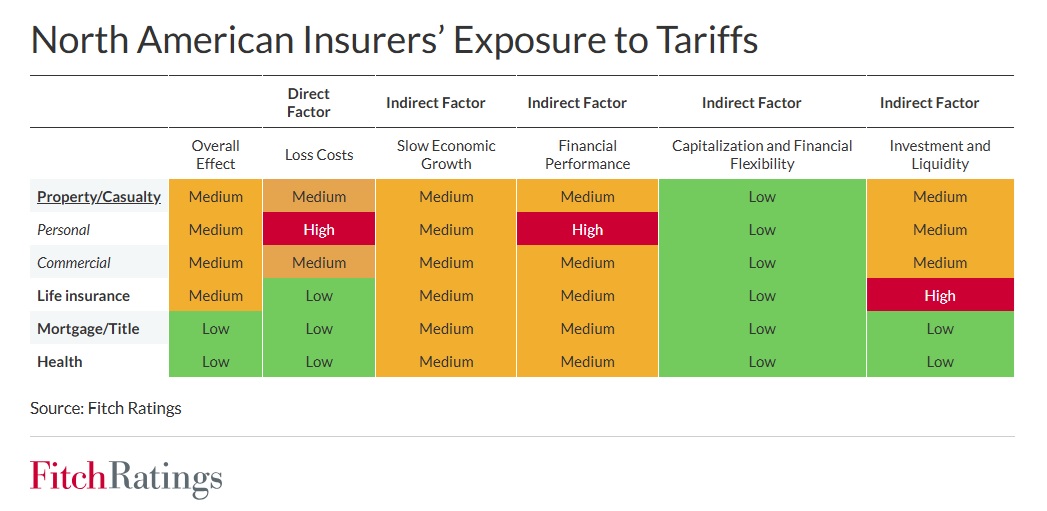

A glaring red block marked “high” appeared over the “personal lines/ loss costs” cell of a chart displaying the impact of tariffs on North American insurers created by Fitch Ratings this week.

While all types of insurers, for the most part, will experience second-order impacts of market volatility and slow economic growth, tariffs will have a direct impact on the costs of home and auto repairs, since repair supplies are globally sourced, Fitch said in a report, “U.S. Insurers See Higher Loss Costs, Market Risk from Tariffs.”

After significant rate hikes fueled notable improvements in the underwriting results of personal lines insurers in 2024, “results in 2025 will likely show deterioration if the inflationary impacts of tariffs on loss costs exceed rate increases,” the Fitch report said.

After significant rate hikes fueled notable improvements in the underwriting results of personal lines insurers in 2024, “results in 2025 will likely show deterioration if the inflationary impacts of tariffs on loss costs exceed rate increases,” the Fitch report said.

(The report was published a day before the Trump administration announced a partial reversal of automobile tariff policies, providing carmakers with credits for up to 15 percent of the value of vehicles assembled domestically, which could be applied against the value of imported parts. Related Reuters report, “Trump Eases Auto Tariffs Burden“)

“P/C insurers’ pricing could fail to keep pace with claims inflation costs as pricing momentum is constrained by macroeconomic weakness, leading to pressure on margins,” the report says.

Fitch will also be monitoring the impacts of loss cost inflation on loss reserve adequacy, the report said.

While the chart shows a “medium” tariff impact on commercial lines loss costs, the report notes that similar cost inflation could be experienced by commercial auto and property writers.

In general, tariff-induced inflation and supply shortages, particularly for construction materials and automobile replacement parts, will lead to rising claims severity for P/C insurers.

Medium impacts are indicated for indirect factors—slower economic growth, capitalization and investments—for both personal and commercial lines insurance sectors.

The report notes, however, that while “slower economic growth would be a negative for commercial insurers, demand has tended to be relatively less vulnerable in past economic downturns than personal lines.”

In addition, over the long term, commercial insurance demand “could recover sooner in the U.S. if the economy continues to be relatively stronger than other countries.”

In response to the administration’s evolving tariff policies, Fitch lowered its U.S. annual growth estimate from 1.7 percent in 2025 to 1.2 percent.

Fitch Ratings also raised its “end-2025 U.S. inflation forecast to 4.3 percent percent from 2.9 percent at end-2024.

Commenting on commercial and specialty lines other than auto and property, the report notes that :

- Business interruption claims may also increase due to supply chain disruption.

- Trade credit has an increased risk of claims from higher defaults. But demand for coverage could be higher to protect from rising volatility and result in increased growth.

- Demand for political risk insurance could rise further with a greater need for coverage in an uncertain environment.

- Premiums for marine insurance could drop if trade routes are reduced; however, the value of goods in transit could increase requiring higher coverage.

- “Higher unemployment in a recession scenario would hurt lines of business where premiums are based on payroll, such as workers compensation, general liability, and employment practices liability insurance (EPLI).”

- More directors and officer liability insurance claims could result from investment market volatility, increased risk of recession and higher defaults.

Fitch believes that industry capital remains strong and should be able to withstand the impacts of higher loss costs and investment risks. Even in the event of a recession, “Fitch-rated insurers would still be able to tap the capital markets given their investment-grade ratings and flight to quality,” the report says.

Related article: No Escape From Tariffs — Not Even for D&O Liability Insurers

The report also describes the impacts on life, health and mortgage insurers.

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly