Some history in life insurance for you. A life insurance product that sold in 1982 had a “new” discounted premium for non-smokers. This was revolutionary — tying a personal behavior to underwriting a life policy premium.

Oh, how we have advanced since then! What’s possible now goes so far beyond that, yet the idea is still the same. Insurers can still underwrite – and yes incentivize – healthy personal practices but can now take advantage of a new customer mindset and a dramatically-advanced data culture. The question now becomes, how can life and voluntary benefits insurers personalize and monetize behavior AND expand product development AND place their products in exciting new channels by using all of the new devices available in their digital toolboxes?

The personalization and monetization of behavior — the opportunity for L&AH in a lifetime

It might be cliché, but right now is a “once in a lifetime” opportunity for L&AH insurers, brought to you by several powerful trends:

- According to a recent survey, “nearly half of all consumers are using health monitoring technology” and “over two-thirds of Generation Z and millennial consumers track their health using wearable healthcare tech.”[i]

- Loyalty programs are now a cultural norm. Gen Z and millennial customers, especially, are “in it” for the perks. Insurance products designed with perks involving other corporate relationships or healthier behaviors stand a greater chance of uptake than ever before. Points mean dollars. Usage means loyalty.

- Price matters – especially today in an inflationary period. Discounts increasingly are important in a purchase. Data and discounts go hand in hand because today’s data is easier to access and quantify.

- Personalized offers are paramount. Today’s customer wants to know that their insurer understands their unique risk and needs are met with products that fit. Data is the currency of personalization and customization.

All of these factors can help enhance and grow a relationship with the customer. A few weeks ago, Majesco released its annual Consumer survey report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance. The report synthesizes the links between high-level customer trends and insurer opportunities that are supported by emerging tech and data practices. The paper serves as a valuable pointer toward areas of potential growth and impact through a new type of relationship with customers — a data-enabled relationship.

L&AH — An opportunity for a new kind of relationship.

The Gen Z and Millennial generation have the potential to reverse the downward tide of life insurance ownership occurring over the last few decades and improve the gap of uninsured. From a high in the mid-1970s with 72% of adults and 90% of households with two-parent owned life insurance[ii] to a new low based on LIMRA’s 2010 life insurance study that found only 44% of US households had individual life insurance, marking a 50-year low.[iii]

Furthermore, a February 2017 LIMRA study noted that employment-based benefits (group and voluntary) life insurance covered more people than individual life insurance as of 2016. The opportunity for growing voluntary benefits is reinforced in a recent analysis that found 50% of North American employers currently not offering voluntary benefits are considering adding them, and 40% who do offer them are looking to add additional benefits.[iv]

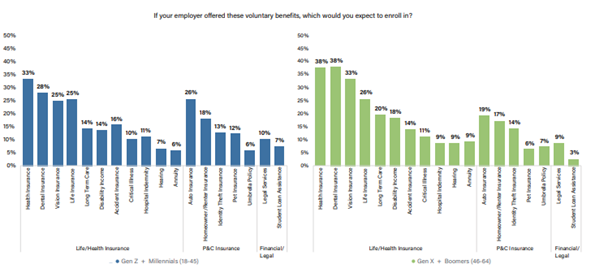

There is considerable opportunity for increasing uptake of voluntary benefits, with just 17% of Gen Z and Millennials and 15% of Gen X and Boomers currently having any coverage. Among the types of voluntary benefits of the highest interest are traditional benefits like health, dental, vision, and life insurance as reflected in Figure 1. The level of interest in life coverage from Gen Z and Millennials is remarkably high, and one area where their interest matches the level of interest from Gen X and Boomers.

The broadening view of financial wellness also opens the door to offering new voluntary benefit options including auto, homeowner/renter, and identity theft, particularly among Gen Z and Millennials. This group also shows twice the level of interest for pet insurance and student loan assistance, while both segments share similarly strong levels of interest in legal services.

Figure 1: Voluntary benefits consumers would enroll in if offered by their employer

“Will you follow me wherever I go?”

Ten years ago, group and voluntary benefits and portability wasn’t even a discussion. Most products and core systems weren’t designed with rich individual capabilities, including portability to an individual policy. Now, many insurers have shifted gears and are leveraging data to better know the individuals within group plans, help them identify the right products for them, and meet their needs for portability. Insurers can now pave product paths from employer to employer or employer to individual — and the opportunity to retain customers and provide consistent risk coverage through their life journey.

This is crucial because of the increased fluid state of employment across all generations. Portability and flexibility of benefits, including offering more individual products or turn-on/turn-off benefits for Gig/contract employees, are now imperative in the competition for talent. Recognition that employees are no longer likely to remain with a company for 20-30 years, requires a rethinking of the benefit plan and specific product design who have different lifestyle needs.

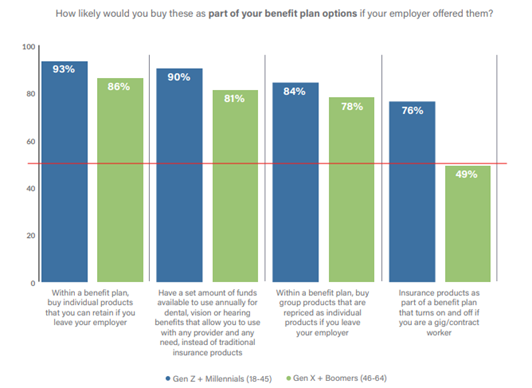

Interest in portability is extremely high as you can see in Figure 2.

Figure 2: Interest in new benefit plan options

The desire for flexibility is further highlighted by seeking alternative options and simplicity for dental, vision, and hearing benefits for both generation groups. Offering employees the latitude to spend a pool of funds on whatever procedures and providers they choose, rather than being limited to the defined plan is of high interest with 81%-90%.

“You want to use my data? What do I get in value?”

In the past, insurance companies could be rightly accused of being impersonal. People were policies. Policies lived in books of business. An insurer’s main concern was “how is this book of business doing?” An energized era of customer focus has shown insurers how offering niche, personalized products, services, and experiences will align with customers’ specific risk needs, using their personal data. From an increased interest in life, critical illness, and disability insurance to telematic and cyber insurance and more, customers want insurance products that assess their personal risk, lifestyle, and behaviors.

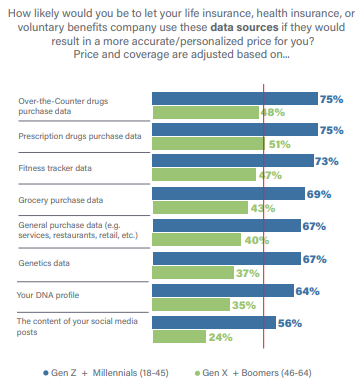

Today’s customers have opened up to the idea that their data “buys” them better products, services, personalized pricing, and a customized experience. (See Figure 3.)

Gen Z and Millennials outpace the older generation by 24% to 32% in willingness to share or use personalized data about them from a wide variety of new, non-traditional sources. Data from over-the-counter purchased drugs, prescription drugs, and fitness trackers lead with 75% willingness as compared to an average of 49% for the older generation. Quickly following are grocery purchases, general purchases, genetics, and DNA data at an average of 67% for Gen Z and Millennials as compared to an average of 38% for the older generation.

Both examples highlight the significant gaps not only in willingness but in expectations that if they manage their lives well from risk, they want to be recognized and rewarded. Given the top-of-mind issues of inflation and finances, it is likely that the cost of insurance and whether to buy it or not is a key factor. Insurers have a significant opportunity to meet the needs and demands of customers, particularly the younger generation who are more likely uninsured, by leveraging their data for personalized pricing.

Figure 3: Interest in new data sources for life/health insurance and voluntary benefits pricing

“Show me your product; show me my perks!”

Traditional product-oriented strategies, however, handicap insurers. Instead, insurers must consider a product to be inclusive of the risk product, value-added services, and the customer experience. This will meet customer expectations for delivering value. Part of that value comes from providing risk prevention and mitigation capabilities and services that help customers avoid loss, dramatically redefining their customer experience.

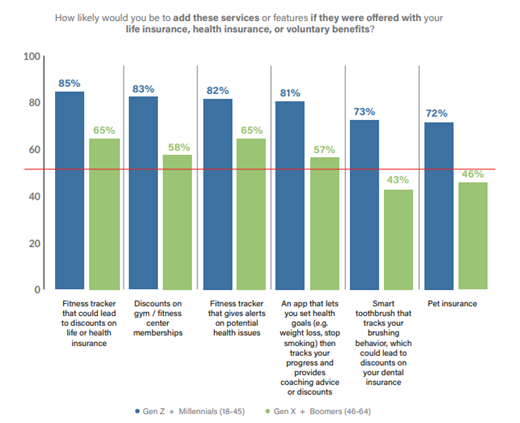

Gen Z and Millennials are excellent targets to meet this demand. Their interest level for value-added services is extremely high at 72%-85% as reflected in Figure 4. Gen X and Boomers likewise indicate interest from 43%-65%, suggesting more targeted interest areas. The inclusion of value-added services will soon become a table-stakes play to attract and retain this generation of customers. Insurers must consider innovative approaches to deliver extended value to the risk product such as discounts, alerts, wellness apps, and more.

Figure 4: Interest in value-added services with life/health insurance and voluntary benefits

“Where are you when I need you?”

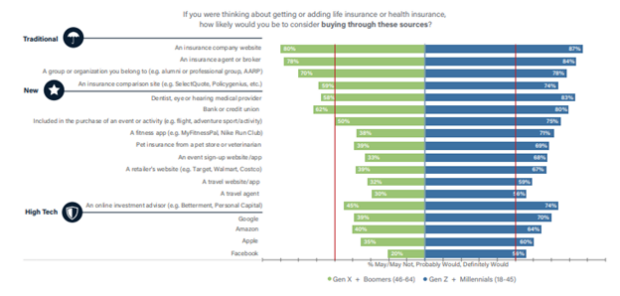

Complexity and out-of-date insurance processes, particularly with distribution, impact the growth and profitability of almost every line of business. As a result, there is a shift to refocus on the “buying” over “selling” approach, through a multi-channel strategy that meets customers where and when they want to buy. What is striking (see Figure 5), is how willing customers are to buy outside of traditional channels.

New and high-tech channels (Google, Amazon, Facebook, Apple) show a divergence between the two generational groups, sometimes sizeable as reflected in the 50% reference line in Figure 5. Gen Z and Millennials show the starkest contrast, with every channel – traditional, new, and high-tech – surpassing the 50% threshold.

Figure 5: Interest in channel options for life/health insurance

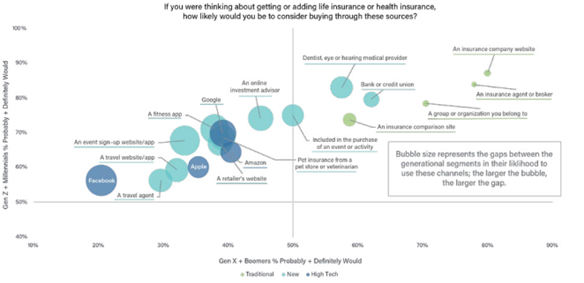

Another view on how the generational segments align and diverge can be seen in Figure 6 where the horizontal axis represents Gen X and Boomers, and the vertical axis represents Gen Z and Millennials channel preference ratings. The size of the bubbles reflects the magnitude of the gap between the two segments and the bubble colors represent the type of channel (traditional, new, high-tech).

The top 3 traditional channels with the smallest bubbles (insurance website, agents/brokers, affinity groups) are in the upper right-hand corner indicating the same preference level for both generational segments. Moving left, Gen X and Boomer ratings rapidly decline while Gen Z and Millennial ratings remain in a tighter range. At the same time, the gaps between the generations grow larger indicated by the increasing bubble sizes.

This view highlights top channel opportunities by generational segment, extending the market reach and driving growth.

Figure 6: Generational alignment on interest in channel options for life/health insurance

“Stay in touch.”

For customers in any age range or demographic bracket, loyalty isn’t something to take for granted. Personalization and data use will only be truly effective in an environment of close contact and frequent personalized communication. Today’s L&AH insurers need to prioritize connection and relevant communications that show true concern for their customers’ lives, health, and safety.

Even if your organization chooses to sell embedded products through outside partnerships, your ability to keep track of policyholders and improve services and relationships will be a key to solidifying your space in the market. Traditional methods for tracking customer data aren’t suitable for today’s mobile and active customers. Majesco’s Core Suite for L&AH, Digital Enroll360 for L&AH, Distribution Management, and our analytics solutions can provide your company with a flexible framework to capture and keep a new generation of customers. You’ll improve insights while improving relationships and best of all, you’ll prepare to place new products and services at the points where relationships are built.

To read more about customer trends in insurance, be sure to read Majesco’s latest report, Enriching Customer Value, Digital Engagement, Financial Security and Loyalty by Rethinking Insurance.

By Denise Garth

[i] Wearable Healthcare Tech Trend Driven by Millennials, PYMTS, December 27, 2022, https://www.pymnts.com/technology/2022/wearable-medtech-revolution-driven-generation-z-millennials/

[ii] Dahl, Corey, “A brief history of life insurance,” ThinkAdvisor, September 9, 2013, https://www.thinkadvisor.com/2013/09/09/a-brief-history-of-life-insurance/

[iii] Ibid.

[iv] Howe, Barbara, “A Fresh Look at Voluntary Benefits,” Corporate Wellness Magazine.com, https://www.corporatewellnessmagazine.com/article/a-fresh-look-at-voluntary-benefits

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Preparing for an AI Native Future

Preparing for an AI Native Future