Underwriting & Pricing

The Hidden Impact of COVID-19 on Auto Rate Adequacy

The market for auto insurance is experiencing significant change. In addition to adapting to a virtual operational environment and other uncertainties that emerged from the COVID-19 pandemic, auto ...

‘Cautious Optimism’ for Cyber Buyers as More Focus on Risk Controls: Marsh

While the market for cyber insurance is expected to remain challenging "for the foreseeable future," there is optimism for rate stabilization as organization focus on cyber hygiene, according to ...

Rate Increases Steady in Q2: MarketScout

MarketScout said commercial property/casualty rates in the U.S. during the second quarter of 2022 were about the same as the first quarter, with composite average rate increases across all lines of ...

Commercial Auto Recovery Uncertain Beyond 2022

Property/casualty insurers have proven resilient in the last two years amid the considerable challenges of the coronavirus pandemic. One unanticipated outcome in this period is sharp improvement in ...

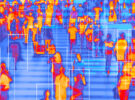

Telematics Has Kept the Promise: Allstate’s Journey Continues

Telematics has been on personal insurers' radar for many years, and it has recently reached a tipping point. Nowadays, it is recognized as a necessary capability for the future success of any auto ...

Carriers Will Be Slow to Raise Limits in ‘Nuanced’ Pricing Market: CEOs

Commercial insurance pricing may decline in coming months, but disciplined management of capacity will continue for a while, executives speaking at a recent industry conference said, pointing to ...

Are Drivers Who Pay at the Pump More Creditworthy? Researcher Probes Alternate Credit Scores

What does your SAT score mean for your ability to pay off a car loan? What does your Facebook feed say about your chances of landing a mortgage? What does your propensity for snacking on road trips ...

Tech Arms Race Favors Giant Commercial Carriers

Midway through a recent interview, the leader of a key business at The Hartford paused to ask a question relevant to executives at carriers that don't have 11-digit premium volumes or capital levels ...