According to the latest J.D. Power survey of small business insurance customers, overall satisfaction levels are about even with last year, but a lower percentage say they will definitely stay with their current insurers.

According to the J.D. Power 2025 U.S. Small Commercial Insurance Study, released this week, just 55 percent of customers said they “definitely will” renew with the insurer they had as of the survey date, compared to 61 percent who said they’d stick it out with their present carriers in 2024.

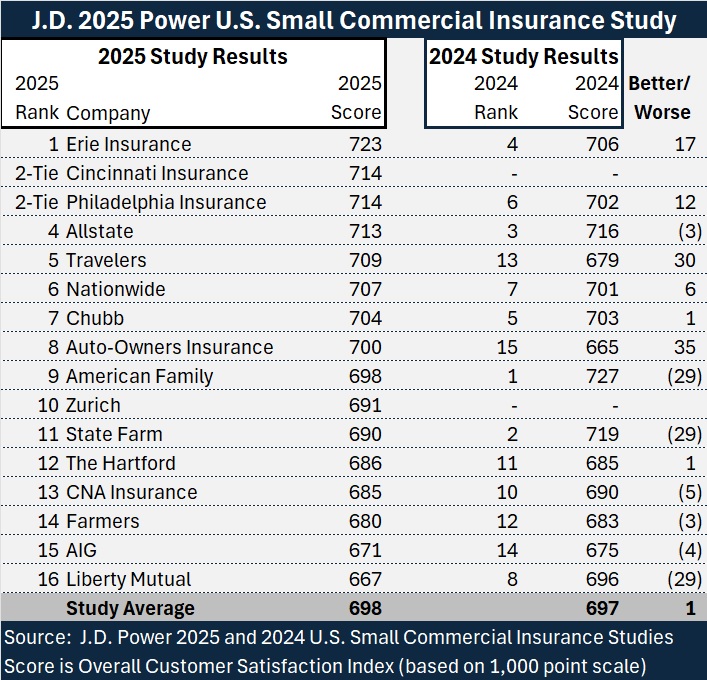

The study, which measures overall customer satisfaction among small commercial insurance customers with 50 or fewer employees, put the average satisfaction index at 698 (on a 1,000-point scale), barely budging from 697 last year.

In both years, carriers were assessed across seven core dimensions on a poor-to-perfect rating scale (in order of importance: trust; price for coverage; product/coverage offerings; ease of doing business; people; problem resolution; and digital channels). Both studies garnered over 2,800 responses.

Stephen Crewdson, managing director of global insurance intelligence at J.D. Power, put a focus on price and communication in a high-level summary of the results. “As premiums have risen to cover the cost of claims, it stands to reason that more customers would be willing to shop their policies. [But] insurers that communicate well and provide a higher level of service can make huge inroads toward keeping customers,” he said, in a media statement

He noted that some of the most satisfied customers are those that saw premium increases but said they completely understood why they have to pay more. Overall satisfaction scores for those customers was 722—identical to the score for customers who saw no premium increase at all.

This “puts a huge onus on insurers to bolster their outreach around rate increases,” Crewdson said, without identifying individual insurers that did a better job at this.

The Best and The Below-Average Insurers

While the report summary shared with the media does not reveal the exact dimensions which propelled them to the top, this year’s top-ranked small business commercial insurers were Erie Insurance, Cincinnati Insurance and Philadelphia Insurance.

Cincinnati Insurance is a newcomer to the list. (The company did not show up on any past rankings reviewed by Carrier Management, dating back to 2013.)

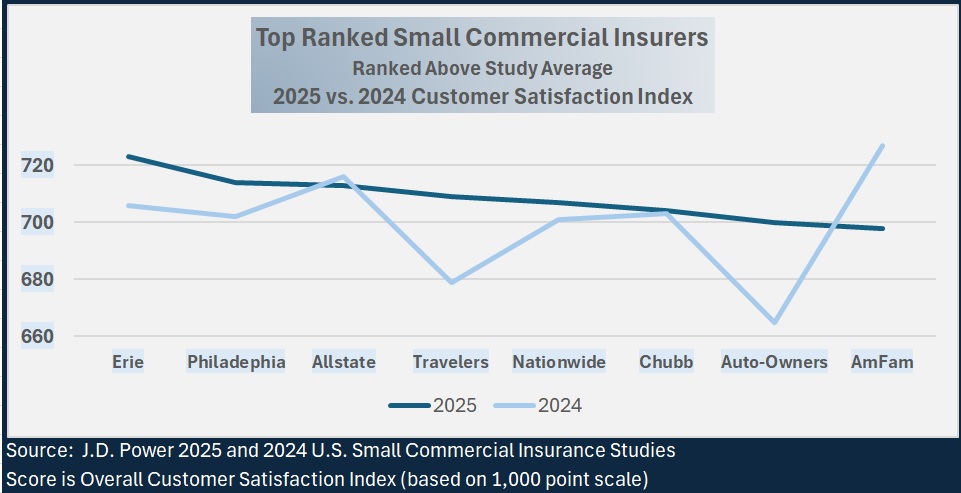

Erie, moving into first place this year, compared to a fourth-place ranking in 2024, saw its 2025 score jump 17 points—to 723 in 2025 from 706 in 2024. Only two other insurers had bigger leaps, Travelers and Auto-Owners Insurance. A 30-point upward change in Travelers’ score vaulted the insurer from a 13-place rank last year to the No. 5 spot this year.

J.D. Power redesigned the U.S. Small Commercial Insurance Study in 2024, moving from an approach based on five factors (billing and payment; claims; interaction; policy offerings; and price) to one based on seven core dimensions (trust; price for coverage; product/coverage offerings; ease of doing business; people; problem resolution; and digital channels)

While Erie has been on the list of top insurers in every year of the J.D. Power study, it’s the first time in a decade Erie has snagged the No. 1 spot. In 2013-2015, Erie ranked first but J.D. Power’s scoring methodology was a bit different at the time.

Most insurers that ranked above the 2025 study average of 698 had better scores in 2025 than in 2024. American Family was the exception, sliding down from a first-place ranking in 2024 to ninth-place in 2025.

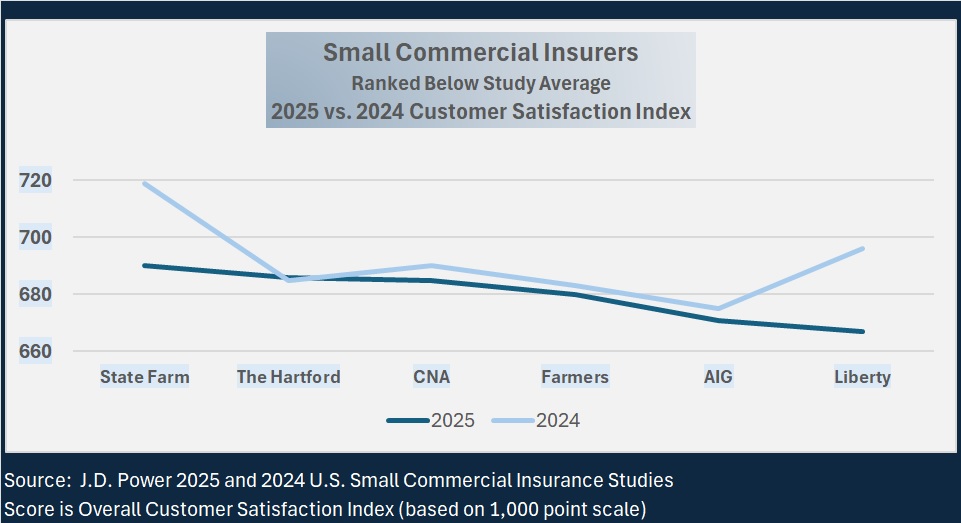

For ranked carriers whose scores fell below the study average, 2025 scores were generally unchanged from 2024 scores. Here, the exceptions were State Farm and Liberty Mutual, each seeing their scores fall by 29 points. State Farm, ranking No. 2 last year, dropped to 11th place for 2025.

Returning to the list this year is Zurich, ranked 10. The carrier hasn’t appeared on the J.D. Power U.S. Small Commercial Insurance Study rankings list since 2017.

The Hanover, ranked ninth in 2024, is absent from the 2025 rankings.

What Moves the Needle?

Highlighting the issue of potential defections from one small business insurance carrier to another, J.D. Power’s media statement about the latest study offered some factors that improve retention beyond communicating why premiums are rising.

- Institutional knowledge is a key retention driver. Insurers’ ability to demonstrate that they fully understand a customer’s business or industry drives a 37-percentage-point improvement year over year in customer intent to renew.

- Website resolution. The ability to resolve a problem entirely on an insurer’s website drives a 23-percentage point higher response to J.D. Power’s question about renewing with the same carrier.

- Better understanding of the policy. Customers who understood their policies were 33 percent more likely to renew with the same carrier.

- Age may be a factor. While J.D. Power saw retention declines across the demographics, intended retention saw the largest dip among Millennials (born 1982-1994)—a drop of 12 percentage points.

J.D Power said that while competitive pricing is a key reason customers select and stay with an insurer, the consumer insights and advisory firm believes that service is important in retaining them. To support that assertion, J.D. Power noted that 16 percent of customers say good service experience is the most common driver of retention, beating out price, coverage options and reputation.

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers