Social inflation has become the industry’s most talked about subject in recent quarters. The frequency and severity of tort claims has increased, and insurers have had to add to prior-year reserves and to re-evaluate pricing and capacity to reflect altered loss expectations.

Executive Summary

The conditions underlying social inflation will plague the P/C insurance industry for the next few years, warn William Wilt and Alan Zimmerman of Assured Research. Prior-year reserves will have to be reviewed, pricing will have to be adjusted to reflect future loss expectations, and they expect a contraction in capacity as some insurers pull away from the market and higher loss reserves create the need for a greater level of allocated capital.It’s not over. We believe the conditions underlying social inflation will plague the industry for the next few years.

The most obvious implication of rising social inflation for P/C insurers is that prior-year reserves will have to be reviewed and pricing will have to be adjusted to reflect future loss expectations. But prices don’t adjust in a vacuum, and we expect there will be a contraction in capacity as some insurers pull away from the market and higher loss reserves create the need for a greater level of allocated capital.

Settlement strategies will also have to be reconsidered as defendants and their insurers, by extension, shy away from the unpredictability of jury trials. We expect that even companies that have heretofore avowed to fight existing claims will ultimately begin to consider settlements.

As another consideration, reinsurance strategies will also need to be re-evaluated. While most reinsurance attention is paid to property coverages, liability protection is also an important risk management tool.

What Is Social Inflation?

For analytical purposes, we place inflation in three buckets. For simplicity, bucket No. 1 measures “stuff,” by which we mean the materials common to the majority of property and auto insurance claims such as lumber or sheet metal. This type of inflation is easily measured via analogs to the consumer price index (CPI) or the personal consumption expenditure index (PCE) for consumers. Bucket No. 2 is medical inflation, which affects not just the healthcare industry but also property/casualty insurers chiefly through workers compensation and auto liability claims.

Bucket No. 3, which in our definition is social inflation, measures everything else. For insurance purposes this includes the increased propensity to sue, rising jury awards and expanding judicial theories beyond the four corners of the contract. With this definition, and because social inflation is a widespread phenomenon, it is difficult to spot and hard to measure objectively.

How Do We Know Social Inflation Is Here?

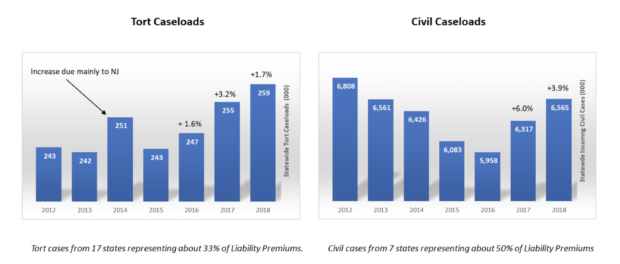

Despite the difficulty in measuring social inflation, it can be identified in various indicators of frequency and severity trends. As for the frequency of tort claims, perhaps most important is that after years of declining, the number of tort cases and civil actions are now on the rise, as shown in Figure 1.

Figure 1: Tort and All Civil Caseloads in States Representing Large Share of Liability Premiums

Source: National Center for State Courts, Assured Research. Latest data available.

Source: National Center for State Courts, Assured Research. Latest data available.

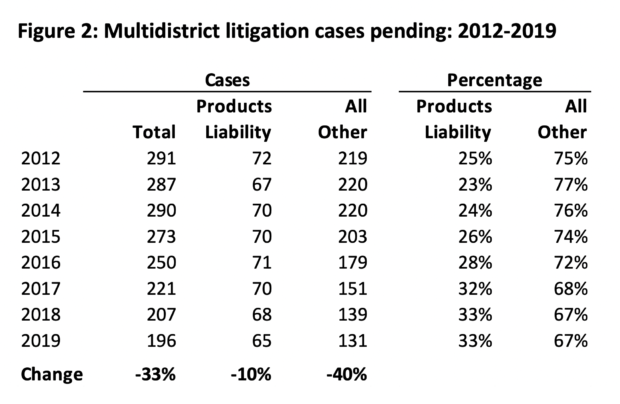

Outside the many anecdotes available as to the rising number of “nuclear” verdicts, reliable indicators of claim severity are more difficult to come by. If we look to national data on multidistrict litigation, there is positive and negative news. Favorable, while the number of outstanding MDL cases has declined (from 291 in 2012 to 196 currently), there has only been a slight decline (-10 percent) in products liability cases, which often have large settlements, while the other cases have fallen by 40 percent. See Figure 2.

But the negative news with multidistrict litigation is that the number of large suits is rising, as is the size of the cases. At present there are 22 pendingcases with over 1,000 claimants and collectively they include about 122,000 claimants. By comparison, in 2012 there were 14 cases in the over-one-thousand category and together they accounted for 48,000 claimants. That’s a 2.5-fold increase in the number of claimants involved in large-scale MDL cases.

Source: Judicial Panel on Multidistrict Litigation, Calendar-Year Statistics, Assured Research

Source: Judicial Panel on Multidistrict Litigation, Calendar-Year Statistics, Assured Research

It’s likely that the increasingly frequent, large jury verdicts awarded in marquee cases covering torts associated with talc, Risperdal or RoundUp won’t, in and of themselves, have major insurance ramifications (many of the makers will be self-insured). However, the “headline effect” is real; jurors’ perception of “fair and equitable” compensation is altered and insurers increasingly lament that citizens have forgotten the value of $1 million when adjudicating “regular” tort actions involving automobiles or slips and falls.

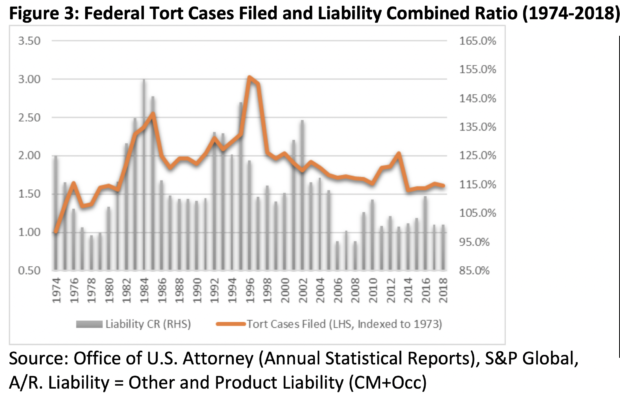

And, if you need any data on the importance of tort cases to the industry’s financial results, Figure 3 shows the relationship of the number of cases to the liability loss ratio for the insurance industry since 1974. While we don’t want to overstate the case, there definitely is some relationship.

We believe social inflation will be around for some time because:

• Juror attitudes have hardened. While macro-economic developments have been quite positive in recent years, the growing income inequality has hardened societal attitudes toward not just politics but also big businesses. This divisiveness has spread to the jury box. What better way express anger and “stick it to the man” than to make a large jury award when given the opportunity.

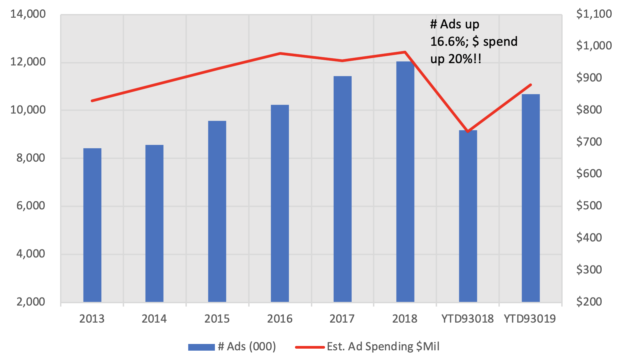

• Plaintiffs’ attorneys have gotten their act together. There is little doubt plaintiffs’ attorneys are utilizing a wider use of data in presenting cases and, in the opinion of many opposing counselors, this has improved the quality of their presentations and the ability to influence awards. Part of this has been fueled by third-party litigation funding, which has allowed them to advertise more (see the nearby inset), thus finding more potential plaintiffs, and to spend more on data research to better support cases.

• Large awards lead to large settlements. As already described, large jury verdicts in marquee, mass tort cases will both encourage more suits and lead to rising jury awards in “regular tort” cases, we believe. While these headline awards will (or in some cases have already) been reduced, they have a big influence on defendant settlement attitudes. For example, any opioid settlement will demonstrate to state and municipal governments that there is big money to be made in pursuing “public nuisance” lawsuits. Next up we expect will be PFAS cases, and there eventually will be more lawsuits against any company that has caused environmental damage (energy companies in particular). The trend of governments hiring outside law firms on a contingency basis to pursue these cases further reinforces the trend toward large settlements.

Figure 4: National and local TV advertising surpass $1 billion in 2019

Social inflation is not here to stay. History teaches us that societal attitudes toward compensation through the legal system swing like a pendulum. And while the pendulum is presently swinging in the wrong direction for insurers and reinsurers, claim pressures will eventually recede—though that may not happen as quickly as insurers would like!

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation