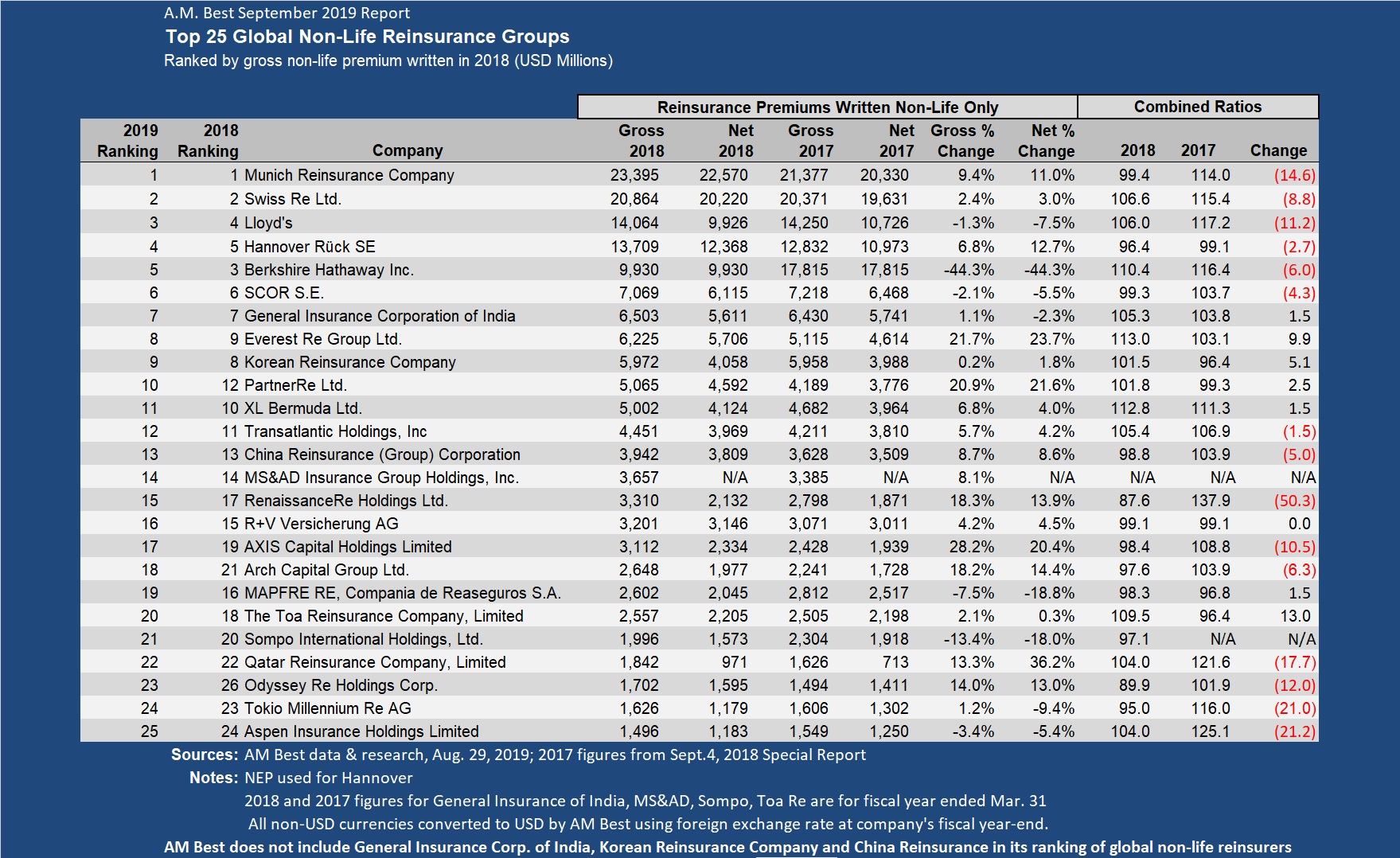

Munich Re tops a ranking of global non-life reinsurers, eclipsing Swiss Re by more than $2.5 billion in gross premiums on a list extracted from an A.M. Best analysis.

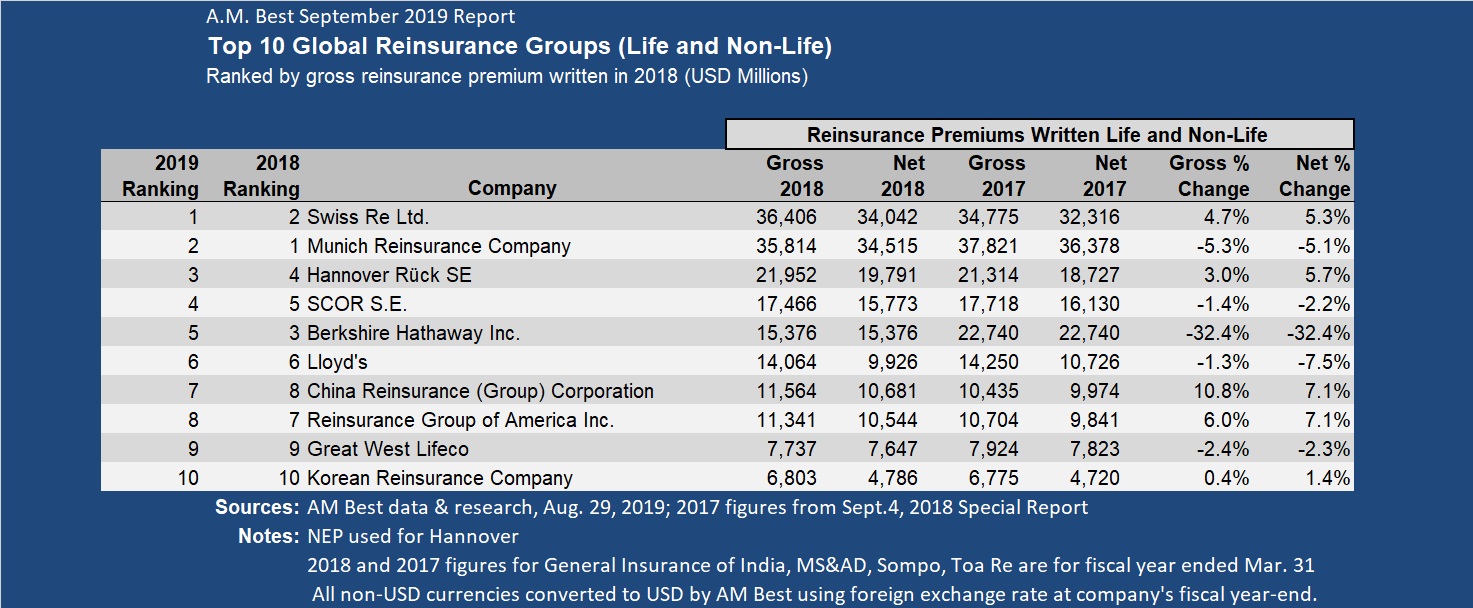

The rating agency’s special report on the reinsurance sector, “Global Reinsurance: Fighting the Last War,” which was published in late August, contains a list of the top 50 global reinsurance groups ranked based on 2018 gross written premiums for life and non-life business taken together.

Pulling out just the non-life gross premiums for 2018 and comparing those to 2017 non-life gross premiums presented in a prior A.M. Best report (published Sept. 4, 2018) reveals that the non-life premium gap between the two giant European reinsurers grew $1.5 billion wider than it had been in 2017.

Munich Re, with $23.4 billion in non-life gross premiums in 2018, grew 9.4 percent on the non-life side of the house, while Swiss Re grew only 2.4 percent to $20.9 billion.

The last time Swiss Re topped A.M. Best’s non-life rankings was two years ago, according to an analysis of prior A.M. Best reports. But since A.M. Best’s 2017 report listed Swiss Re’s non-life premium for 2016 at more than $21.9 billion, the reinsurer’s non-life premium volume has declined 4.6 percent while Munich Re sprinted nearly 25 percent to $23.4 billion in 2018 from just $18.8 billion in 2016.

On the other hand, Swiss Re has been growing on the life side—13.5 percent since 2017 on 2016 premiums—while Munich Re’s life reinsurance premium fell by a similar percentage (13.0 percent) over the same two-year period.

That growth helped put Swiss Re back in the lead on overall ranking based on life and non-life premiums for 2018 shown in A.M. Best’s 2019 report (top 10 of 50 excerpted below).

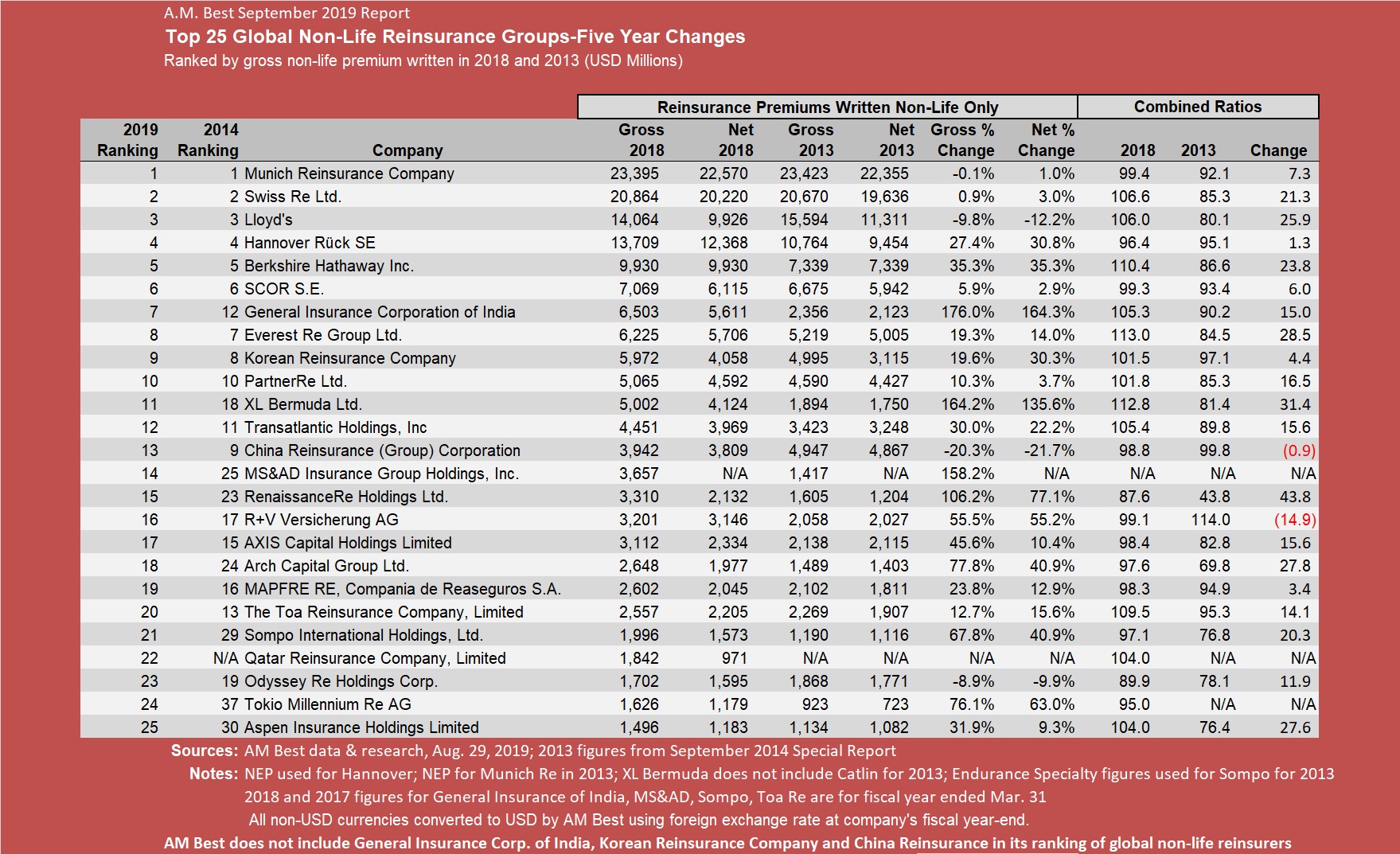

On both the non-life and the total reinsurance premium rankings, the top six company names have remained exactly the same (although sometimes ordered slightly differently) for as long as Carrier Management editors have been collecting data from the A.M. Best reports (since 2012). Below, we present a comparison on the non-life side showing a snapshot of the most recent 2019 report and one published five years ago in 2014.

Only one new name appears in the top 10—General Insurance Corp. of India—and only two reinsurers have moved into the top 25 over the five-year period—Tokio Millennium Re and Aspen Insurance Holdings.

(Editor’s Note: A non-life ranking of 15 top “global non-life” reinsurers that is published within the A.M. Best Aug. 20, 2019 report does not include companies such as General Insurance Corp. of India and Korean Reinsurance Co., which are not global players. Carrier Management has included the regional reinsurers in the ranking of 25 shown above in order to be consistent with prior articles we have published about the A.M. Best rankings.)

Also noticeable is the fact that premiums for Munich Re and Swiss Re appear to be almost unchanged in the two reports five years apart even though premiums for almost every other member of the 25-member cohort have grown. (Lloyd’s is a notable decliner also.) Part of the explanation behind the flattish premiums for Munich Re, however, is likely attributable to the fact that A.M. Best changed its methodology for capturing premiums of top players three years ago. For reinsurers with a sizable amount of insurance premiums on their books (75 percent or more of their total gross premium volume), A.M. Best makes an effort to exclude primary insurance premiums. Munich Re falls in that category, while Swiss Re falls below the threshold.

The explanation of the adjustment suggests that Munich Re’s non-life reinsurance premiums have actually grown over the period, although it is not possible to determine how much based solely on the A.M. Best reports.

A more telling statistic from the five-year comparison is the fact that net combined ratios for all but two of the top 25 have risen—15 by more than 10 points. Twelve of the 24 recorded combined ratios in excess of 100 in 2018 compared to only one in 2013. In fact, 13 of the 23 recorded combined ratios for the cohort were below 90 in 2013. Those are sobering statistics given that insurance results that may have been included five years ago for hybrid insurer/reinsurers would likely have raised the 2013 combined ratio results.

An appendix to the A.M. Best report reveals that in the aggregate combined ratio for the Big Four Europeans (Munich, Swiss, Hannover and SCOR) rose 10.4 points to 99.7 in 2018 from 89.3 in 2013; for the U.S. and Bermuda Market, the jump was 17.2 points to 103.8 in 2018 from 86.6 in 2013.

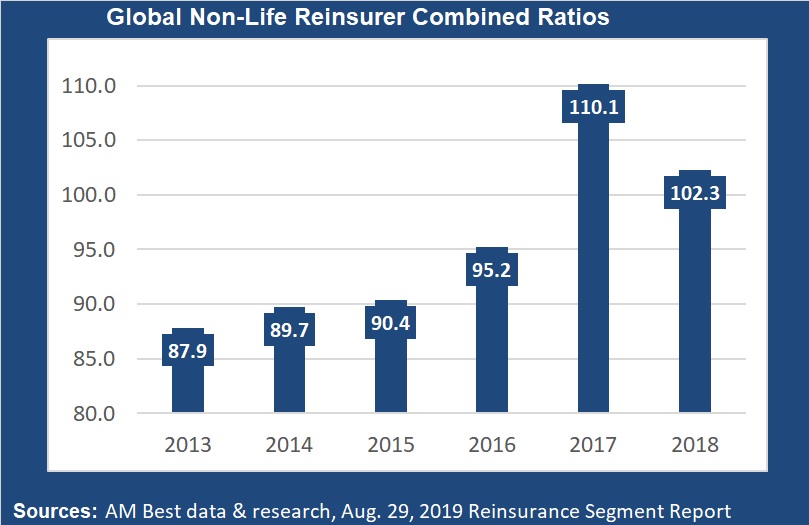

For the global reinsurance market overall, A.M. Best analysts calculate a combined ratio of 102.3 for 2018—14.4 points higher than the 2013 figure of 87.9.

Despite the visible deterioration in underwriting profitability, A.M. Best changed its market outlook for the global reinsurance sector to stable from negative at the end of 2018.

“The reason we went stable is not necessarily because we felt the environment had improved substantially. But rather, following the [catastrophe] events of 2017 and ’18, [we felt] that pricing was likely to stabilize and that return metrics did hit bottom for the sector,” said Robert DeRose, an A.M. Best vice president, during a webinar discussing the report last week (also stressing that it was a market performance outlook not a rating outlook).

In fact, combined ratios did rebound some in 2018—to 102.3 for the global reinsurance segment overall from the high point of 110.2 in 2017, according to figures in the A.M. Best report. And the overall segment return-on-equity turned positive again, coming in at 1.0 percent overall compared to 0.3 percent in 2017.

But was 2017 truly the bottom for return metrics?

Looking at different cohorts of reinsurers, Willis Re and Aon reported 1.5 and 2.0 points of deterioration in aggregate combined ratios for the first half of 2019 compared to first-half 2018. But both reported ROEs around 14 percent, driven by strong investment gains. (For the smaller groups of reinsurers, Willis Re and Aon report overall combined ratios around 94-95.)

While DeRose said pricing momentum and a disciplined alternative capital market were big factors in moving the A.M. Best market outlook to stable, the prospect of continued low interest rates seemed to dampen his enthusiasm for sector results.

Noting a recent signal from the U.S. Federal Reserve that an interest rate cut might be coming next July, DeRose said, “If there’s no hope of investment returns and we’ve had a series losses, it would seem to me that there is going to be more pressure on underwriting discipline, certainly for the traditional players.” But he also observed that interest rates “have been low for a long time, and at the same time pricing continued to compress. We’ve seen that manifest itself in lower ROEs.”

With the prospect of rising interest rates seemingly off the table, alternative capital might make a bigger push into the space, he said, noting that one of the key factors underpinning the stable outlook is the discipline of alternative capital which bodes well for pricing over the near term.

“I don’t know whether you guys feel there is a hope that things can get substantially better from where they are right now,” he said, seemingly losing some confidence in the outlook as he talked through the interest rate scenario with reinsurer executives who were co-panelists on the webinar.

Mark Kociancic, chief financial officer of SCOR Group, seemed less rattled. While agreeing that alternative capital would likely come back in a larger with lower interest rates, he said, “That will be an additional pressure point, but it will emphasize the need for underwriting discipline…especially with the type of loss experience we have seen for cat and casualty lines of business over the last couple of years.”

The A.M. Best report shows that while the loss component of the combined ratio has fluctuated within a 10-point range over the last five years, the expense ratio component has remained around 34-35 points. At one point during the webinar, DeRose asked whether technology might be able to drive down distribution costs and expense ratios for the insurance and reinsurance industries overall.

“Are the producers going to be willing to accept lower commissions as their costs theoretically should come down?” he asked.

“That’s difficult to envision under any circumstance,” Kociancic said. “Market forces are going to define that,” he added. “Ultimately, regardless of what your role is—reinsurer, primary, broker—you truly have to justify your value proposition for a client, otherwise your long-term purpose in the industry is questionable,” he said.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists