Expect upward pricing pressure on 14 commercial insurance lines in 2019, with likely decreases in another two, Willis Towers Watson predicts in its latest report. Higher losses in casualty insurance along with industry consolidation and better technology appear to be driving the trend.

Expect upward pricing pressure on 14 commercial insurance lines in 2019, with likely decreases in another two, Willis Towers Watson predicts in its latest report. Higher losses in casualty insurance along with industry consolidation and better technology appear to be driving the trend.

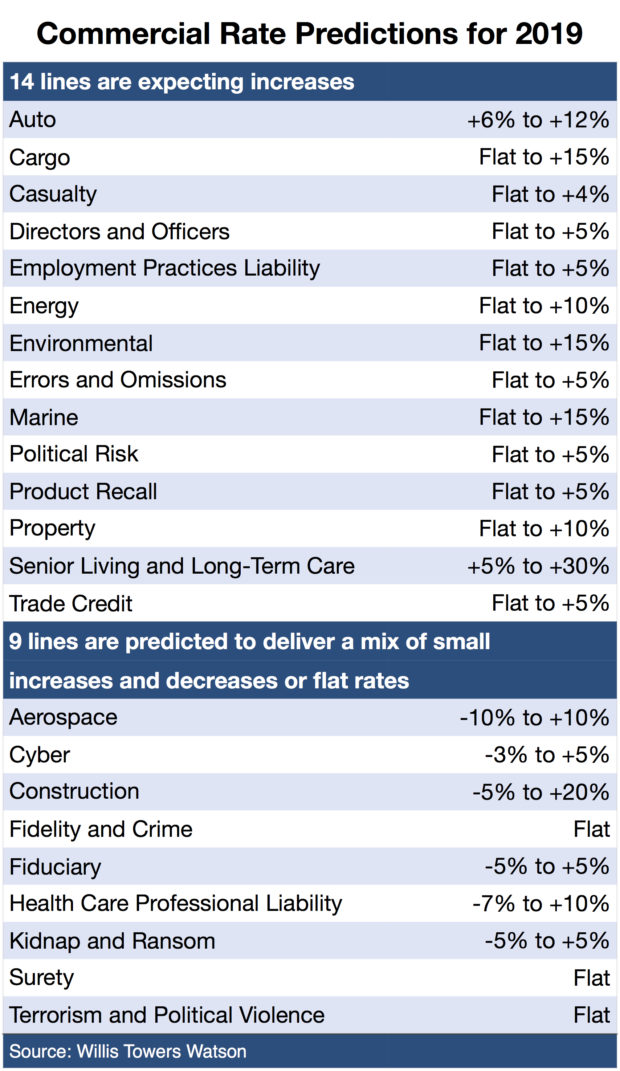

Auto, cargo, casualty, directors and officers, employment practices liability, energy, environmental, errors and omissions, marine, political risk, product recall, property, senior living and long-term care, and trade credit will all see flat to mid-single or double-digit increases, according to the firm’s 2019 Insurance Marketplace Realities report.

Workers compensation will experience flat pricing to dips of around 4 percent on average, the report states. International casualty is expected to see prices decrease between 5 percent and 10 percent.

The company described what it sees in commercial insurance as “stealth” firming, because many people focused much more on the property market in the wake of large catastrophe losses in 2017 and 2018, rather than the casualty side. Willis Towers Watson said that Hurricanes Florence and Michael will create short-term disruption “but will not be significant market moving events.”

The company described what it sees in commercial insurance as “stealth” firming, because many people focused much more on the property market in the wake of large catastrophe losses in 2017 and 2018, rather than the casualty side. Willis Towers Watson said that Hurricanes Florence and Michael will create short-term disruption “but will not be significant market moving events.”

Some additional report predictions:

- Auto liability premiums will rise for the third consecutive year, jumping between 6 percent and 12 percent. The jump, Willis Towers Watson said, will come from the sector attempting to deal with deteriorating loss costs stemming from improving economic conditions (more vehicles on the road).

- Nine lines should see a mix of both small increases, decreases or flat rates, including aerospace, cyber, construction, kidnap and ransom, and surety.

- International tensions switched political risks from a trend of small decreases to single-digit increases.

- Environmental insurance should be flat or see rates rise up to 15 percent versus 10-20 percent rate hikes predicted in the spring.

- Aviation should see both declines and increases after a brief period of price declines.

Source: Willis Towers Watson

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next