Damage from water leaks and frozen pipes are the most common insurance claims for small-business owners, while fire claims are the most expensive, according to an analysis of The Hartford’s small-business claims from 2020 to 2024.

According to the small business insurer’s analysis of more than one million small-business property and liability policies, water and freezing damage represented an estimated 22 percent of small-business claims over the past five years.

Water and freezing damage claims are also the fourth most costly claims, averaging $34,600.

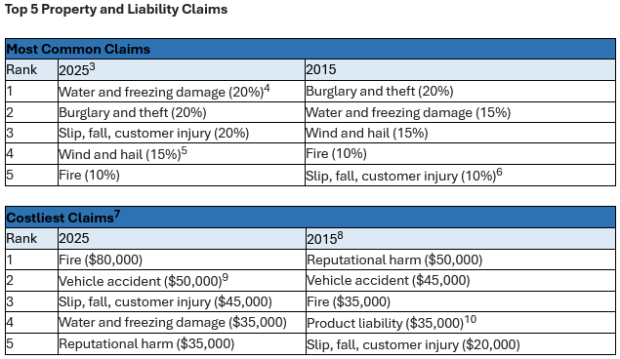

The Hartford’s 2025 analysis builds on its 2015 claims report, providing a 10-year comparison that includes some notable shifts.

The volume of claims from water and freezing damage rose from 15 percent to 20 percent.

Wind and hail claims remained consistent at 15 percent over the decade.

The average cost of fire damage claims rose from $35,000 in 2015 (approximately $47,600 adjusted for inflation) to $80,000 in 2025, making it the top-ranked costliest claim.

The number of slip, fall, and customer-injury claims also increased and became more expensive from 2015 to 2025.

Due in part to the growing influence of litigation and legal system abuse, the trend has resulted in higher settlements and costlier verdicts, the insurer added.

“Water sensors that detect leaks and video cameras that monitor for slips-and-falls are just a few of the smart tools now available to help small businesses mitigate risk,” explained The Hartford’s Head of Small Business Chris Jones.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best