In the aftermath of devastating flooding in Texas Hill Country earlier this month, the Insurance Information Institute (Triple-I) published an analysis of the property/casualty insurance landscape in the Lone Star State, revealing a complex risk environment that contributed to its ranking as the sixth-least-affordable for homeowners insurance in the United States.

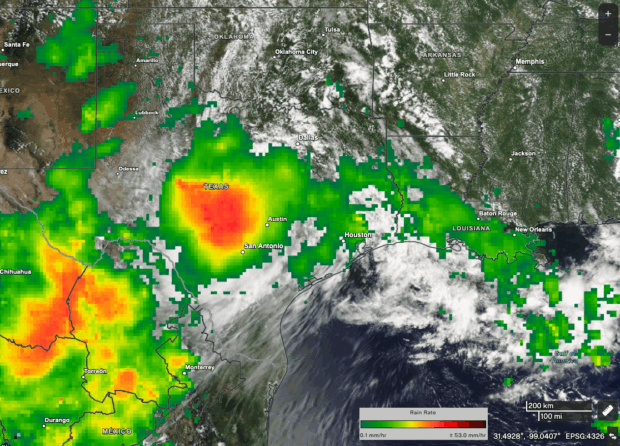

Triple-I’s new Texas Issues Brief highlights how severe inland flooding related to tropical systems, in this case Barry, have become increasingly more frequent and severe.

Floods are the most common and costly natural disasters in the United States, yet flood insurance remains one of the most underutilized forms of protection, according to Triple-I.

Flood coverage typically must be purchased through a separate policy, most often provided by the National Flood Insurance Program (NFIP), which is managed by the Federal Emergency Management Agency (FEMA).

As of July 2024, NFIP data estimate the national flood insurance penetration rate is around 6 percent.

Texas is one of the most flood-prone states in the country, given its exposure to hurricanes, tropical systems and severe convective storms.

“The catastrophic flooding in Central Texas exemplifies a troubling trend we have seen with events like hurricanes Harvey, Ida, Ian and Helene – devastating flood damage occurring far from storm landfall,” said Patrick Schmid, Triple-I’s chief insurance officer. “In Kerr County, where the worst flooding occurred during the recent Hill Country disaster, only 2.5 percent of homeowners have flood insurance through the National Flood Insurance Program.”

Texas faces an unprecedented combination of natural catastrophe risks:

Severe Convective Storms: Texas experiences over 100 tornadoes annually – the most of any state – with highest activity in the Panhandle and North Texas. The state also recorded 878 hail events involving stones one inch or larger in 2024, again leading the nation, the Triple I report said, citing information from the U.S. Department of Commerce, Storm Prediction Center, National Weather Service.

Lightning and Hail Damage: Texas recorded 4,369 homeowners’ insurance lightning loss claims in 2024 (Triple-I/State Farm data), second only to Florida, with an average cost per claim of $38,558 – significantly higher than Florida’s $23,686 average.

Wildfire Risk: With 244,617 homes at risk for extreme wildfire, Texas ranks third nationally behind California and Colorado, the Issues Brief said, citing data from Cotality, a property data and analytics company.

Grid Vulnerability: The February 2021 winter storm that caused catastrophic power grid failure across Texas and other states continues to influence the Lone Star State’s risk profile, with 80 percent of insured losses from that event occurring in Texas alone.

These combined vulnerabilities have resulted in Texas homeowners paying an average of 3.13 percent of median household income for homeowners insurance, making it the sixth-least-affordable state nationally, according to Triple I’s data..

Personal auto insurance in Texas is more affordable at 1.65 percent of median household income, ranking 14th nationally.

“All insurance pricing needs to reflect the risk inherent in the coverage provided,” Schmid explained. “For Texas homeowners, their poor affordability reflects the high levels of natural catastrophe risk – most notably, severe convective storms and hurricanes. Improving the resilience of homes, businesses and communities is essential to reduce the risk, improve affordability and save lives.”

Featured image: 1-day precipitation totals from NASA’s IMERG multi-satellite precipitation product show heavy rainfall over central Texas on July 4, 2025. Credit: NASA Worldview, Jacob Reed (NASA GSFC)

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End