Actions announced by credit rating agencies early this month included Fitch’s upgrade of Cincinnati Financial Corporation’s ratings, AM Best’s upgrade of Next Insurance US and downgrade of Erie Insurance Group members.

***

Fitch Upgrades Cincinnati Financial Corp.’s Ratings; Outlook Stable

Fitch Ratings upgraded the insurer financial strength ratings for Cincinnati Financial Corporation’s insurers to “AA-” (very strong) from “A+” (strong).

Fitch said upgrade is primarily based on a better assessment of capitalization. Secondarily, sustained strong underwriting performance and a very strong company profile drove the boost in ratings, Fitch said, also noting the rating agency’s consideration of Cincinnati Financial’s above-industry risky asset ratio.

On the capital assessment, Cincinnati Financial’s balance sheet strengths include conservative operating subsidiary capitalization and modest financial leverage. The property/casualty group’s score on Fitch’s Prism capital model remained “extremely strong” at year-end 2024.

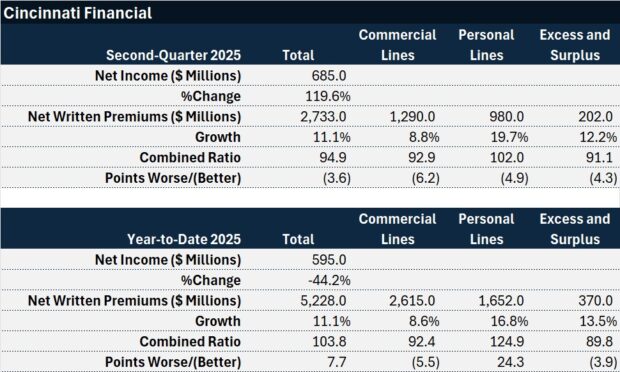

While the GAAP combined ratio for first-half 2025 was 104, nearly 8 points worse than the prior period (primarily from the California wildfires), Fitch projects a modest underwriting profit for the full year 2025. “As a property writer the company is exposed to weather events, but with prudent risk management Fitch expects the company will not be overly exposed to a single event.”

Fitch also noted that the company’s established independent agency system contributes to its value proposition and operating success.

In terms of investment risk, even though asset allocation to equities remains nearly double industry norms, the company’s “very strong” capitalization and cash flow provide a cushion against short-term fluctuations in valuation, Fitch said.

“A focus on stocks with a demonstrated ability to pay increasingly higher dividends provides some stability in the investment contribution to earnings and can provide a floor to their valuation,” Fitch said.

Fitch also commented on reserve risk, stating that the rating agency believes Cincinnati Financial’s reserves are “adequate and well managed,” with favorable prior-year reserve development recorded in each of the last 33 years.

Fitch has also upgraded Cincinnati Financial’s issuer default rating to “A+” from “A” and senior unsecured notes to “A” from “A-“.

The rating outlook is stable for all ratings.

AM Best Upgrades Next Insurance US Company Ratings

AM Best has removed from under review with positive implications and upgraded the financial strength rating of Next Insurance US Company (Next US) to” A+” (superior) from “A-” (excellent).

The ratings reflect Next US’s inclusion as a member of the lead rating unit, Munich Reinsurance Company (Munich Re), which on a consolidated basis has a balance sheet strength that AM Best assesses as strongest, as well as its strong operating performance, very favorable business profile and very strong enterprise risk management.

Munich Re acquired Next US to support expansion into the U.S. small and medium-size business segment. Previously, Munich Re had been a significant minority shareholder in Next US.

Related article: Munich Re’s Ergo Buys Next Insurance; InsurTech Valued at $2.6B

Under Munich Re, AM Best anticipates that Next US will benefit from greater amounts of implicit and explicit support.

AM Best also upgraded Next US’s long-term issuer credit rating to “aa” (superior) from “a-” (excellent.

The outlook assigned to all the ratings is stable.

AM Best Downgrades Erie Insurance Group P/C Member Ratings

AM Best has downgraded the financial strength ratings of the property/casualty (P/C) members of Erie Insurance Group (Erie) to “A” (excellent) from “A+” (superior).

The remainder of the P/C group is composed of inter-company pooling members, Erie Insurance Company and Erie Insurance Company of New York (Rochester, NY), and reinsured subsidiaries, Erie Insurance Property & Casualty Company and Flagship City Insurance Company.

The downgrades reflect the deterioration in Erie’s overall balance sheet strength, driven by multi-year surplus declines over the recent five-year period, AM Best said.

Large underwriting losses as a result of elevated weather-related events and increased severity in both the auto and homeowners’ segments have driven the surplus declines, putting the group’s risk-adjusted capitalization, as measured by Best’s Capital Adequacy Ratio (BCAR), in a downward trend.

This deterioration has been accompanied by rising underwriting leverage, mixed reserve development and gradually declining liquidity metrics, the Best announcement said.

The announcement also noted proactive steps that Erie has taken to stabilize its financial position, including ate and non-rate actions and restructuring its catastrophe reinsurance program with significantly higher limits.

These measures are beginning to yield results, but the impacts of the corrective measures have slower than Erie’s peers have seen in response to such measures.

“This lag is partly due to Erie’s use of 12-month auto policies and its ‘rate lock’ feature, which delays the recognition of premium rate increases,” the rating agency announcement said. Best also noted that the visibility of underlying improvements in the book of business “has been masked by continued elevated weather activity through the first half of 2025.”

In addition to its balance sheet strength, which AM Best assesses as strongest, the ratings reflect Erie’s adequate operating performance, favorable business profile and appropriate enterprise risk management.

AM Best also announced the downgrades of Erie’s long-term issuer credit ratings to “a+” (excellent) from “aa-” (superior), and the affirmation of the “a” (excellent) financial strength and long-term ICR of Erie Family Life Insurance Company (EFL).

The outlook of all the ratings is stable.

NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates