A day before the first publicly traded U.S. insurer to report fourth-quarter 2025 financial results, Travelers, published its measures of underwriting and investment success, Swiss Re Institute released an industrywide outlook for the next two years—2026 and 2027.

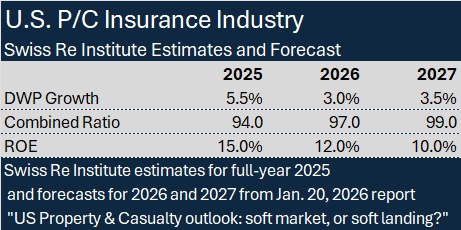

The Swiss Re Institute report, U.S. Property/Casualty Outlook, highlighting third-quarter 2025’s 89 combined ratio for U.S. P/C insurers as the “strongest quarterly [underwriting] result in decades,” forecasts overall returns-on-equity and premium growth moving down to historical norms over the next two years. In the Swiss Re analysts’ view, 2025 was the “cyclical peak” for U.S. P/C insurance underwriting profitability.

Rising competition, easing premium rates and persistent claims impact of inflation will push combined ratios up, the report says. In addition, “investment income remains supportive but is no longer a growing tailwind,” the report says, forecasting ROE of 12% for 2026 and 10% in 2027—”a normalization of total industry returns, with ROE moderating toward cost of capital by 2027.”

Incorporating information on the latest available quarter’s premium growth, which showed a third-quarter dip to 4%, compared to 9% growth for third-quarter 2024, Swiss Re Institute analysts predict full-year 2025 direct premium growth coming in at about 5.5 percent, followed by a 2026 trough of roughly 3%. That should normalize to 3.5% in 2027 “as the cycle moves toward balance,” the report says.

Through nine months of 2025, premium growth decelerated strongly to around 5% after four years of roughly 10% annual premium growth between 2021 and 2024, the Swiss Re Institute report reveals.

A graph in the report shows year-over-years premium growth for selected individual lines of business for recent quarters (from fourth-quarter 2023 through third-quarter 2025), revealing pronounced drops for personal auto, fire and commercial multiple peril. The auto growth levels plummeted from over 15% in fourth-quarter 2023 to 2% in third-quarter 2025, while fire and CMP dropped to around 3% and 4% in the latest quarter.

“Growth rates are converging toward the low- to mid-single digits in most personal and commercial lines,” the report says. “Personal auto is a key swing factor for 2026. Strong profitability in 2025 is already translating into rate reductions and could weigh further on industrywide growth,” the text of the report says, noting that property premiums “are also expected to continue easing, though this may be slightly offset by incremental demand linked to data center expansion.”

Putting information on premium growth together with the absence of hurricanes and the presence of favorable loss reserve development (through nine months) together, the report estimates a 94 combined ratio for full-year 2025, followed by 97 and 99 combined ratios in 2026 and 2027.

(Editor’s Note: Fitch Ratings and S&P Global Market Intelligence delivered separate assessments late last year.)

Related articles: What to Expect in 2026: U.S. P/C Results More Like 2024 and Best Quarter in a Quarter Century: S&P GMI U.S. P/C Q3 Analysis

The strong profitability will generate retained earnings and strengthen insurer appetites to deploy capital, intensifying rate competition, the report suggests. “The pace and breadth of pricing erosion will be a key determinant of industry growth and profitability through the next phase of the cycle.”

What About Travelers?

A day after Swiss Re Institute released its outlook report, Travelers reported a full-year 2025 combined ratio of 89.9—nearly four points better than Swiss Re’s expectation for the U.S. P/C insurance industry overall.

Travelers also reported overall net written premium growth of 2% for the year and a 21% return on equity, with after-tax underwriting income up 23% and net investment income climbing 10% after taxes.

Carrier Management will publish a full report on Travelers fourth-quarter and full-year earnings later this week. (Related article: 20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut)

As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance

As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance  Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops

Berkshire Hathaway Profit Falls; Insurance Income Lower for GEICO, Other Ops  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End