Underwriting

Viewpoint: When the Cloud Sneezes, the Digital Ecosystem Catches a Cold

Google had a pretty bad day recently. The kind of day that would make Spotify stop singing, Discord and Snapchat go quiet, and give retailer Marks & Spencer a panic attack. Why? Because too many ...

Middle East Tensions Raise Loss Accumulation Risks: Report

Marine, aviation, cyber, and terrorism insurers face immediate underwriting pressures and potential accumulation losses as a result of heightened hostilities between Iran and Israel, according to ...

U.S. E&S Growth Slowed Again in ’24; Berkshire, AIG Top Premium Rankings

A recent analysis by S&P Global Market Intelligence reveals that the pace of growth in the U.S. excess and surplus lines market slowed to 13.4 percent in 2024, down from 14.5 percent a year ...

Claims Against Insurance Companies: How to Avoid Bad Faith Setups

Insurance companies are in the business of providing important financial and logistical assistance when customers experience some kind of event or incident covered by a policy. Those things—often ...

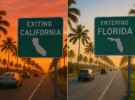

California vs. Florida: A Tale of Two Insurance Markets

Until recently, homeowners insurers weren't allowed to use catastrophe models to justify needed rate increases, or to include the cost of reinsurance in their rate indications in the state of ...

How Insurers Can Leverage Agentic AI as Public Data Disappears

The property/casualty insurance sector has long operated on a foundation of robust data analytics, with public sector information serving as a cornerstone for risk assessment, premium pricing, and ...

U.S. P/C Industry Posts $1.1B Q12025 Underwriting Loss: AM Best

Growth in net earned premiums during the first three months of 2025 was offset by losses and expenses, resulting in a $1.1 billion net underwriting loss of the U.S. P/C industry. According to ...

Industry Vets Bonneau and Bredahl Lead ‘Novel’ HoldCo.; Supports MGU Biz

The former chief executives of Partner Re and Howden Tiger are joining two other industry veterans to form a company, which they describe as "an independent holding company that oversees carriers ...