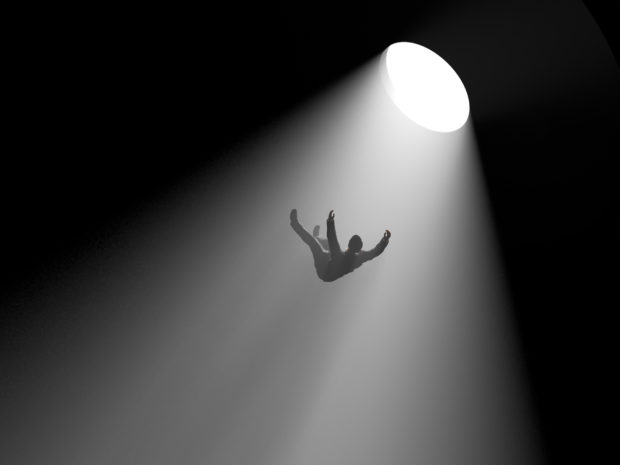

When an Italian man attended an art exhibit in the Serralves Museum in Portugal last year, he didn’t expect to be hospitalized just for trying to view one of the works on display. But that’s exactly what happened when a 60-year-old visitor and others were gathered around an installation called “Descent Into Limbo” by Anish Kapoor.

Viewing the exhibit involves staring down at a large black dot painted on the floor. There is an eight-foot-deep circular hole in the middle of the dot and the extremely black paint around the hole is meant to give “the illusion of a depthless void,” according to reports of the back injuries sustained by the observer when he fell into the work of art. (Curious readers can see a photo of the installation on Facebook.) The hole within a circle of blackness was a risk hiding in plain sight—right in front of the art enthusiast but very easy to miss.

Why not 25? Why not 50 or 100 risks? Twenty-two was the number of risks that we had room to publish here. But there are more. What underappreciated risks are on your radar screen? Share your ideas by contributing to a future Risk Alert. Submit your ideas to Susanne Sclafane at ssclafane@carriermanagement.com or Andrew Simpson at asimpson@wellsmedia.com.

Even extremely vigilant insurers and reinsurers scanning the risk landscape for potential future liability problems are likely to fall into some landmines. What insurance and organizational risks of the immediate or distant future are being overlooked now?

Carrier Management offers its second look at some of the least visible risks, some that may not have surfaced in property/casualty C-suites or boardrooms, on insurance conference agendas, or in the mainstream press. So, there is nothing about drones shutting down airports, biometric privacy lawsuits or Alexa spying capabilities. This subjective list consists of items that intrigued Carrier Management editors for one reason or another. Some are worrisome; others perhaps laughable. But all triggered thoughts about insurance implications.

The editors invite feedback and suggestions for more “almost hidden” risks and urge readers to watch for CM Risk Alerts in a recurring series to be continued online and in print. Also, readers may wish to revisit CM‘s first publication of risk alerts: “67 Emerging Risks Nobody Is Talking About,” Oct. 18. 2015 by Andrew G. Simpson.

Here are 22 risks hiding in plain sight:

1. More people are anxious and depressed. The World Economic Forum Annual Meeting in late January reported on the No. 1 mental health problem in the world: anxiety. According to 2016 data from the Institute for Health Metrics and Evaluation, anxiety impacted 3.83 percent of the world’s population, or about 275 million people. Depression ranks second, affecting 3.77 percent. Are members of your workforce part of the statistics? What is your company doing to recognize the signs and help? Will depression and anxiety increase the cost of bodily injury liability and workers comp claims? The Forum’s Global Risks 2019 report also discusses the ripples of individual anxiety on the global risk landscape. Psychological and emotional well-being is not just a risk for individuals in and of itself, “it also affects the wider global risks landscape, notably via impacts on social cohesion and politics,” the report says.

(“This is the world’s biggest mental health problem—and you might not have heard of it,” weforum.org, Jan. 14, 2019 by Sean Fleming; 2019 Global Risks Report, Jan. 16, 2019)

2. Is the ledger truly immutable? The question addresses one of a number of new risks arising from the use of smart ledgers, according to Michael Mainelli, executive chairman of Z/Yen Group. Others are: “Who indemnifies who for data entered on the ledger? What about systemic failure?” The risks, he said, suggest “some potentially big solutions…that insurers can provide.”

(“Unblocked by the Chain, Smart Ledger Systems Are ‘The Thing’ to Insure,” Carrier Management, Sept. 17, 2018 by Michael Mainelli)

3. ADA website accessibility suits. While not a new risk, the number of lawsuits alleging that business websites are not compliant with the Americans with Disabilities Act are reaching record levels, according to Seyfarth Shaw attorneys in their ADA Title III News & Insights blog in mid-July last year. Plaintiffs with visual impairments and other disabilities filed more website accessibility lawsuits in federal court for the first six months of 2018 (1,053) than in all of 2017 (814). Will insurers continue to pay for defense? Under what policies? What about website modification costs?

(“Website Access and Other ADA Title III Lawsuits Hit Record Numbers,” ADA Title III News & Insights blog at www.adatitleiii.com/, July 17, 2018 by Minh N. Vu, Kristina M. Launey, Susan Ryan and Kevin Fritz)

4. Risks cemented; tall wood buildings get green light. The Portland Cement Association alerted Carrier Management via email about what it views as a threat to public safety: the potential approval by the International Code Council (ICC) of construction of tall buildings from wood products. The American Wood Council sees it differently, lauding the ultimate passage of a package of 14 tall mass timber code change proposals in December. “Mass timber has been capturing the imagination of architects and developers…ICC’s rigorous study, testing and voting process now recognizes a strong, low-carbon alternative to traditional tall building materials used by the building and construction industry,” AWC’s president said. What about insurers? Portland Cement Association’s alert said that “insurers recognize that there are greater risks with wood-frame construction buildings versus concrete buildings,” citing a 2017 survey by the National Ready Mixed Concrete Association finding lower builders’ risk and commercial property rates for concrete structures.

(Press Release: “National Poll: Three in Four Americans Think Tall Wood Construction Is a Threat to Public Safety,” cement.org, Aug. 14, 2018; Press Release, “AWC: Tall Mass Timber code changes get final approval,” awc.org, Dec. 19, 2018; “Survey of Insurance Costs for Multifamily Buildings Constructed with Wood frames and Concrete,” Boston College, Dr. Pieter VanderWerf and Nicholas Haidari)

5. In the name of beauty: toxic trio. InsurTech analytics company Praedicat estimates that latent liability from dibutyl phthalate (DBP) affecting both consumers and workers has the potential to generate in excess of $100 billion in losses to the U.S. economy. DBP is one of three toxic chemicals commonly found in nail polish and other beauty products, Praedicat and Allianz Global Corporate & Specialty alerted in a September 2018 report. Whether the inclusion of the three chemicals is known and intended or it is unknown, general liability insurers may pay bodily injury claims and product recall costs. Also among the risks is the growing threat of product mislabeling. “Manufacturers who market their products as being ‘three-free could be held liable if their products contain any of these chemicals, even if it is not their fault.”

(“Emerging Liability Risks: The ‘Toxic Trio,'” by Allianz Global Corporate & Specialty and Praedicat)

6. Babies from human cells. A researcher at Japan’s Kyoto University created stem cells from human blood cells and then guided them to develop into “primordial” reproductive cells at a very early stage of egg development. The Washington Post, reporting on the research published in the journal Science, describes this production of “a precursor” to human eggs in a laboratory as game-changing. Actual egg production is just “a matter of time,” a former Brown University dean of medicine told the newspaper. Beyond the ethical concerns discussed in the article, a Harvard Medical School stem cell researcher said a major concern will be the possibility of cancers or other diseases that could arise in any babies created from such an egg, suggesting one scenario that might impact liability insurers for future egg developers.

(“The ‘game-changing’ technique to create babies from skin cells just stepped forward,” The Washington Post, Sept. 20, 2018 by Carolyn Y. Johnson; “IVF moonshot takes step towards making human eggs from skin,” Sept. 21, 2018)

7. Here come driverless trolleys. Siemens Mobility demonstrated a test tram driving autonomously in real traffic last September on a six-kilometer section in Potsdam, Germany. According to The Guardian, a staged emergency added drama to the demonstration when a Siemens employee pushed a pram onto a walkway running across the path of the tram, causing the vehicle to brake until a human conductor restarted the system after the track was clear. With multiple lidar, radar and camera sensors serving as “digital eyes” and complex algorithms functioning as the tram “brain,” commercial insurers and reinsurers will need to respond with a complex collection of liability and technology E&O coverages.

(Press Release: “Siemens Mobility presents world’s first autonomous tram,” Sept. 3, 2018; “World’s first autonomous tram launches in Germany,” MIT Technology Review Download, Sept. 24, 2018; “Germany launches world’s first autonomous tram in Potsdam,” The Guardian, Sept. 23, 2018)

8. Keeping tech dinosaurs alive. According to a Wall Street Journal report, Cobol is still the most prevalent programming language in the financial services industry worldwide, with software programmed in Cobol powering millions of banking transactions every day and underpinning critical computer mainframes. What’s in your mainframe? Are you ditching it? If not, you’ll be on the hunt to find a programmer with a generation of Cobol specialists retiring.

(“Do You Know COBOL? If So, There Might Be a Job for You,” Wall Street Journal, Sept. 21, 2018 by Max Colchester)

9. EEO language scares off minority candidates. “Job seekers believe that the inclusion of an EEO [equal employment opportunity] statement considerably raises the belief that African Americans and Hispanics are token hires,” two university researchers said in a working paper released by the National Bureau of Economic Research. As a result, job listings with EEO language draw fewer minority candidates—in some cases, 50 percent fewer—than ads without the phrase. A novel starting point for EPL claims? How will you create a more diverse workforce at your company?

(“A surprising way minorities are turned off by job postings,” Quartz, Sept. 25, 2018 by Oliver Staley, accessed via SmartBrief on Workforce)

10. But they’re so cute. Doctors at Johns Hopkins Hospital in Baltimore report that therapy dogs visiting to cheer kids undergoing cancer treatment carried MRSA bacteria around the facility. Kids who spent more time with the dogs had a six-times greater chance of coming away with superbug bacteria. While the study came to a happy conclusion, and also found that washing the dogs before visits and using special wipes in the hospital took away the risk, liability insurers need to be on alert for other ways of spreading bacteria. Mobile devices, perhaps?

(“Therapy dogs can spread superbugs to kids, hospital finds,” Associated Press, Oct. 5, 2018 by Mike Stobbe)

11. Silicon Valley bubble. The former head of PR at Google, Jessica Powell, has written a “totally fictional but essentially true” story of Silicon Valley, satirizing cultural stagnancy at what many think of as the world’s most innovative companies. Instead, she finds an “engineering-and-data-obsessed monoculture that invites little input from people outside the bubble,” The New York Times wrote in its account of the book. “If you have a hierarchy where engineers are at the very top and the people who are interfacing with the outside world are a couple rungs below that, you really miss something when those people don’t have an equal voice at the table,” Powell told NYT, describing “a monoculture of thought” as a “real problem.” As tech engineers invade the insurance space, will they bring an unwelcome culture with them?

(“Silicon Valley’s Keystone Problem: A Monoculture of Thought,” The New York Times, Oct. 2, 2018 by Farhad Manjoo, reporting on Jessica Powell’s book, “The Big Disruption,” available on Medium)

12. Get some sleep! “The amount of sleep as well as its quality is in decline across the globe. Increasing pressure at work and in our spare time, blue LED lights in our smartphones disrupting our internal body clock, and travel are among the many drivers that don’t allow us to sleep enough or not well enough,” warned Jeffrey Bohn, director of the Swiss Re Institute, in the September/October 2018 edition of Carrier Management. Explaining why P/C insurers should care, he notes that two out of three losses worldwide are due to human failure. Based on Swiss Re’s sigma research, this would mean that people trigger a loss volume of $3 billion per year. Separately, speaking at the World Business Forum in November, Arianna Huffington, co-founder of The Huffington Post, implored executives to recognize that “in the human operating system, downtime is a feature not a bug.” Huffington, who founded Thrive Global, a wellness platform, after her personal experience of collapsing from exhaustion, is on a mission to change the habits that Bohn referred to, famously penning an open letter to Elon Musk about his “wildly outdated, anti-scientific and horribly inefficient way of using human energy.”

(“Emerging Risks: What’s the Next Asbestos?” Carrier Management, Sept. 19, 2018 by Jeffrey Bohn based on Swiss Re Institute’s May 2018 Swiss Re report “SONAR 2018: New emerging risk insights“; “An open letter to Elon Musk,” Aug. 17, 2018, Thrive Global by Arianna Huffington)

13. Will it float? When Business Insider tweeted out the message, “In the future, floating islands could be considered home,” on Oct. 8. 2018, the idea wasn’t entirely new. Business Insider, the BBC, National Geographic and other media have described these artificial solutions to growing populations and rising seas for several years. In fact, the video accompanying the tweet was published by MARIN (the Maritime Research of the Netherlands) in July 2017, which tested the “first floating mega island” constructed of interconnected floating triangles capable of supporting housing, infrastructure or serving as places to generate renewable energy. “It is unknown how much wind and currents the islands can withstand,” Business Insider noted, asking the types of questions insurers ask about coastal properties. What about people? Will half the population get sea sick? What types of insurers will cover floating cities and floating wind farms against those natural perils and manmade ones as well? Home insurers? Marine and energy underwriters? A new category of coverage?

(@businessinsider, https://t.co/lE9IZhnOFH; MARIN press release, July 13, 2017)

14. E-scooting on the job. “If an employee opts to use a motorized scooter for a work-related purpose and is injured, under certain circumstances a workers compensation claim could result.” The warning from Colorado workers comp insurer Pinnacol Assurance is one of the most recent discussions of potential risk resulting from hopping on an e-scooter that can be unlocked from a smartphone app. While Pinnacol has yet to see a comp claim, scooter services Lime and Bird have already been hit with lawsuits, including a class action filed in Los Angeles accusing the firms of “gross negligence” and “aiding and abetting assault.” Separately, MIT Technology Review compiled more reports revealing how the promise of stress-free mobility is causing unintended problems: a potential software malfunction causing e-scooters to abruptly halt midride, throwing off and injuring passengers, which prompted Bird to stop operations in Switzerland; allegations that motorized vehicles violate the Americans with Disabilities Act by blocking access to San Diego’s streets and sidewalks set forth in a lawsuit filed by Disability Rights California; battery fires prompting a partial recall of some scooters. “So if you cause an accident, are you covered?” The Insurance Information Institute addresses the questions in a September 2018 blog. Maybe by a personal umbrella, but not by homeowners or auto insurance, I.I.I. says.

(“Class-action lawsuit accuses e-scooter companies of ‘gross negligence,’“ The Washington Post, Oct. 12, 2018 by Peter Holley; “Lime is pulling its scooters in Switzerland after a possible software glitch made people fall off,” The Download/MIT Technology Review, Jan. 14, 2019; “Disability advocates target city of San Diego and scooter companies in lawsuit,” Los Angeles Times, Jan. 12, 2019 by Greg Moran; “E-scooter sharing programs: are you covered?” The Triple-I Blog, Sept. 7, 2018 by Lucian McMahon)

See also, “15 Emerging Risks from Policies to Playgrounds, Sandboxes to Scooters,” Oct. 18, 2018, Insurance Journal by Andrew G. Simpson; “First e-Scooter DUI Case for Los Angeles,” Oct. 1, 2018, Insurance Journal/Associate Press.

15. Hacking a water disaster. Researchers from Ben-Gurion University found that popular commercial irrigation systems have security weaknesses, potentially allowing hackers to turn them on and off remotely. According to an MIT Technology Review report on the research, the vulnerability means that hackers can trick the irrigation systems into watering by feeding IoT devices fake commands directly or by serving up bogus weather data. “The researchers claim a botnet of 1,350-odd sprinklers could empty an urban water tower in an hour, and around 24,000 could empty a flood water reservoir overnight,” the article says, offering an example of a cyber physical damage disaster scenario that may not be insurable.

(“Hackers could turn your garden sprinklers into a cyber weapon,” The Download from MIT Technology Review, Aug. 8, 2018)

16. Mountains of batteries. As polluting gas-powered vehicles are replaced with electric ones, another environmental problem will quickly emerge. “As the first generation of electric vehicles and stationary storage begins to phase out next decade, millions of lithium-ion battery packs will go out of service. BloombergNEF [New Energy Finance] estimates the total will reach one million metric tons in 2027 and keep growing, creating challenges and opportunities for regulators, manufacturers and recyclers.”

(“A World of Worn Out EV Batteries,” Bloomberg Businessweek, Jan. 11, 2019 by Richard Stubbe)

17. Blame it on climate change. A report from the Miami-Dade government in Florida finds that tens of thousands of county septic tanks are failing. “By 2040, 64 percent…could have issues every year, affecting not only the people who rely on them for sewage treatment but the region’s water supply and the health of anyone who wades through floodwaters,” a Miami Herald article says, revealing that sea-level rise is contributing to the problem. Septic tanks need a layer of dirt underneath for final filtration work and to return liquid waste back to an aquifer. But sea-level rise is pushing the groundwater higher and soaking through dirt that was once dry. “Waste water doesn’t filter like it’s supposed to in soggy soil. In some cases, it comes back out, turning a front yard into a poopy swamp,” the article says, putting the cost to rip out all the failing tanks and laying down new pipes at $3.3 billion. While home insurers aren’t likely to cover septic problems, the murky situation could complicate other property insurance claims, and there might be scenarios where environmental insurers cover similar sea-level-induced problems for municipalities.

(“A $3 billion problem: Miami-Dade’s septic tanks are already failing due to sea rise,” Miami Herald, Jan. 10. 2019 by Alex Harris)

18. Cyber meets EPL. One-third of identity theft victims say they experienced difficulties at work—either with their boss or co-workers—as a result of the crime, according to an analysis of 2017 trends from The Identity Theft Resource Center, a consumer advocate. A CNBC report on the analysis says potential effects can include fights with the boss over time off, job loss and difficulties gaining new employment with employers who check credit score but don’t ask why scores are bad. A clash problem with an insurance solution?

(“What to do when personal identity theft becomes a professional problem,” CNBC.com, Jan. 8, 2019 by Kelli B. Grant)

19. Are we getting dumber? In its May 2018 SONAR report, Swiss Re Institute suggested that “digital assistance systems make us complacent, obedient and less skilled.” Kicking off the idea, the report asks: “Ever been impressed by a child using the latest tablet as if this were an instinctive skill? Maybe you have watched a child trying to swipe a finger across the page of a printed book only to learn it needs a different movement to turn the page. The more we digitize, the more our analogue skills atrophy.” Among the hypothesized and observed insurance impacts: “Overreliance on digital assistance can increase the number of [motor] accidents,” and “Catastrophic event losses may significantly increase should assistance systems fail and human skills are not available for workarounds.” Says the report: “We see strange accidents where cars drive off a cliff or into a lake seemingly for no reason.”

(Swiss Re Institute’s May 2018 Swiss Re report, “SONAR 2018: New emerging risk insights,” p. 28)

20. Restructuring leads to suicides. A cautionary tale on how not to handle a workforce reduction comes from France, where telecom executives were put on trial after a wave of staff suicides. “Management used ‘pathogenic’ restructuring methods such as forcing people into new jobs and giving unattainable performance objectives,” said a report by labor inspectors. The restructuring plan aimed to reduce headcount by 22,000 while shifting 10,000 people into new jobs and recruiting 6,000 new employees.

(“Orange, former executives to stand trial over staff suicides,” Reuters, June 16, 2018)

21. Smartphoneaholics anonymous. Even though a July 2018 Financial Times article reported that “serious legal threats or class action lawsuits have not yet emerged around smartphone addiction,” with activist investors and pension funds demanding action to protect the youngest smartphone users earlier in the year, can legal actions be far behind? “There is a developing consensus around the world, including Silicon Valley, that the potential long-term consequences of new technologies need to be factored in at the outset, and no company can outsource that responsibility,” Jana Partners LLC and the California State Teachers’ Retirement Systems said in a letter to Apple obtained by the Wall Street Journal last January. While the investor pleas centered around the negative consequences of obsessive smartphone use on children, behavioral addiction impacts people of all ages. “Researchers who study behavioral addiction see strong parallelsin how the human brain responds to addictive substances like drugs, alcohol and cigarettes and potentially addictive behaviors like gambling, shopping, exercise and, yes, smartphone use,” reported Praedicat, an analytics firm, in a March 2018 blog item. Unlike substance abuse, which can undeniably be linked to serious harms, “the long-term tangible damages to human health and well-being (beyond accidents caused by distracted driving and walking) are not understood at this time,” Praedicat’s David Loughran wrote. “Given the role that addiction played in establishing liability in the $250 billion tobacco litigation, Praedicat is expanding its monitoring of the biomedical research and its implications for liability to include addiction, with analyses expected on a range of both substance- and behavior-related addictions such as opioids, sugar, gambling and the most quintessential of modern risks, smartphones,” he said.

(“iPhones and Children Are a Toxic Pair, Say Two Big Apple Investors,” Wall Street Journal, Jan. 7, 2018 by David Benoit; “Smartphone addiction: big tech’s balancing act on responsibility over revenue,” Financial Times, July 23, 2018 by Tim Bradshaw and Hannah Kuchler; “What might smartphones, gambling, sex and exercise have in common: Behavioral addiction,” Praedicat blog, March 12, 2018 by David Loughran)

22. Desks failing in fitness. The headline of a February 2018 article in The Telegraph says it all: “Standing desks ‘increase pain’ and slow down mental ability, study suggests.” Touted by many as a way to combat the ills of increasingly sedentary lifestyles, the new study, published in the journal Ergonomics, actually linked prolonged use of standing desks with lower limb discomfort and deteriorating mental reactiveness. The Australian researchers only observed 20 participants working at standing desks for two hours, with backaches and swollen veins—which can endanger the heart—being reported. “Mental reactiveness also slowed down after roughly an hour and a quarter; however, ‘creative’ decision-making was shown to marginally improve,” the article said, without providing an example of either reaction. “They are not a panacea for back pain, yet companies are worried that if they provide them, they’ll be sued,” the article says, quoting a University professor. Or maybe their use will result in more workers comp claims. (“Standing desks ‘increase pain’ and slow down mental ability, study suggests,” The Telegraph, Feb. 23, 2018 by Henry Bodkin)

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies