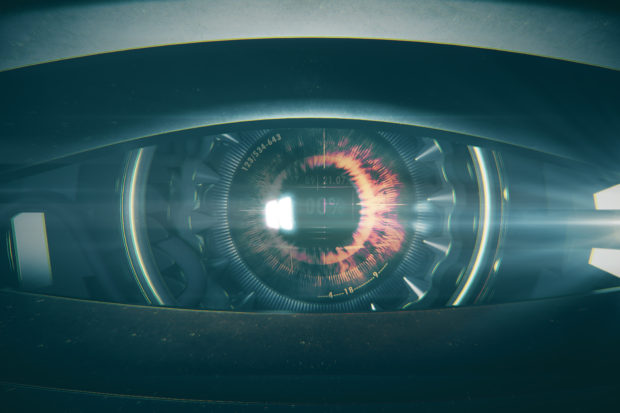

Underwriting is the nucleus of the insurance business. For centuries, human beings have performed this process, evaluating a risk to determine whether or not it is insurable at a profit for the insurance carrier. To this task they brought significant statistical and analytical skills, attention to detail, and judgment.

Executive Summary

Veteran insurance journalist Russ Banham interviews leaders of four InsurTechs focused on making insurance underwriting more accurate and less burdensome, freeing underwriters to take on more strategic, value-added work.Well, move over people; here come the robots. Through the use of cognitive computing tools like machine learning, predictive analytics, robotics processing automation, and both image recognition and natural language processing, underwriting is becoming less manual and more automated. Providers of the tools offer novel ways for underwriters to better gauge risk, set premiums, save time, become more efficient and lower loss ratios.