Member insurers in Pennsylvania have a new way to explore workers compensation data and benchmark their performance—without the burden of static reports or time-consuming manual comparisons.

This week, the Pennsylvania Compensation Rating Bureau (PCRB) launched WorkComp360, a cloud-based business intelligence and analytics platform built on Cloverleaf Analytics’ Insurance Intelligence technology.

Designed to serve more than 400 member insurers, interactive dashboards offer information on claim trends, carrier performance metrics, injury data and premium analysis—all accessible through a secure, zero-download web portal.

“WorkComp360 represents a monumental leap forward in workers compensation analytics,” said William Taylor, president & CEO Emeritus of PCRB.

Its launch represents Vice President and Chief Actuary Brent Otto’s vision of the platform since his tenure began six years ago.

The new tool is a vast improvement from the static annual report previously offered to members, he said, with easily accessible data so that anyone looking to view metrics to improve performance can navigate it.

The tool includes data from accident years 2012 through 2021 and provides two core dashboards: Claims Insights and Market Insights.

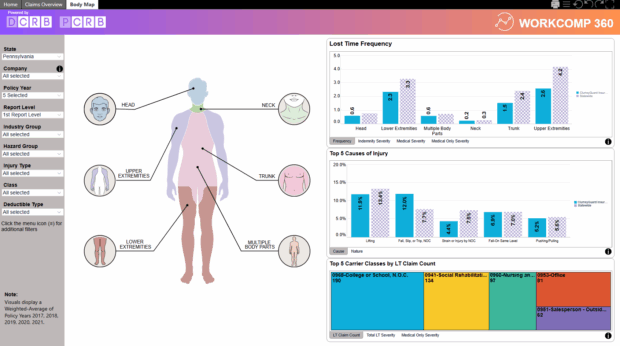

The Claims Insights dashboard offers users a dynamic view of claim frequency, severity and distribution by body part. An intuitive body map — divided into six regions such as head, trunk, upper and lower extremities — allows users to filter by cause of injury and even analyze lost-time claim frequency specific to a body region.

Through a left-hand menu, users can select their company, policy year, insurance group, hazard group, class code, deductible type and more.

Privacy safeguards ensure that each user only sees their own company data while still being able to compare it against statewide metrics.

Everyone from carrier executives and actuaries to claims professionals and underwriters can instantly assess performance against the broader market, Otto explained.

The information offers data on statewide averages for those looking to benchmark their performance against other carriers.

Previously, carriers had to do their own benchmarking by using statewide data gathered by PCRB and merging it with their own.

In addition, there is a top 10 carrier list for claims involving specific body parts, as well as for the top five causes of injury.

Information can be easily exported for internal presentations or further analysis.

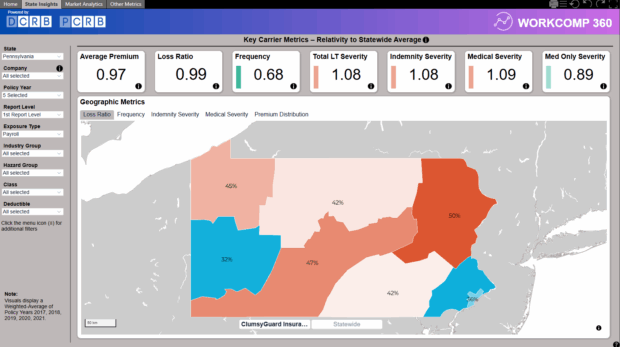

The second dashboard focuses on Market Insights and is designed with executive decision-makers in mind. The tool allows carrier executives to analyze premium trends, market share, geographic performance and pricing factors—comparing them against statewide norms.

A geographic map allows users the ability to analyze metrics based on the county region. The tool also allows the user to drill down to industry metrics.

Carriers can compare company performance by region, something that wasn’t available to members before, said Otto.

Filters let users toggle between class codes, industries and counties.

“This is a transformative tool that provides benchmarking of key metrics and will lead to refined risk analysis, safer workplaces and optimized strategies,” said Brett Hall, director of Actuarial Services, Workers Compensation, for PCRB member WorkPartners/UPMC.

Later this year, the PCRB plans to roll out DataPro+, a replacement for their legacy flat file explorer. The tool will give analysts direct access to granular-level policy and statistical data for custom querying.

The new database is now live and available to all Pennsylvania Compensation Rating Bureau and Delaware Compensation Rating Bureau members.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best