There’s been steady growth in homeowners’ associations across the U.S., with nearly 44% of homes for sale now subject to a monthly HOA fee, climbing from 34.3% in 2019 to 43.6% in 2025, according to the newly released “Homeowners Association Report” from Realtor.com.

“HOAs are no longer confined to condos or brand-new developments,” said Joel Berner, senior economist at Realtor.com®. “The HOA-heavy construction boom earlier in the decade is now filtering into the existing-home market, and many of those newer communities were built with shared amenities, private roads, and common spaces that require ongoing maintenance. At the same time, rising insurance costs, stricter building safety standards, and higher labor and material prices are pushing associations to raise dues, making monthly HOA fees a much more common—and more costly—feature of homeownership than they were even a few years ago.”

The report found that the median HOA fee reached $135 in 2025, up from $125 last year and $108 in 2019, continuing a multiyear upward trend in monthly dues.

In 2025, 43.6% of U.S. home listings included a non-zero HOA fee, up from 41.9% in 2024 and well above pre-pandemic levels.

HOAs are far more common among condos and townhomes, with 84.8% of those listings subject to monthly dues, but their reach is expanding across the broader market.

Roughly one-third (33.4%) of single-family homes now carry HOA fees.

Homes with HOAs tend to be larger and more expensive.

Single-family homes with HOA fees have a median size of 2,306 square feet and a median price per square foot of $216.76, compared with 1,818 square feet and $205.10 for those without HOAs.

Condos with HOAs are about the same size as those without, but they command a higher price per square foot—$276.97 versus $255.35.

New construction remains the most HOA-heavy segment of the market, with 67.9% of new builds subject to HOA fees, compared with 38.9% of existing homes.

The online realtor found that the share of existing homes with HOAs is growing more quickly, reflecting how the HOA-heavy construction boom of 2020–2022 is now showing up in the resale inventory.

The median price for a home with an HOA is $450,000, compared with $374,900 for a home without one.

The gap reflects differences in housing age: the average existing home with an HOA was built in 1998, while the average existing home without one dates back to 1968.

Despite the extra monthly cost, being subject to an HOA in 2025 had little effect on how long listings stayed on the market in aggregate.

Nevada leads all states and the District of Columbia in HOA prevalence, with 68.3% of listings subject to an HOA fee. South Dakota sits at the other end of the spectrum, with just 12.3% of listings carrying HOA dues.

Geographically, the West and South are home to more homeowners’ associations and have also seen the largest gains in HOA share since the pandemic. Both regions have high levels of new construction activity, which may help explain their growing HOA footprint.

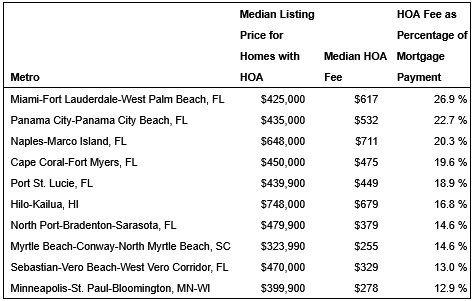

Metros With the Most Expensive HOAs

In Florida, HOA payments make up the largest share of monthly housing costs.

Among the 300 largest metro areas with above-average HOA prevalence, the places where HOA fees account for the biggest portion of a typical monthly mortgage payment include:

Florida tops the metro areas due to the prominence and the price of HOAs in the state, the report noted. “Climate-related insurance costs are a major factor, and legislative changes following the 2021 Surfside condo collapse have added pressure on condominium associations to build reserves and conduct more intensive inspections, driving up shared costs and monthly dues.”

“Florida is a clear outlier when it comes to HOA costs,” Berner said. “Between rising insurance premiums and stricter safety and reserve requirements, many associations are facing higher operating expenses that ultimately get passed on to homeowners.”

The report aggregates weekly snapshots of for-sale listings in the United States on Realtor.com from 2019 to 2025.

Uber Ballot Measure to Cap Personal Injury Fees, Limit Medical Damages Sparks Ire

Uber Ballot Measure to Cap Personal Injury Fees, Limit Medical Damages Sparks Ire  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists