Bermuda-based Everest Group, Ltd. published three announcements yesterday—one detailing a third-quarter income decline, and others describing actions to sharpen the company’s focus on its core global reinsurance and wholesale and specialty insurance businesses.

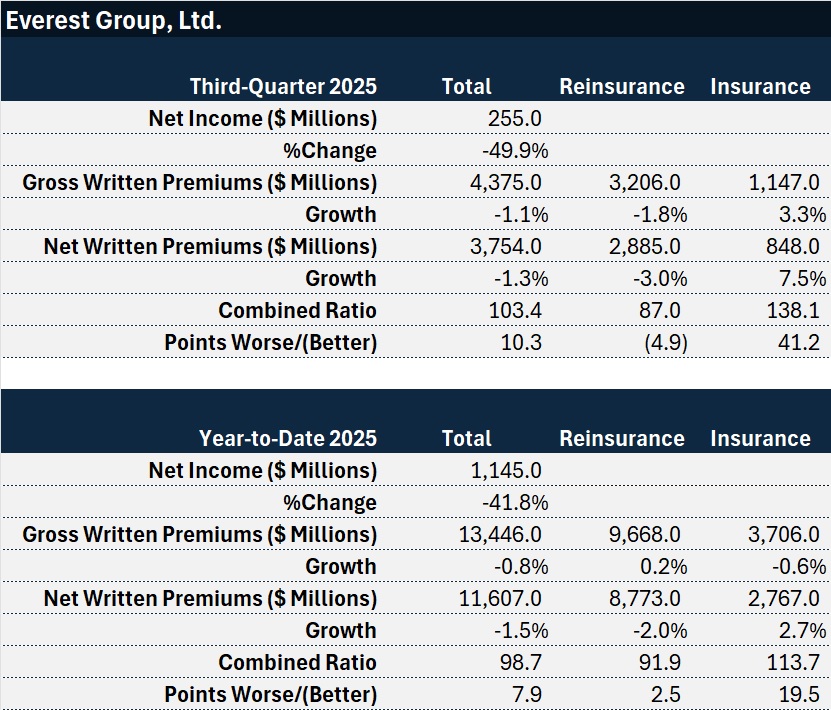

Third-quarter 2025 net income of $255 million was roughly half the $510 million figure Everest reported for third-quarter 2024. Much of the decline was attributable to $478 million of unfavorable development on prior-year loss reserves, which added 12.4 points to the overall combined ratio of the group.

The bulk of the development—$361 million—was recorded in the insurance segment, where strengthening of excess casualty and U.S. liability lines for accident years 2022-2024 added 38.5 points to the insurance segment combined ratio. The segment combined ratios landed at 138.1 for the quarter.

Addressing the prospect of further development impacting future results, Everest also announced that it has entered into an adverse development reinsurance agreement, effective Oct. 1, 2025, supported by Longtail Re, an affiliate of Stone Ridge Holdings Group.

The agreement provides $1.2 billion of gross limit protection against future adverse reserve development arising from substantially all insurance policies written by Everest Insurance’s North American business for accident years 2024 and prior.

According to the media statement, Everest will retain sole authority to handle and resolve claims.

The cover is composed of two layers in excess of $5.4 billion of North America liability subject reserves—a $700 million first layer and a $500 million second layer. Everest will have a co-participation of $100 million in each layer.

(Editor’s Note: A separate SEC filing actually describes adverse development reinsurance agreements between Everest and State National Insurance Company, Inc., as well as MS Transverse Insurance Company, indicating that these agreements are “supported on a retrocessional basis by Longtail Re.”)

Related article: Questionable Loss Reserves: Are Legacy Reinsurance Deals the Answer?

Everest’s third announcement yesterday discussed definitive agreements with American International Group under which Everest is selling renewal rights for Global Retail Commercial Insurance business—totaling $2 billion of gross premiums—to AIG, as Everest looks to focus on wholesale and specialty insurance within the insurance segment.

“Everest has taken decisive steps to define its strategic direction and position the company for improved performance,” said Jim Williamson, Everest’s president and chief executive officer, who revealed that the renewal rights transaction and the move to secure an adverse development cover were the outcomes of a careful strategic review of the company.

“These actions will provide meaningful flexibility to deploy capital toward share repurchases, strategic opportunities, and selective investments in talent, technology, and data that will enhance our competitive edge.”

Related article: AIG to Acquire Renewal Rights of Everest’s Retail Commercial Biz Worth $2B

Williamson started delivering bad news about unfavorable development in the casualty business in late January, just a few days after Everest’s board of directors officially appointed him to the chief executive role. Williamson had been acting CEO after the former leader, Juan Andrade, departed to take the helm of USAA in early January. Four days after Everest announced that Williamson’s ascent to a CEO spot would be permanent, the company announced a $1.7 billion loss reserve charge for U.S. casualty insurance lines.

Explaining the factors driving the charge a day later, Williamson said that misguided underwriting choices had magnified the impacts of social inflation. At the time, he also described remedial actions, including a “one renewal standard”—essentially walking away from any casualty account that couldn’t get back to target profitability in one renewal.

Related articles: ‘Underwriting Choices’ Added to Everest’s Social Inflation Woes: CEO; Everest Group Boosts Casualty Loss Reserves $1.7B; Andrade Leaving Everest for USAA; Williamson Named Acting CEO

Through the first nine months, reinsurance remains the bulk of Everest’s business, representing roughly 70 percent of gross written premiums and 75 percent of net premiums. The split was about the same when Andrade joined Everest in late 2019, with no prior experience on the reinsurance side of the business and an intention to get the company to roughly a 50-50 mix of insurance and reinsurance at some point in the future.

Williamson, who held prior positions as Group chief operating officer and head of the Reinsurance Division at Everest, and senior roles at other insurers serving in all aspects of commercial, specialty and consumer property/casualty lines of business, offered his own vision of the future company that will emerge following the latest strategic actions.

“The go-forward Everest is a more focused, higher-return enterprise anchored in Reinsurance and Wholesale & Specialty Insurance, built on underwriting excellence, balance sheet strength, and disciplined execution,” he said in a media statement.

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage