The rating agency’s special report on the reinsurance sector, “Innovation: The Race to Remain Relevant,” which was published last Monday, contains a listing of the top 50 global reinsurance groups ranked based on 2015 gross written premiums for life and non-life business taken together.

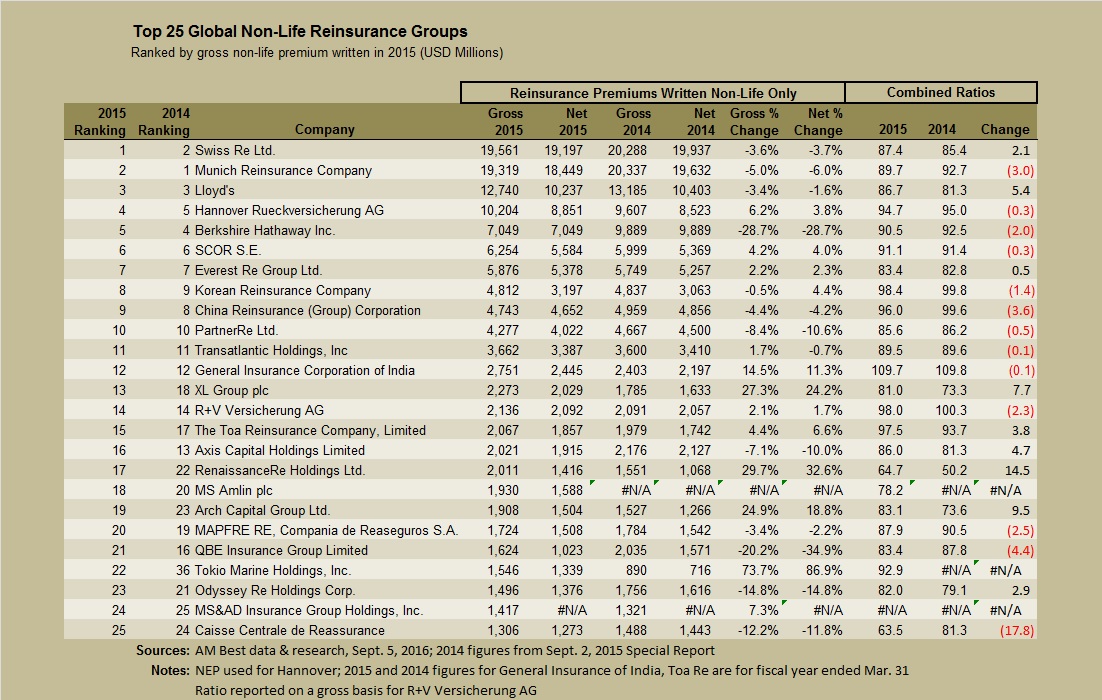

Pulling out just the non-life gross premiums for 2015 and comparing those to 2014 non-life gross premiums presented in a prior A.M. Best report (published Sept. 2, 2015) reveals Swiss Re’s repositioning, with $19.6 billion of gross reinsurance premiums putting the Swiss giant just about the $19.3 billion total of its German peer. (Click on image to enlarge.)

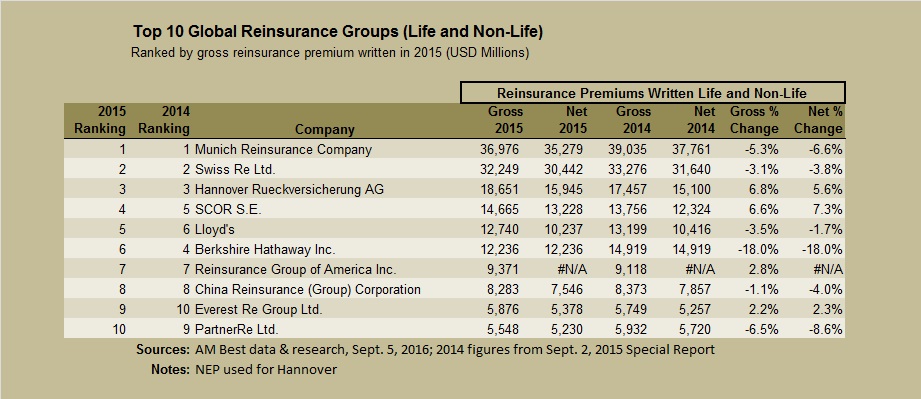

But when life reinsurance premiums are added in, Munich Re is back on top with $5 billion more gross premiums written than Swiss Re on the life reinsurance side of the house.

The top 10 excerpt from the top 50 global reinsurer list in A.M. Best’s report (shown below) reveals that both Swiss Re and Munich Re saw total reinsurance premiums fall in 2015. While Munich’s premiums fell just a little bit more than Swiss Re—roughly 5 percent for Munich vs. 3 percent for Swiss Re—neither saw a decline close to the double-digit drop recorded for Berkshire Hathaway’s reinsurance operations.

With non-life premiums falling nearly 29 percent in 2015 and total reinsurance premiums down roughly 18 percent, Berkshire slipped in the rankings, coming in at No. 4 behind Hannover Re based on just non-life reinsurance premiums and at No. 6 for overall reinsurance premiums, with Hannover, SCOR and Lloyd’s all eclipsing Berkshire’s $12.2 billion gross premium total.

A.M. Best analysts highlighted Berkshire’s tumble, both in the report and during a webinar late last week, a few days ahead of the start of the Rendez-Vous de Septembre in Monte Carlo.

“That’s a conscious decision on their part. They have pivoted away from the reinsurance market,” said Scott Mangan, an A.M. Best senior financial analyst, noting public comments by Berkshire’s leaders, including Chairman Warren Buffett, who has noted the lack of opportunities in the reinsurance market and the emphasis on the specialty insurance segment as an alternative avenue for growth.

The Berkshire “pivot” is just one example of the strategies that global reinsurers are undertaking generally in the face of challenging market conditions, increased ceding company retentions, and stiff competition within the traditional reinsurance market and from alternative capital players, said Robert DeRose, an A.M. Best vice president. “There truly is a race to remain relevant,” he said, referencing the title of the report as he kicked off last Thursday’s webinar.

DeRose and other Best analysts listed an array of “innovations,” including acquisitions of managing general agencies, build-outs of life reinsurance platforms and increased participation in specialty lines. “They are just trying to find ways to access the market, to get closer to the client, to secure the risk and yet remain disciplined,” DeRose said, also listing “partnerships with competitors” as a less popular but notable strategy.

Building on the same theme, the written report highlights another action by Berkshire—a July 2016 agreement between TransRe and Berkshire’s General Re under which the 11th largest non-life reinsurer, TransRe, serves as the exclusive underwriter for U.S. and Canadian broker-sourced treaty business on behalf of General Re. “One might be inclined to describe this deal as unfathomable,” the report said.

“You have two very relevant players who feel they have to find a way to be even more relevant to the market. And if it’s successful, it will certainly improve the relevancy of both. But then you have to ask yourself the question, what does that mean for the players at the lower end” of the ranking, DeRose said during the webinar.

“Does this compel other companies to try to become more relevant or to come up with some other innovative way to bring more capacity to the market?” asked Mangan.

More M&A Inevitable

“You have two very relevant players who feel they have to find a way to be even more relevant to the market…What does that mean for the players at the lower end?”

Robert DeRose, A.M. Best Vice President

Assessing the deal environment going forward, Reisner noted that improving reinsurer valuations make deals easier to get done than they had been in some recent past years and that the deal drivers of 2015—access to broader product capability, geographic reach, greater influence with brokers and potential attractiveness to third-party capital—are still present.

“I do think that investment bankers are working very hard to try to construct deals, and I do think that deals are being entertained,” said DeRose. “Whether they actually occur, no one can predict. But I do think that [given] the dynamics of the market, it’s inevitable that there will be more M&A.”

DeRose continued: “The smallest players are going to be under greater pressure to remain relevant to the market, and ultimately, whether they like it or not, or whether the conditions are prime or not, it may force M&A to occur. If your share on a [reinsurance placement] slip is being reduced because you’re small, or you’re not viewed to be relevant in the eyes of the client, that can only go on for so long. Ultimately you have to come to the [conclusion] that something needs to be done, and usually it’s in the form of M&A,” he said.

Chirico and Reisner noted that pressure from shareholders and private equity investors will factor in as well. On the one hand, reinsurers try to be disciplined, but “at what point do you shrink to the point where you’re not really relevant anymore?” Chirico asked.

Reisner said that ROEs in the Bermuda reinsurance market fell below 10 percent for the first time in 2015. “And we know returns are somewhat inflated by favorable reserve development,” DeRose added. If levels of favorable development start to taper off, “you’re probably looking more at 4-4.5 percent ROEs,” he said, “Shareholders, investors, boards are going to become impatient, and they’re going to drive change,” he said.

Mangan noted that M&A typically occurs “in spurts,” explaining that the intermittent surges take place because initial deals in the wave give “a sense of urgency” to competitors. “After they see some of their peers grow or make some drastic changes, it increases the need for the other companies to be active,” he said.

Rated Balance Sheets for Non-Traditional Competitors?

Mangan and DeRose also suggested that the “race to remain relevant” is not confined to traditional reinsurers.

“There’s also some irony in that it was the convergence capital that was pressuring the traditional reinsurance players. Now you have traditional players entering or playing in the collateralized market, and it’s pressuring the collateralized players to innovate and come up with different ways of reducing their cost of capital and increasing their profitable business,” Mangan said.

Turning to DeRose, Mangan went on to ask: “At some point, do you see collateralized markets looking at a rated balance sheet, turning everything upside down?”

“There’s no question. That’s already happening,” DeRose replied, noting that alternative capital providers are using their own MGA facilities “to get closer to client—to find a controlled level of distribution.”

Currently, “collateralized capacity identifies a risk, finds a front who is willing to provide the paper but doesn’t want that type of risk to pass through. But there’s a cost to doing that,” he said. Forming a company to replace the front and reduce the cost in deal flow is a trend that “is evolving,” DeRose suggested.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  The Future of HR Is AI

The Future of HR Is AI  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies