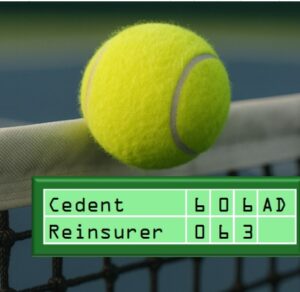

While the U.S. Open Tennis tournament was entering its final days in North America, reinsurance brokers preparing their trips to Monte Carlo predicted a common outcome in the 1/1/2026 match between reinsurers and cedents.

Reinsurance buyers have the advantage, executives from Aon said during a renewal briefing last week, essentially agreeing with the conclusions presented by Guy Carpenter leaders a day earlier.

Reinsurance buyers have the advantage, executives from Aon said during a renewal briefing last week, essentially agreeing with the conclusions presented by Guy Carpenter leaders a day earlier.

The two brokerage firms presented different estimates of capital levels dedicated to reinsurers and measures of retained and redeployed earnings that are contributing to an oversupply of capacity, but both said that record levels of traditional and alternative capital are driving continued buyer momentum ahead of Jan. 1 renewals.

Related article: How Fast Will the Reinsurance Market Soften?

“We definitely see the reinsurance market as being very robust with plentiful capacity and record levels of capital serving the industry,” said Alfonso Valera, chief executive officer of International for Reinsurance Solutions at Aon. In particular, he highlighted the fact 2025 is a record year for catastrophe bond issuance, despite the fact that the year hasn’t ended.

Later Mike Van Slooten, global head of market analysis, revealed Aon’s estimates of $121 billion of alternative capital—including cat bonds, sidecars and other alternatives—and $614 billion of traditional capital at June 30, for a new high level of global reinsurer capital of $735 billion.

Aon also includes more capital in its measure of traditional capital, putting it at $614 billion, compared to $535 billion estimated by Guy Carpenter.

“As a firm, we encourage and welcome new capital into the business, as ultimately [it] will bring competition and more offer to our clients—and will create a more competitive environment,” said Valera.

“We also enter the renewal with very solid results from reinsurers, both in terms of combined ratios and returns on capital despite a heavy cat 2025….Also, which is very important, [we enter] with a very strong desire as expressed by most, if not all, reinsurance companies to grow their business….”

“With these ingredients we anticipate and we believe the market will be very much a buyer’s market,” Valera said.

“We saw 50 percent year-on-year growth in the property-cat aggregate limit placed, and we expect this trend to continue,” said Aon’s Tracy Hatlestad, commenting on midyear growth and 1/1/2026 property renewals.

In addition to expressing the desire to grow, Van Slooten said reinsurers are avowing “greater willingness to show flexibility in response to the needs of reinsurance buyers.” Added Van Slooten, “You can rest assured that we’ll be testing these [intentions during] upcoming renewals.”

Putting some numbers behind the statement about solid results across the reinsurance sector, he said that in the last two-and-a half years since the “market reset in 2023,” the reinsurance sector has reported some of the best results the sector has ever produced.

During the first-half of 2025, the average reinsurers combined ratio was just under 95 despite the elevated loss activity in the broader market, and the average return on equity was close to 15 percent, with many of the larger companies closer to 20 percent, Van Slooten said, citing results Aon calculated across 30 global reinsurers.

“We conclude that most major reinsurers remain on track to produce a third year of strong results subject to major loss activity in the remainder of the year,” he said.

Describing the buyers’ market that has resulted from the good results, high capital levels and reinsurer appetites for growth, Valera said, “We anticipate pressure on pricing and we also see the opportunity for our reinsurance buying clients optimize their programs, ceding more volatility, and leveraging reinsurance capital to support their pursuit of profitable growth.

Having said this, we believe that reinsurance terms and conditions remain robust after the significant reset…. At the same time, we see tremendous opportunity for reinsurers, and we

call on them to be creative and partner with us and our clients to respond to insurer needs.”

10%-Plus Property-Cat Rate Reductions Ahead?

Reinsurers may have already started seizing opportunity in 2025.

Tracy Hatlestad, Global Head of Property Reinsurance for Aon Reinsurance, recapped activity during midyear renewals, noting that reinsurance and insurance-linked securities markets sought to deploy capacity and grow market share, resulting in broadly competitive market environments that are likely to prevail at 1/1/2026.

Already, she reported, reinsurers were offering greater flexibility in terms of conditions and options for insurers to purchase expanded coverage and new products. “As an example of this, we saw 50 percent year-on-year growth in the property-cat aggregate limit placed, and we expect this trend to continue as reinsurers position themselves to support insurer coverage priorities and maintain capacity on core occurrence placements.”

Hatlestad also reported that the continued depopulation of Florida Citizens and growth in the portfolios of national carriers fueled a 6 percent rise in demand for property reinsurance globally during midyear 2025 renewals. Looking ahead to 2026, Aon expects demand for property-cat programs to increase by about 5 percent again, driven primarily by growth in the U.S. and in EMEA, she said.

Commenting specifically on the property-catastrophe reinsurance rate environment, she said, “the industry is sitting approximately 20 percent above the global index mean rate level over the latest full-market cycle.” She also said that reinsurers target mid-40s expected loss ratios for property-cat business, and that despite this year’s cat activity so far, 2025 calendar-year industry ceded loss ratios are somewhere between 25 and 30 (prior to potential reductions related to subrogation of California wildfire claims).

We’re still well below [40] going into the Atlantic hurricane season. And in essence, we could see an estimated additional $8 billion in ceded loss emanating from property-cat programs before the market reaches that mid-40 level.”

“With that in mind, and the profitable results [achieved] for reinsurance portfolios over the last couple of years as well, we believe reinsurers will still be able to achieve target ROEs on their property cat portfolios with rate reductions of 10 percent or more going into January 1.”

Casualty Reinsurance: No One Pulling Back

Amanda Lyons, Global Head of Product, reviewed casualty reinsurance market conditions, and in spite of insurance and reinsurance executives’ worries about the U.S. litigation environment, she had some good news about 1/1 casualty renewals also.

“This would mark the first 1/1 in quite a few years where there’s not a major player announcing a pretty significant pullback,” Lyons said, after explaining that optimism on the primary rating environment and the actions that many of carriers have taken on the claim side will likely prompt reinsurers to hold capacity consistent at 1/1, or look to grow.

Setting the stage for 1/1, she described a “bifurcated” market at midyear 2025, with renewal outcomes varied by subline. She also delivered a laundry list of factors that helped some cedents fare better than others.

Beyond just achieving rate in excess of expectations, “loss emergence at or below expected” was another key ingredient for better renewals. Reinsurers differentiated clients that spotted loss trends early “and put robust plans in place to counteract market forces,” she said, noting, in particular, clients that adjusted claims handling to react to litigation trends and those who delivered good historical data.

Reinsurers also react favorably to insurers that pay attention to the changing environments in particular states, deploying less limit or tightening terms and conditions in problem areas, she said.

Positivity about primary casualty and excess insurance pricing, generally, is also setting the stage for more reinsurance capacity at 1/1, she said. “We’re projecting excess liability [insurance] rates well into the double-digits for the second half of the year, and very high-single digits for GL and auto,” she reported, adding that D&O pricing is also stabilizing—”and not anywhere near the price decrease as we saw a few years back.”

Named-Peril Casualty, Cyber Surge Stops and Real-Time Models

Ahead of Rendez-Vous de Monte Carlo, Lyons also described some casualty reinsurance innovations Aon recently introduced, and Hatlestad previewed an analytics platform launched at Monte Carlo to help insurers assess and respond to catastrophe events.

Aon’s Event Analytics platform “provides real-time access to portfolio insights before, during, and after catastrophe the event,” Hatlestad said.

Fragmented data, she said, hampers insurers in their ability to efficiently deploy resources to policyholders and stakeholders, suggesting that the new Aon solution will empower them to understand the full scope of potential impact and to take more decisive action with the information provided.

Specifically, the platform offers customized reports and user alerts that capture the insurer’s view of hazard, its exposure and its loss together, she said, adding that advanced mapping capabilities help insurers to visualize event footprints and to quickly assess key portfolio loss drivers. “In addition, it provides a multi-vendor model of insurer loss and industry loss figures from a global network of data providers,… as well as real-time loss information from Impact Forecasting’s Automated Event Response service.

On the casualty side, Lyons highlighted the fact that Aon has been working with Moody’s to develop named-peril reinsurance for emerging casualty risks, borrowing a concept from the property reinsurance world. “The idea here is not to reduce traditional buys, but really to ensure that protection is available for certain [emerging] exposures.”

In early September, in conjunction with the publication of a report by Aon and Moody’s said the “explicit coverage for precisely identified and quantified risks” could add $5 billion of premium to the reinsurance market annually.

“Named peril solutions, unlike broad traditional policies, drive transparency and certainty by covering specific emerging pre-litigation threats, such as microplastics or ultra processed foods,” the report said.

Contrasting the current market response of adding exclusions after litigation begins, Moody’s and Aon aim to combine advanced analytics and AI-enabled casualty cat modeling to “proactively shape a scalable, structured market poised for substantial growth.”

Related: Volatile Casualty Cat Market Offers $5B Opportunity for Reinsurers (Carrier Management); “$5B growth opportunity in the coming casualty catastrophe market” (Moody’s)

During the Aon renewal briefing, Lyons also mentioned an Aon innovation in the cyber reinsurance market—the midyear placement of cyber surge stop-loss cover. Aon’s Chief Executive Officer Greg Case also highlighted this on Aon’ second-quarter earnings conference call.

“Unlike traditional reinsurance products that require a specific event to trigger coverage, Aon ‘Surge’ Stop-Loss triggers based on aggregate loss thresholds, resulting in broader, more flexible protection,” Case said.

A midyear report from Aon on reinsurance market dynamics, published in July, gave more details, stating that the “surge” cover protects an insurer “against abnormal loss activity over a pre-agreed time (usually 60-90 days),” and that, in contrast to other cyber catastrophe covers, it “does not require an event definition.”

By dropping the event definition requirement, “Surge” responds to a broad range of “malicious and non-malicious” cyber losses, the report said. Referencing last year’s CrowdStrike outage, the report cited the potential for insurers to see a sudden surge in claims from multiple insureds affected by a related cyber incident, such as contagious malware or a supply chain cyber attack.

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  The Future of HR Is AI

The Future of HR Is AI  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers