As artificial intelligence (AI) gains more widespread adoption in insurance and other industries, we see four distinct uses for it. In this article, we examine them and describe some current and potential future applications.

Executive Summary

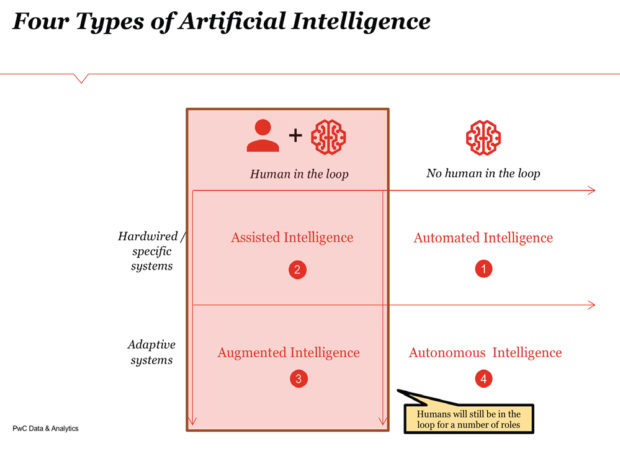

After defining four types of artificial intelligence—assisted AI, automated AI, augmented AI and autonomous AI—PwC’s Dr. Anand Rao provides some guidelines that insurers can follow to determine which type of intelligence applies to various commercial underwriting tasks and decisions.Early applications of AI in commercial insurance have focused on well-defined tasks with systems that are programmed or logic and analysis that is hardwired. For example, a new business and underwriting system that can orchestrate multiple aggregator systems, pull data from them to populate the new business systems and provide a quote is a good example of a well-defined automation task. In this particular case, there is no need for the intervention of any human operators. We call these types of well-defined, fixed systems with no human in the loop “automated intelligence.”

In addition to automation, insurers also have used a number of AI technologies to help humans make specific insurance decisions, like those involving underwriting and claims. We refer to these fixed, rule-based decision support systems that assist underwriters, claims adjudicators and others as “assisted intelligence.”

Automated and assisted intelligence have existed for a couple of decades and have been steadily improving with accelerating technological advances (e.g., increased processing power, open source software, big data, etc.). However, what has pushed AI to the limelight in recent years has been the ability to build systems that learn from historical data. As a result, we now can build more adaptive systems that learn from humans and improve their own performance over time. For example, consider an underwriting system that allows a certain level of discretion to the underwriters in accepting or rejecting risks based on the strength and length of relationship with both the insured and the agent, overall risk appetite, economic condition, etc.

While in the past we would have built a rule-based underwriting system and periodically redesigned it, we now can have the system learn from how the underwriters are using their discretion. The machine learning algorithm can apply salient features from how expert underwriters use their judgment. We call such adaptive machine learning systems that help humans “augmented intelligence.”

As machine learning systems work with humans and improve over time, we might reach a stage where there may be no need for human input. Alternatively, we might want to build systems that adapt or continuously learn without human intervention. Such systems exhibit “autonomous intelligence.” For example, in a connected world with the Internet of Things (IoT), insured physical assets will have a number of sensors that can accurately estimate potential losses and even take preventative measures to reduce losses. They also can calculate actual losses after the event with no human assistance. Automated trading and autonomous vehicles are examples of such autonomous intelligence in action today. The figure below illustrates these four different types of artificial intelligence along the two dimensions of a human being in the loop or not and if the system is fixed or adaptive.

While this categorization illuminates the different uses of AI, it doesn’t help a business executive or data scientist determine which tasks and decisions within their scope fall under which category. Accordingly, the following are some practical guidelines based on our experience working with commercial insurers.

- Structure-Relationship Dimension: We have conducted workshop sessions with commercial insurance executives to identify all tasks in their scope of activities and map them along a 2×2 grid where the x-axis ranges from a well-defined task (e.g., calculating replacement value for an insured asset) to an ambiguous task (e.g., marketing products to customers) while the y-axis ranges from being a logical task (e.g., pricing risk) to an empathy-driven task (e.g., managing agents).

Well-defined and logical tasks fall within automated intelligence and often can be automated. Logical and ambiguous tasks, as well as well-defined tasks requiring empathy, can be implemented as assisted or augmented intelligence. Tasks that are ambiguous and require empathy are better done by humans, with some assistance or augmentation from machines, as required.

- Cognitive-Frequency Dimension: Another 2×2 grid that we have found useful in determining which type of intelligence to apply depicts the manual vs. cognitive nature of a task on the x-axis and routine vs nonroutine nature of the task on the y-axis. Manual and routine tasks (e.g., data entry) often can be automated using simple robotic process automation. Cognitive and routine tasks (e.g., creating a semantic concept graph of key terms from a policy document) also can be automated using intelligent process automation.

When it comes to nonroutine tasks (manual or cognitive), we need to determine if there is a cost-benefit justification to build any type of AI solution. If the frequency of nonroutine tasks is high and there’s sufficient data to enable machine learning, then we can build assisted or augmented intelligence. Assessment of medium-level and large-level risks may fall under this category. For example, underwriting directors and officers liability can be substantially enhanced by augmented intelligence systems that are capable of collecting all relevant data; can identify key features that drive D&O liability for a client or a client in a sector; and can provide risk-rating recommendations. Based on how the human underwriter adjusts these ratings, the machine learning algorithm can become smarter over time and eventually perform the rating with no input from the human underwriter.

As commercial insurers contemplate the use of automation or AI-based projects within their organizations, they need to have a sound vision or strategy for which tasks and decisions require which type of intelligence and then determine where humans need to be involved in making critical decisions. While machine intelligence (or AI and automation) certainly can add value and reduce costs, there are still many decisions and tasks that require human judgment and empathy. Combining the best of human and machine intelligence will yield better results than either one on its own.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Preparing for an AI Native Future

Preparing for an AI Native Future