The leader of W.R. Berkley Corp. has seen it before—some version of the MGA movie in which delegated underwriting authority is given to market participants whose ambitions aren’t always aligned with capacity providers.

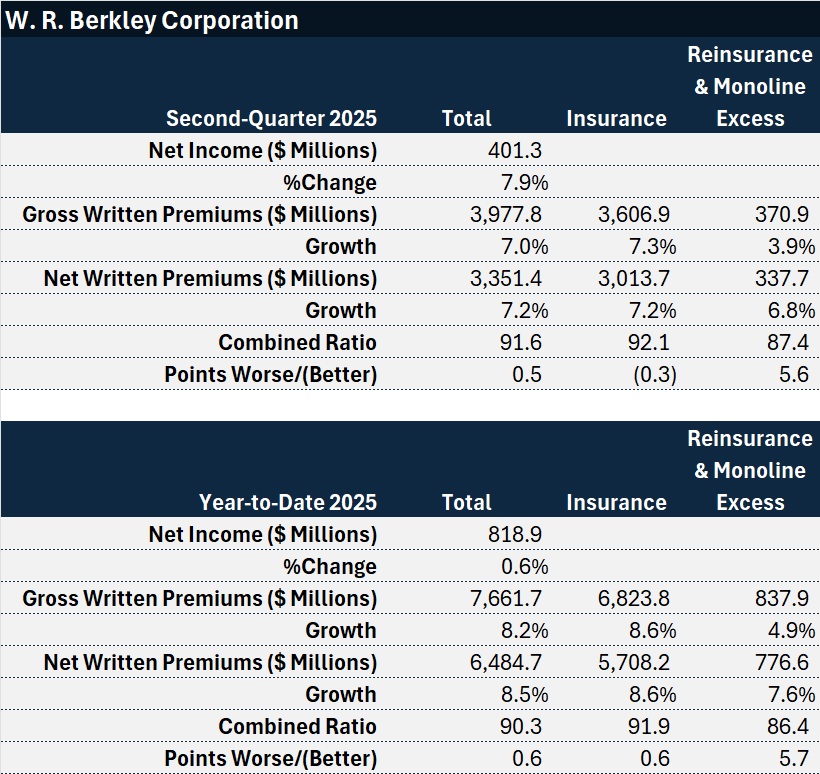

President and Chief Executive Officer W. Robert Berkley Jr. called out the potential market impacts of managing general agents several times during a second-quarter earnings conference call this week, while he and other executives also reported the specialty insurer’s jumps in income and premiums each over 7.0 percent and a combined ratio of 91.6.

In spite of what he characterized as stable and solid results, and his forecast of high-teen to low-20s returns for the foreseeable future, Berkley has his eye on the cast of characters in this year’s remake of MGAs Come Into the Property/Casualty Insurance Market—particularly new entrants, reinsurers and private equity investors.

“There is no doubt that inherently, in many of the delegated authority models, there is a mismatch or a lack of alignment of interest between those with the pen and those with the capital,” he said. “It is not that all of these relationships are bad. Some of them are quite good. One just needs to have their eyes wide open and understand that it is not a perfect alignment of interest and make sure that it is controlled appropriately,” he said, commenting on the general landscape.

Still, he said, “there has been extraordinary growth in the MGA space. A lot of it has been generated by new entrants that lack expertise.”

“A lot of it has been supported by reinsurance capacity that seems to have an unquenchable thirst for growth without necessarily their finger fully on the pulse.”

“We’ll have to see how this plays out.” Those of us “that have been around for a long while, have seen some version of this movie.”

Adding investment bankers to this year’s cast of characters, Berkley said that within the last 60 to 90 days, Berkley executives have received “a startling number of inbound calls” from the bankers, gauging their interest in buying MGAs. “And typically, they are capitalized or owned by private equity,” he said.

The frequency of calls, he suggested, is ” perhaps a leading indicator that the music is slowing.”

“We’ll see who has a seat at the end, though oftentimes, that does take some time,” he said.

Asked about W.R. Berkley’s response to these phone calls, the CEO said that while always being open to conversations, “it’s a pretty high hurdle to truly get us to want to engage.”

“When the day is all done, we evaluate every opportunity, as you’d expect, on its own merit. That having been said, we take the expertise and the responsibility to capital—both of those things—very seriously,” he said.

Commercial Auto: A Bursting Hose

In the second quarter, W.R. Berkley reported a record $3.4 billion in net written premium with the biggest jumps coming in short-tail insurance (9.8 percent), property reinsurance (13.5 percent), commercial auto insurance (9.9 percent), and monoline excess and umbrella (26.2 percent). Casualty reinsurance premiums were flat and professional liability insurance premiums grew just over 1 percent.

Overall, Berkley said that rates increased 7.6 percent in the quarter on average across all lines excluding workers comp.

He gave his line-by-line take on market dynamics, starting with the increasingly competitive property market. The drivers, he said, are a reinsurance marketplace that is “willing to provide capacity at a lower rate” and “some of the MGA market, which is becoming clearly more active.”

He noted a bifurcation in the property market, however. The most competition exists for larger accounts, “particularly shared and layered” business, he said. For smaller accounts, “it’s not that there isn’t competition, but it pales in comparison to the larger end of town.”

Turning to commercial transportation, Berkley again highlighted MGA activity in the marketplace. “We continue—and others seem to be—pushing for rate, but without a doubt, the MGA participants are creating at least a short-term headwind for that market truly going hard.”

“My expectation is that that’s a bit of a kink in the hose….Consequently, it is going to build up pressure and ultimately will inure to the benefit of responsible long-term participants when that snaps and the market shifts.”

As for professional liability, Berkley reported that the public D&O market “is beginning to find some sense of bottom,” while the private and non-for-profit D&O spaces remain particularly competitive. He again flagged the MGA component contributing to competition on miscellaneous professional liability classes.

Some Positive News for Worker Comp

Berkley also flagged recent news in the California workers compensation market, noting that the insurance commissioner approved an 8.7 percent increase in advisory pure premium rates, effective Sept. 1, 2025.

Related article: California Insurance Commissioner OKs Higher Workers Comp Pure Premiums

California, “this time around, is out in front of the rest of the market as far as firming,” Berkley said, adding that the commissioner’s action “is certainly a strong message that was well received by us. We look forward to more coming behind that,” he said.

Asked whether the loss cost increase in California should be seen as a leading indicator for other states, Berkley said the action is not likely “a perfect proxy for the rest of the country.”

“California is definitely a unique animal. That having been said, I would offer the observation that if you gut a product line’s rate enough, eventually it ends badly.”

In addition to that, “medical trend is not working in the workers comp market’s favor,” he said. He went on to suggest that medical trend has “been artificially held back or suppressed because of how it prices off of Medicare” in many states.

To Berkley’s mind, “California response is warranted—and then some.”

“I don’t think it’s a perfect indicator for the rest of the country, but it is an indicator that ultimately, if you take enough rate out of it, eventually, it ends badly and response is required,” he said.

Related article: Don’t Forget Workers Comp Tariff Impacts: Berkley

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best