As Jamaica and Cuba continue to pick up the pieces in the aftermath of Hurricane Melissa, the third Category 5 hurricane of the 2025 Atlantic season, new insured property loss figures range between $1.5 billion to a little over $4 billion, according to catastrophe modeling firms.

Cotality (formerly CoreLogic) reported estimated insured losses ranged for Jamaica from $1 to 2.5 billion, while property damage is estimated between $5 to and $9 billion when wind, surge, and flooding are combined. The loss estimate excludes automobile infrastructure, offshore marine, inland marine, and losses to other islands.

Based on the high-resolution KCC Caribbean Hurricane Model, the firm estimates privately insured loss from Hurricane Melissa will be $2.4 billion. This estimate includes the privately insured damage to residential, commercial, and industrial properties in Jamaica and Cuba.

Verisk Extreme Event Evolutions estimated a slightly higher range of USD $2.2 billion to USD $4.2 billion. The industry loss range includes estimated wind and precipitation-induced flood from Melissa’s track across Jamaica, with most of the modeled loss attributable to wind.

Moody’s RMS Event Response also estimated higher total insured losses from Hurricane Melissa, ranging between US$3 billion and US$5 billion. This estimate reflects insured losses from property damage and business interruption across residential, commercial, industrial, and automobile lines in Jamaica.

Hurricane Melissa made two landfalls, one in Jamaica on October 28 as a Category 5 hurricane with maximum sustained winds of 185 mph, and in Cuba on October 29 as a Category 3 hurricane with 120-mph winds.

According to KCC, there was only one other season with at least three Category 5 hurricanes in 2005 (Emily, Katrina, Rita, and Wilma).

Hurricane Melissa set a record as the most intense hurricane to make landfall in Jamaica and tied for the most intense hurricane landfall globally since recordkeeping began in 1851

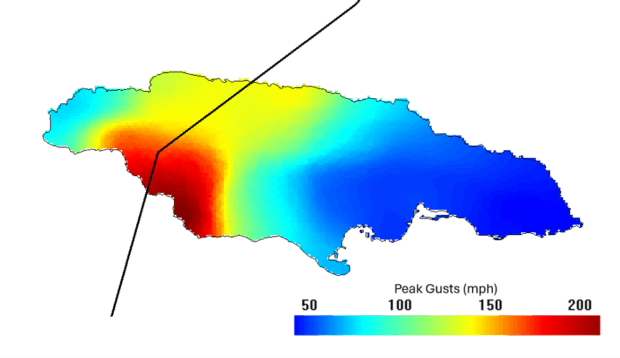

First making landfall in New Hope, Jamaica as a Category 5 hurricane with 185 mph maximum sustained winds, Hurricane Melissa’s most severe impacts were concentrated in the western parishes of St. Elizabeth, St. James, and Westmoreland, according to KCC data.

Displaced roofs with walls and framing still intact were the most common damage reported.

According to Moody RMS, a” dichotomy exists in Jamaica’sbuilding stock, with most insured buildings being well-built and resilient to high winds while uninsured residential buildingslargely exhibitless stringent build quality.”

Buildings in Jamaica are mostly masonry constructed (almost 70 percent), with an estimated 30 percent wood-framed, according to Verisk. The masonry-constructed buildings provide strong resistance to high-wind lateral loads, while the roofs are typically made of metal or zinc sheets directly attached to the roof framing without a roof deck. The lightweight roofs, often the weakest part of the structure, are highly vulnerable during hurricanes. KCC researchers said.

Roofs are mostly low to pitched flat, and the construction practices are informal with minimal to almost no professional input, KCC added.

Jamaica’s building code wasn’t legally mandated until 2003, and Verisk expects “the passing of Jamaica’s Building Act in 2019 is expected to improve the enforcement and rigorous application of this building code and enhance the resilience of Jamaica’s built environment moving forward, particularly given the magnitude of damage inflicted by Hurricane Melissa.”

Over 75 percent of buildings in St. Elizabeth Parish were damaged or destroyed, the result of 150-mph wind speeds, with areas reporting significant damage of 80-100 percent of roofs destroyed, according to Verisk.

Non-engineered residential buildings and engineered commercial buildings experienced similar degrees of damage, Verisk added.

Montego Bay in St. James Parish, where winds reached 135 mph, also experienced severe damage to both residential and commercial buildings, KCC reported.

St. James Parish sustained most of the commercial losses from Hurricane Melissa.

Savanna-la-Mar in Westmoreland Parish—which experienced 125-mph winds—also suffered significant damage, though less severe than Black River.

Kingston, the capital of Jamaica, experienced only tropical storm-force winds and sustained much less damage compared to western towns; thus, losses from Kingston are expected to be low.

The storm’s western eyewall scoured Jamaica’s breadbasket, according to KCC.

In St. Elizabeth parish, 185 mph winds destroyed large egg and crop operations, fueling fears of staple shortages and higher food prices until at least February 2026.

Montego Bay’s tourism corridor also suffered extensive structural damage, according to both KCC and Verisk, due to damage from wind, storm surge, and precipitation-induced flooding.

Sandals Resorts International will reopen five properties in early December, but three flagship resorts (Montego Bay, Royal Caribbean, and South Coast) will remain closed until May 30, 2026.

The insured impact will be significantly less than the total economic impact due to low insurance penetration rates in both Jamaica and Cuba, KCC said.

Reinsurers are expected to absorb most of the payout, as local insurers cede most of the risk.

Overall economic losses (distinct from Moody RMS’ estimate of insured losses) in Jamaica could potentially exceed the island’s GDP, which was approximately US$20 billion as of 2024.

“Hurricane Melissa was truly a generational event for Jamaicaandwill be the storm that defined the 2025 North Atlantic hurricane season…repairs andrecoverywill inevitablygo through significant supply chain challenges, even as several key ports on the island remain operational.Forthese reasons,we expect recovery efforts to take several months, if not years,” said Jeff Waters, director, North Atlantic Hurricane Models, Moody RMS.

Persistent protection gaps remain, both Cotalitiy and Verisk reported. Household and small-business insurance penetration is thought to range between 5 and 20 percent, with a significant number considered underinsured. In addition, a large portion of commercial and automobile lines are also uninsured, according to Verisk.

Insurance coverage for large hotels, utilities, and airports reaches 80 to 100 percent.

Insured losses from other impacted Caribbean islands, such as the Bahamas, Haiti, Turks and Caicos are expected to be minimal, according to Moody RMS.

In eastern Cuba, buildings in the affected areas sustained extensive envelope and structural damage, according to KCC, with approximately ten percent experiencing total collapse, while more than 30 percent lost their roofs completely. In addition, over half of the affected buildings suffered moderate or severe roof damage, including loss of covering, deck separation, or framing failure.

Melissa’s physical damage could rival or exceed the inflation-adjusted toll of 1988’s Hurricane Gilbert (today gauged at $4 to 6 billion for insurable damage), according to KCC.

This story was updated on Nov. 7, 2025, to reflect Moody RMS figures.

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers