The growth of the Internet of Things (IoT) is a relevant trend for our hyper-connected society. A few years ago it was estimated that on a normal day, 127 new devices were connecting to the Internet each second. Nowadays, this trend is growing exponentially. Insurers cannot stop this. They can only leverage the data that comes from these connected devices or ignore this data.

Executive Summary

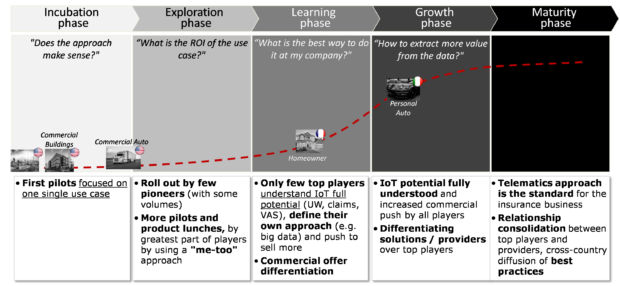

By selling IoT-based services to small commercial insureds and gaining their permission to use IoT data for core insurance activities, carriers will derive value on their bottom lines, believes Matteo Carbone, founder of the IoT Insurance Observatory. Using the analogy of telematics in personal lines, he shows that global insurance telematics best practices fuel loss control benefits, changes in behavior and risk self-selection effects that can improve insurer profit margins.As of today, the insurance sector has exploited IoT data more on the personal lines side of the business than in commercial lines. Insurance telematics in personal auto has been out there for more than 15 years. The Italian market has achieved more than 22 percent telematics penetration in the auto insurance business. Penetration in the U.S. personal auto insurance market is still low, but in the last two years the market has evolved significantly. French insurers have built a success story on smart home insurance (télésurveillanceservices) over the same period, and even in the United States experimentation is progressing, with players such as American Family leading the pack.

We are starting to see the emergence of commercial lines applications, especially in the United States. Some commercial auto insurance products, such as Progressive Smart Haul, are gaining traction, and the interest in the application to other business lines is growing.

However, in commercial insurance, outside of commercial auto, we are still talking about theoretical ideas and POCs (proofs of concepts), and there are only a few already commercialized products. In my activity at the IoT Insurance Observatory—a think tank that in North America has aggregated almost 30 members including six of the top 15 property/casualty insurance carriers as well as major reinsurers—I have directly seen a growth in appetites of traditional insurers for IoT applications.

The Opportunity

The insurance sector has four different opportunities to leverage the IoT data in commercial lines:

- New risks. First of all, there is the opportunity to insure new risks that are emerging due to this technology, and also to insure the outcomes of IoT solutions adopted by business owners.

- Existing risks. Another area of opportunity is to develop new ways to insure existing risks.

- Current insurance activities. IoT data (and processes based on this data) allow for better performance of core insurance activities (underwriting, pricing, risk management and claims handling) related to current insurance products.

- Services. Last, there is the opportunity to sell IoT-based services.

To understand the first opportunity, new risks and insurable IoT outcomes, think about a small manufacturing company, Company A, that decides to stop producing one of its products at its own facility, instead renting IoT equipment, owned by Company B, to remotely produce the product. Company A is exposed to new risks, such as contingent business interruption and counterparty risk. The IoT outcome, the failure of the IoT project, is also a new risk that can be insured.

Or consider a company that buys an IoT project to target the problem of equipment breakdown, allowing preventive maintenance with the goal of eliminating production stoppage longer than six hours. An insurer can sell a business interruption coverage that is triggered by any stop in the production longer than six hours. There are already insurers that are doing this: They study the specific IoT project and insure its outcome.

To understand the opportunity of finding new ways to cover existing risks, think about the real-time measurement of the key drivers of exposure to insurance coverage, such as the presence of people in an area for general liability or the inventory for theft insurance.

The last two opportunities are the key aspects that have worked well for IoT in personal lines. Indeed, based on Observatory research over the past few years, the most relevant international insurance IoT success stories have been characterized by five common characteristics:

- A product sold through current distribution channels, frequently as an option on an existing product.

- A closed system with devices/app provided by the insurer.

- Fees paid by the customer for services, which include the rental of the devices.

- Explicit usage—so with customers, consent at the time of purchase—of the data for activating multiple use cases in order to create value on the insurer’s income statement (loss control, change of behavior, pricing, risk self-selection, which is described in the next section of this article).

- The sharing of a material value with customers through discounts, cashback, incentives, etc.

The marriage of IoT-based services and IoT impacts on the core insurance activities will allow insurers to obtain a competitive advantage in small commercial. This segment has not yet been penetrated by the IoT services because the first targets of IoT companies have been large and medium enterprises, but I believe insurers can succeed in delivering bundles of IoT services and insurance coverages to this segment.

The synergies between those two aspects—services and impacts on the core insurance activities—are possible because the same data used to deliver services will allow insurers to improve the technical profitability of the insurance business. In this way, IoT creates value on the insurance P&L, and this value can be shared with the client.

The bigger the difference between insurance premium and service cost, the higher the potential value of the bundle to share. Consider that spending for commercial line coverages—even excluding commercial auto—can easily be several thousand dollars for a small enterprise.

The Value Creation

The sensors necessary for the service delivery—let’s, for example, think about security cameras with AI on the edge—can be fundamental to the detection of risky situations. This is precious information for an insurance company. First, it allows claims prevention and damage mitigation. These could be achieved through real-time alerts to a field supervisor, such as the store manager in a retail shop, or to the provider of the necessary emergency services, such as an emergency plumbing service provider.

The second use case linked to the detection of risky situations is reporting. The quick delivery of these insights provides objective information to claim handlers. In this way, the insurance company can be ready to address the claim in a more efficient and effective manner, limiting fraud and inflated claims.

The reporting of claims and near-miss incidents also allows insurers to provide automated loss control advice to the business owner. This information can also be taken into account for underwriting decisions at renewal and even to influence pricing.

More value creation is possible from the use of the sensor data to manage behavioral change mechanisms. As experiments in personal lines have revealed—from life to health and even to auto insurance—by working on awareness creation, behavior suggestions and incentives, it is possible to reduce the expected losses of an insurance portfolio.

One last aspect to consider in terms of value creation is the self-selection effect. The personal lines experience has taught us that at each pricing level, individuals who accept telematics monitoring are better risks (produce lower loss ratios) than peers who don’t accept monitoring. So, we can be pretty confident that the business owners who chose the IoT-based insurance coverage are better risks (because they have nothing to hide from their insurers) than their peers who don’t accept IoT monitoring.

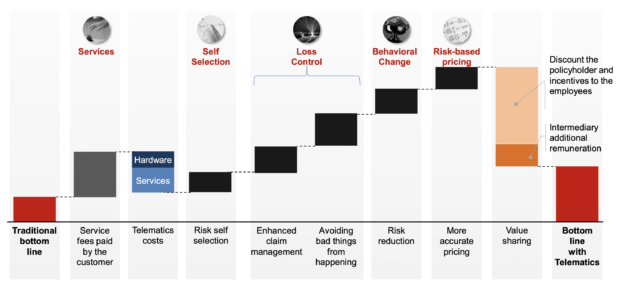

The insurer that succeeds in these areas will obtain the waterfall represented above, where the sum of the service fees and the effect of risk selection, loss control, risk-based pricing and behavioral change—all the elements that in my previous articles I have defined as “value creation levers”—covers the IoT costs and creates a relevant amount of extra value. This value can be shared first of all with policyholders through discounts and incentives. However, part of it should also be shared with intermediaries—agents and brokers involved in the insurance policy distribution through extra commissions—in order to scale up the IoT-based portfolio.

Challenges Ahead

The main challenge to introducing IoT-based coverage to small commercial insurance will not be the choice of technology, as many may expect. The trickiest aspects are the design of the insurance IoT strategy, the delivery on the field and its progressive optimization based on the lessons learned.

First of all, it will be key to identify and design the services that target customers are interested in paying for. The sensors necessary for these services will be the foundation of the insurance IoT approach, and all the additional sensors with costs lower than achievable benefits should be added on top of them. In the design of the insurance use cases, all the different functions related to the value creation levers described above must be involved, as well as all the business lines of the insurance group. The potential in each coverage and each endorsement dedicated to the segment has to be squeezed in order to maximize value creation and therefore the return on the IoT investment.

In these cost-benefit analyses, it is necessary to adopt a multiyear perspective, thinking toward the amortization of the hardware cost over multiple periods. These are the same challenges that have been successfully addressed by the best practices on personal lines.

Specialized solutions by segments will be necessary in order to deliver effectively. This aspect is an additional challenge that was not present for carrier experiences in personal lines, which have been easily addressed with a “one-size-fits-all” approach.

Another complexity, also not present in personal lines, is the presence of multiple actors to be involved in the adoption of the solution, in the prevention and mitigation, and in the behavioral change. The business owner (or eventual employees appointed to purchase the insurance coverage), the on-field supervisor (such as a store manager) and operative employees are relevant stakeholders. The IoT insurance approach must take into account all of them in order to succeed.

Benefits Outweigh Challenges

Let’s consider the reasons for investing to overcome these barriers facing the IoT-based opportunity. This approach represents an effective way to win more business and to generate a more profitable commercial lines portfolio. It will also allow carriers to generate new knowledge about clients and their risks (which will lead to opportunities for cross-selling and up-selling).

Beyond this, consider the positive possible societal benefits beyond the boundaries of any one insurance company. Sales of insurance IoT solutions can generate positive externalities to an entire society by contributing to the modernization of the small and medium enterprises of the geographic region.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook