Wildfire losses obscured what executives of Travelers described as outstanding underlying results for the insurer’s first quarter—and looking ahead, the company is well-positioned to face the impacts of macroeconomic uncertainty, the chief executive said.

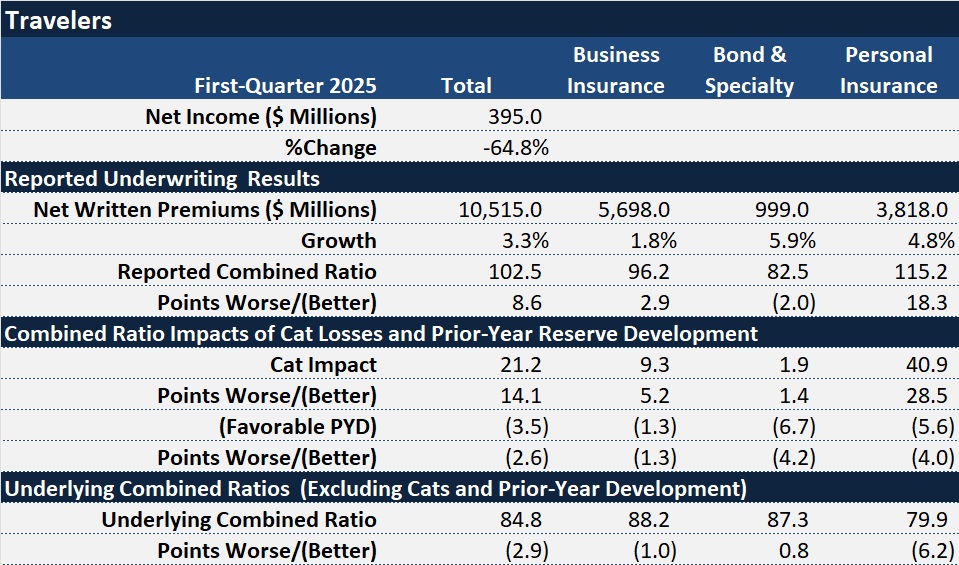

During an first-quarter earnings conference call to discuss results that included $395 million of net income, a 102.5 combined ratio and 3 percent growth in net premiums to $10.5 billion, Travelers Chair and CEO Alan Schnitzer concluded his opening remarks by voluntarily answering a yet-to-be-asked question: How will economic uncertainty will impact Travelers for the rest of the year?

“It’s just a fraction of auto and property losses that are physical damage-related—and only a fraction of those are from materials that would be impacted by the tariffs.”

Alan Schnitzer, Travelers

“We are a market leader in a diversified portfolio of businesses, each with a strong value proposition to offer to our customers and distribution partners. Our underlying margins are in great shape, and in each segment, we have attractive loss ratios and expense ratios that reflect years of strategic focus,” he said. In addition, a “thoughtfully managed” investment portfolio can deliver “highly reliable returns including through periods of market stress,” he said, adding that a “a fortress balance sheet featuring a strong capital base” also positions the company to travel “what feels like an uncertain macroeconomic road ahead.”

More directly responding to a specific question about the impacts of tariffs on the personal and commercial lines businesses, Schnitzer focused in on personal auto and suggested that impact would be minimal and manageable.

“It’s just a fraction of auto and property losses that are physical damage-related—and only a fraction of those are from materials that would be impacted by the tariffs,” Schnitzer stated.

The CEO said the most likely impact for Travelers could be “a one-time impact to physical damage repair costs” affecting the private passenger auto line. Assuming tariffs remain in place as announced, “we’d expect somewhere around a mid-single digit increase to [personal insurance] auto severity,” he said, stressing that this would be a “one-time impact, not a slope impact.”

“From there, the impacts diminish pretty significantly,” for other lines, he said, also predicting that the actual impact on personal auto severity could be even lower.

“We think participants in the value chain will likely seek to mitigate the impact through some combination of advanced inventory buildup, substitution of goods, reorganization of supply chain, lower tariff pass through rates. [And] the actual impacts could be mitigated by other factors, for example, extended lives of cars on the road,” Schnitzer suggested.

Finally, he highlighted Travelers profit margins for personal auto. They’re in “a pretty good place, and if recent favorable loss trends persist, [then] we may be able to absorb whatever the impact is inside our loss picks,” he said..

“We’re prepared to watch and react to the extent that we need to,” he said, noting that Travelers has the tools and capabilities see loss trends quickly and reflect them in pricing models.

For the personal auto line, Travelers reported a first-quarter 2025 combined ratio of 83.4 on $1.9 billion of written premiums. While premiums were flat compared to first-quarter 2024, the auto combined ratio improved 11.2 points.

Wildfire Impact By the Numbers

In spite of the auto improvement, Travelers reported an overall underwriting loss of just over $300 million for the first-quarter, translating to a companywide combined ratio of 102.5—8.6 points higher than first-quarter 2024—as incurred losses from the January wildfires hit the books.

Consistent with preannounced figures released in February, Travelers reported wildfire losses of $1.7 billion pre-tax, and $1.4 billion after taxes. Schnitzer noted that the insurer has already paid out nearly $0.75 billion, including substantial advanced payments to customers who suffered total losses.

Severe wind and hail storms in multiple states added to the catastrophe loss total for the quarter, bringing the total after-tax cat impact to $2.3 billion, representing 21.2 points of the combined ratio.

Excluding the cat losses, and favorable prior-year loss development of almost $400 million, underlying underwriting income of $1.6 billion (pre-tax) for first-quarter 2025 was up more than 30 percent over the prior year quarter. The underlying combined ratio improved 2.9 points to 84.8.

The chart below displays the impact of catastrophe losses on three segments of Travelers’ insurance portfolio—business insurance, bond & specialty and personal lines. In spite improved personal auto underwriting margins, catastrophe losses incurred under homeowners policies added 40.9 points to the personal lines combined ratio, and 78 points to the homeowners combined ratio by itself. The reported personal lines combined ratio was 115.2, while the underlying ratios (excluding cats and reserve development) was just 79.9.

For homeowners, the 78.0-point cat impact for the line was higher than the underlying homeowners combined ratio for the line (72.6), pushing the reported homeowners combined ratio up to 145.5.

The underlying homeowners combined ratio—ex- cats and excluding 5.1 points of favorable prior-year reserve development—improved 5.0 points compared to first-quarter 2024.

Net written premiums for personal lines increased 5 percent to $3.8 billion. Schnitzer and Michael Klein, president of Personal Insurance, said the jump reflected strong renewal premium change—19.6 percent for homeowners and 7 percent for auto.

Policies in force fell 4 percent in homeowners and 3 percent in personal auto compared to the prior-year quarter, and Klein said the result was intentional. The homeowners PIF decline “continues to be driven by our deliberate efforts to improve profitability and reduce exposures in high cat-risk geographies,” he said. “While those same actions continue to constrain our ability to grow auto PIF in the near-term, we believe the trade-off makes sense for the long-term performance of our diversified personal lines portfolio.”

Travelers executives noted that net written premium growth for business insurance—just under 2 percent to a record of $5.7 billion—was distorted by the ceded premium impact of an enhanced casualty reinsurance program that the company announced late last year. we announced last quarter.

Gregory Toczydlowski, president of , Business Insurance, reported that commercial lines pricing remained strong with a renewal premium change average of 9.2 percent, driven by a renewal rate change of 6.4 percent and high levels of policy retention (86 percent).

The combination of strong pricing and retention, he said, “is a reflection of marketwide discipline in response to ongoing environmental trends and uncertainty.”

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report