Aon published a report on the MGA market this week, estimating $109.2 billion in direct premiums written by MGAs in 2024, identifying State National as the biggest MGA-dedicated carrier and Accelerant’s AUMI as the largest MGA.

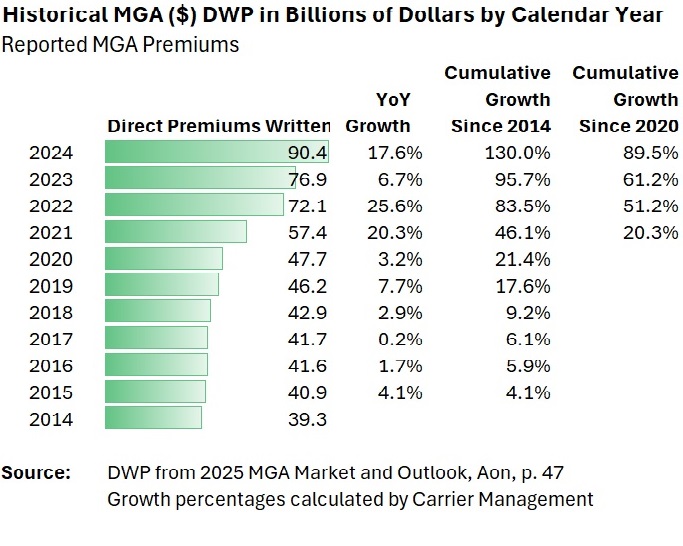

Like a report published by Conning earlier this year, the Aon report totaled direct premiums written by MGAs recorded in Note 19 of P/C carriers’ annual statutory filings statements at just over $90 billion. NAIC reporting regulations for Note 19 require that companies disclose individual MGA premium data only for those MGAs that are responsible for producing at least 5 percent of an insurer’s surplus. Aon added $18.8 billion for the missing amounts, bringing the total to $109.2 billion, according to information displayed on a chart in the report (“2025 MGA Market and Outlook: Data as of Year End 2024,” p.47).

Related article: MGAs by the Numbers: Fronting Biz, Non-Affiliated MGAs Drive Growth

The chart shows direct premiums written through MGAs and recorded in the statutory statements for each of the last 10 years (2014-2024). According to the figures shown, after staying in the $40-$50 billion range from 2014-2020, MGA premiums grew by double-digits in 2021, 2022 and 2024, putting the cumulative growth since 2020 at roughly 90 percent and growth for the decade well over 100 percent.

Commenting on the drivers of last year’s growth, the report points to new MGA formations, new product offerings, rate increases and a tighter admitted market.

“MGAs’ and issuing carriers’ growth trajectory is attracting talented individuals and creating continued opportunities for entrepreneurial professionals to advance and innovate the market,” the report says.

The report also gives snapshots of each of 30 issuing carriers, providing details like date of founding, key executives, financial strength rating, premiums and loss ratios over the last five years (shown graphically), program business distribution by line and state, and top MGA relationships (names and premiums).

As a group, Aon reports that the issuing carriers have also experienced tremendous growth over the past year, ending 2023 with $29.1 billion of total direct written premium, up from $23.8 billion at year-end 2023. “This growth is fueled by incumbent carriers and newly formed entities, predominately funded by private equity, now starting to see substantial premium growth.”

Individually, premiums for these carriers range from under $100 million for N.C-based Cimarron Insurance and Morristown, N.J.-based Emerald Bay to over $3 billion for AF Group and State National, according to the profiles in the report .

Ironically, Cimarron is listed as the company with the oldest founding date (1947) and Emerald Bay is the youngest (founded in 2024). With under $40 million in direct written premiums in property lines in 2024 from four MGA relationships Emerald Bay barely registered a loss ratio, even though 64 percent of the business is in California, according to the Aon profile. Cimarron, with a heavy concentration of personal auto and under-served workers compensation risks in the Southeast from a dozen MGA relationships posted loss ratios in the 60-80 range—similar to other liability-heavy writers, the report shows.

Related articles: Spinnaker Veterans Launch P/C Fronting Carrier With Backing From Bain Capital; Emerald Bay and Arrowhead Launch Commercial Earthquake Facility in California, Pacific Northwest; Emerald Bay Launches Co-Op and Condo Casualty Program with Vanderbilt Properties

The largest writers, State National, with 30-plus MGA relationships and AF Group, with 25, have been posting loss ratios in the high-60s to 70 range. AF Group is supporting a number of auto programs from MGAs, including $654 million of direct premiums from Tesla Insurance Services, representing 18.0 percent of the total, the report shows.

A chart in the report listing the percentage of total premiums from all MGA relationships for each of the fronting companies indicates another distinction between the two largest insurers in the report. While State National wrote 100 percent of 2024 direct written premiums through MGAs, the comparable percentage for AF Group was just 23 percent.

According to the report, members of Accredited Insurance group and Trisura actually had more MGA relationships than either State National or AF Group. Trisura, wrote programs through 70 MGAs last year. Accredited wrote 28, according to the Aon report, which draws information from U.S. filings. (In a media statement last year, announcing the completion of a sale of Accredited to Onex Partners from R&Q, Accredited revealed that it writes more than $2.1 billion of gross premium and partners with MGAs on over 70 programs in Europe, the UK, and the U.S.)

Related articles: Onex Partners Completes Acquisition of R&Q’s Program Manager, Accredited; R&Q Insurance to Sell Insurance and Program Management Unit to Canada’s Onex

MGA Loss Ratios Better: At Least for Now

There is a section of the Aon report devoted to loss ratio comparisons of MGA-focused business to the overall property/casualty industry for the last decade.

According to Aon’s figures, MGA-focused loss and LAE ratios across all lines were roughly 3 points lower than the overall P/C Market in 2023 and 2024 (1.9 points lower in 2024 and 4.4 points lower in 2023). “This is driven heavily by favorable catastrophe losses in commercial property,” the report states.

Prior to 2023, for the years 2017-2022, MGA-focused loss and LAE ratios were more than 8 points higher than the P/C industry, on average. The MGA results were roughly five points better during the earliest years of the decade (2014-2016).

A separate by-line analysis of average loss ratios across the entire 10-year period reveals MGA business performing better in casualty and motor lines. MGA 10-year average loss ratios were only worse in four lines—flood, credit and surety bonds, property and crop. The differentials were largest for flood (30 points) and surety (16 points), while MGA loss ratios for property and crop were only 6-7 points higher than the overall industry.

The Biggest MGAs

The report also provides a list of top unaffiliated reinsurers, a map presentation of how MGA premiums are distributed across the country, and graphs of premiums and loss ratios for issuing carriers participating in the cyber and pet insurance markets.

Taken together, the issuing carriers wrote more than $415 million of cyber insurance, up by $95 million from 2023.

Geographically, MGA premium is heavily concentrated in the South (Florida and Texas, in particular). Southern states premium accounted for 51percent of 2024 direct premiums.

A final list in the report reveals the top 50 MGAs and fronting carriers providing paper. Topping the list are:

- AUMI, listed with fronting carrier, Accelerant

- AMRISC, LLC, fronting carriers MS Transverse and Spinnaker

- Tesla Insurance Services, Inc., fronting carrier State National

- Arrowhead General Insurance Agency, Inc., fronting carriers MS Transverse, Palomar and Spinnaker

The acronym AUMI likely refers to an Accelerant affiliate which the insurance company itself identifies as AUM in various financial reports. According to an S-1 registration filing for an initial public offering published in June by Accelerant Holdings, AUM is “the U.S. program management affiliate of Accelerant, which also acts as a ‘master’ MGU that sub-delegates underwriting authority to members.”

Related article: Accelerant Launches Exchange for Specialty Underwriters

The filing explains that Accelerant Holdings, the ultimate parent of surplus lines insurer Accelerant Specialty Insurance Company (ASIC), and Accelerant National Insurance Company (ANIC), an admitted carrier, operates “a data-driven risk exchange that connects selected specialty insurance underwriters…with risk capital partners.”

According to the filing, AUM provides “a full suite of data-driven, underwriting-led program management services to multiple Risk Exchange Insurers, including ASIC and ANIC.” The services include due diligence and onboarding, actuarial services, product development support, underwriting management, claims management, data analytics, regulatory compliance support, and enterprise risk management support.

AUM “receives delegated binding authority from the Risk Exchange Insurers to serve as the MGU for their portfolio programs,” the filing states. “Typically, AUM further delegates its binding authority to its sub-agent Members….These Members administer various insurance programs on behalf of AUM and Risk Exchange Insurers in accordance with AUM’s specific direction in addition to policies and procedures outlined in the AUM’s sub-agent contract(s).”

Earlier in the Aon report, “Accelerant Underwriting Managers, Inc.” is also listed the only 2024 MGA relationship for Kestrel, a recent startup founded by two former executives of State National—Terry Ledbetter, State National’s co-founder, and Luke Ledbetter, who formerly served as chief underwriting officer of State National.

In May, Kestrel completed a combination with Maiden Holdings, creating a “balance sheet light, fee-revenue focused, specialty insurance group” that is now listed on the NASDAQ exchange. Kestrel’s 2025 media statement about the combination with Maiden indicates that the company is writing specialty program business through four insurance company subsidiaries of AmTrust Financial Group and “retains an option to acquire the insurers from AmTrust.”

Related content: Terry, Luke Ledbetter Form Kestrel Group in Texas; Kestrel Group and Maiden Holdings Complete Combination to Form a New Publicly Listed Specialty Program Platform | Kestrel Group, Ltd.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits