insurers, IoT represents the opportunity to connect with clients and their risks. However, even insurers’ journeys have been much more difficult than originally appreciated. Personal auto telematics is the most mature area, but less than 10 insurers around the world have built a telematics portfolio with at least one million policyholders based on the data of the IoT Insurance Observatory.

These successful organizations have embraced telematics across various business functions and at all organizational levels. As articulated by one of the co-authors of this article (Frey), telematics adoption should be seen “as not just launching a program but actually building a business capability within your organization. The biggest difference as you switch your perspective from program launch to capability building is that you look at building buy-in, understanding and expertise across the organization while launching the program. It becomes an organizational effort rather than the job of a specific product, marketing or innovation team.” (“Building an Insurance Telematics Capability,” August 2020, posted on LinkedIn)

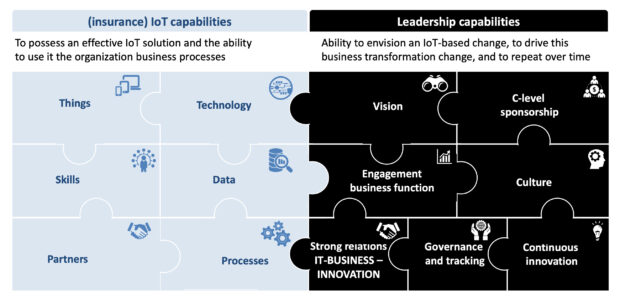

Mastering the usage of telematics data involves business transformation that requires both technical and leadership capabilities. Only a multiyear commitment allows companies to develop and consolidate them, and they need to be managed and evolved.

The Necessary Capabilities

Current State of U.S. Commercial Auto Insurance

While telematics for commercial auto has seemed like a slow mover, it has started to pick up pace over the last three years. More commercial insurance telematics programs are beginning to surface, and some of the early programs are maturing. From traditional usage-based insurance, to fleet management services, to data exchanges and even miles-based concepts for small business, commercial carriers are looking to leverage the benefits that telematics can bring to their long-term viability in the market and to their customers.

The value of telematics is exponential as it matures. It’s not really linear, which is a challenge that many carriers have in adopting a telematics program. In other words, as a telematics program grows in volume—data, enrollments, vehicles—the value expands. Given long struggles with commercial auto insurance profitability across the industry, telematics can be a strategic capability that can provide value and return on many different levels.

Nationwide’s Telematics Experience

Nationwide’s strategic choice to adopt telematics in commercial auto has matured in the context of a successful journey in adopting it in personal auto. Commercial telematics at Nationwide has been able to leverage quite a bit from the competencies developed by the organization managing SmartRide and SmartMiles programs for personal auto customers. Both programs have been incredibly successful in terms of customer growth and agent satisfaction. From an insurance standpoint, both have also shown positive impacts on key performance indicators such as loss ratio, growth and retention.

In building the commercial telematics program, Nationwide’s commercial innovation team has collaborated heavily with personal lines counterparts to try and incorporate learnings, strategies and methods that can accelerate their place in the market. Instead of reinventing, they’ve pinpointed opportunities where they can approach things mutually, whether it’s an approach to data or how they leverage key partners. From a policyholder standpoint, the value propositions may differ slightly between a personal and commercial insurance telematics offering, but there are certainly many other aspects that can be shared.

Commercial Auto Telematics-Based Value Proposition

For adoption, it is fundamental to understand the value perceived by policyholders. Business owners and corporate clients may see value in getting a participation discount or a fleet management service at an affordable price. One critical success factor in commercial telematics adoption is making sure that the customer value proposition is clearly determined and communicated to all the relevant stakeholders. If a carrier assumes that a telematics proposition is the same for personal auto customers as it is for commercial, they are running a high risk of failure.

- “Leading Digital: Turning Technology Into Business Transformation” by G.B Westerman (Book, 2014)

- “Connected and sustainable insurance” by Matteo Carbone, Pietro Negri and Marco Harb (Article, 2016)

- “Building an Insurance Telematics Capability” by Pete Frey (August 2020, LinkedIn Post)

- “IoT Success Stories Are Emerging in Commercial Lines” by Matteo Carbone, June 2021 (Article, Leaders Edge)

- “From Risk Transfer to Risk Prevention – How the Internet of Things is reshaping business models in insurance” by Isabelle Flückiger and Matteo Carbone (Geneva Association Research, May 2021)

Commercial customers come in many different shapes and sizes. They have different needs, different challenges and varying ecosystems. They have businesses and their own customers to manage, and employee drivers to contend with. Telematics can be beneficial to all of them, but the trick is figuring out how and then convincing them of the insurance benefit.

The agent and customer dynamic is also a key variable. The relationship between agents and commercial customers can be different depending on the account, and that can weigh heavily on how telematics is incorporated into the insurance transaction. It is fundamental to engage the distribution channel in the go-to-market of the telematics program, both adequately sharing with them the vision and designing processes around their needs.

Connecting telematics to insurance value is not as easy as it may seem for commercial customers and agents. However, insurance carriers have access to strategic resources that can help: loss control and risk management teams. With focus on safety and risk prevention, these resources can play a vital role in being advocates and champions for telematics use. They are usually trusted allies of both customers and agents in helping to bring value to the insurance relationship, as well as helping to optimize business environments and making them safer all around. They are natural ambassadors.

Telematics Data Usage for Creating a Sustainable Business Case

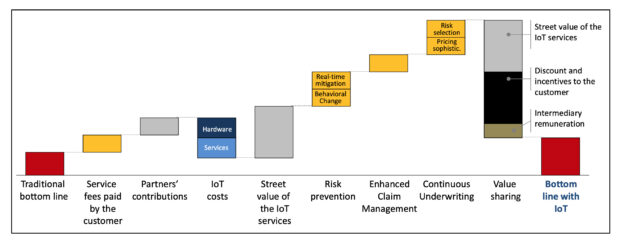

Insurers need to build sustainable business cases in order to offer value to customers. The reality is a telematics business case is complex. Unfortunately, it’s not one of those endeavors that you can launch and have a return that is immediate. Telematics is an investment. To make a decision to commit to telematics is committing to a new way of doing auto insurance.

As mentioned before, the value is exponential based on the levels of maturity a carrier wishes to achieve with their program. The business case almost has to be looked at as an evolving artifact, with measured steps and managed expectations along the way. Depending on the program strategy that is adopted, a carrier may have to base their business case on incremental KPIs as their program matures. The first phase, for example, could focus on customer enrollment, risk mitigation and behavioral trends. Later in the program, KPIs could be introduced around retention and loss frequency. Further still, KPIs around underwriting profitability and segmentation may become more apparent.

Early on in a program, a carrier may see value from a loss control and safety angle. Insurers around the world are investing in the prevention solutions with two approaches, as evidenced in the 12-month research done by The Geneva Association and the IoT insurance Observatory:

- Real-time risk mitigation, where the detection of a risky situation triggers a reaction aiming to prevent an accident from happening.

- Behavioral change enhancing the activity of the loss control team but also rewarding employees’ safe behaviors.

Moreover, as the program matures, the data begins to provide value for pricing sophistication, risk selection and underwriting. To complete the value chain, telematics can then have positive impacts on claims in terms of services, efficiency of the process and effectiveness of the decisions (including minimization of fraud and inflated claims).

The Value Creation Framework

All these elements of the value creation equation need to be managed in order to deliver an adequate value for all the relevant stakeholders. This requires engaging and coordinating a multitude of both internal (e.g., innovation, different business functions, IT) and external (telematics service providers, other partners, agents and brokers, clients) operational functions of an insurance carrier.

Nationwide has recognized that a “one-size-fits-all” approach may not be best for commercial customers and agents. The company has multiple programs, each tailored to meet customer needs and values. The programs have required distribution and customer engagement strategies that also are contemplated based on customer and agent context. For larger businesses, for example, Nationwide’s loss control teams are essential in guiding and consulting as customers learn to adopt telematics into their environments. Loss control professionals help business owners understand behavioral insights provided by telematics solutions while at the same time guiding them through the best type of dashcam features that make the most sense for their fleets and drivers.

The solution for small business customers is aimed at simplicity and value. For larger business fleets and commercial agriculture customers, Nationwide proposes a program that offers more in the way of fleet and driver management capabilities. For other larger fleets or trucking fleets, the insurer offers dashcam telematics solutions.

Altogether, even though the solutions may look different across different customer segments, they are all centered around the customer and delivering safety, service and value. Ultimately, if Nationwide can influence behavioral change through telematics, driving can be safer and insurance costs can go down.

Telematics Strategy

Hand in hand with the above-mentioned business case is the strategy for how a carrier wishes to implement telematics. This will determine the cost structure that needs to be considered.

In the past, there was an assumption that the only way to build a program was to partner with a telematics service provider and white-label a solution. The cost was typically pretty high as carriers had to pay for things like devices, software licensing, data management and monitoring, integration with internal systems, logistics…and the list could go on.

In looking around the commercial insurance market, however, there are plenty of examples of programs that look very different from that model. There are traditional usage-based insurance programs, but there are also other programs that revolve around risk management services, ELD (electronic logging device) partnerships, OEM and fleet management partnerships, data aggregator arrangements, and other creative models.

The point here is that there are many ways that a carrier can leverage telematics into its commercial auto strategy. In addition, while the above-mentioned competencies are consolidated, a carrier can incrementally incorporate the usage of telematics data into its value chain as desired. Should the focus be on underwriting and pricing value? Should it be around risk management? Claims? All of the above? It comes down to where the carrier’s focus needs to be and what will strengthen its relationship with customers and distribution channels.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation