With 28 catastrophic weather events in 2023 causing nearly $93 billion in damage, customer service satisfaction plunged to a seven-year low, according to the latest J.D. Power 2024 U.S. Property Claims Satisfaction Study released today.

More extreme weather events led to a larger number of high-severity claims and longer claims settlement times, the report said. The average claims cycle time—the amount of time from reporting the claim to finished repairs—has now reached 23.9 days, over six days longer than in 2022. For claims related to catastrophic events, that average repair cycle time jumped to 34.2 days.

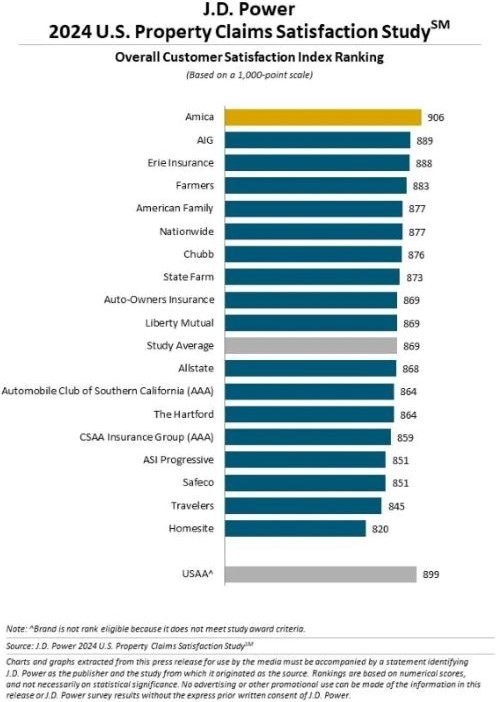

As a result, customer satisfaction has declined by five points to 869 (on 1,000-point scale) from a year ago, the study found.

The average overall satisfaction score among customers who experienced catastrophic claims is 841.

“Catastrophic weather events are straining an already fragile system still experiencing supply chain issues that affect the availability and cost of materials,” said Mark Garrett, director of claims intelligence at J.D. Power. “Resources become strained for both insurers and the contractors doing the work. Unfortunately, it’s when claims last beyond three weeks that J.D. Power sees things decline. When claims last less than three weeks, satisfaction improves, so it’s the longer claims that are solely responsible for the decline. Insurers are challenged to manage expectations and proactively communicate during longer claim periods as customers tend to have more questions when experiencing delays.”

Surprisingly, even customers who utilized digital tools for reporting claims or submitting photos and experienced faster claim cycle times didn’t always report higher levels of overall satisfaction.

Claims taking longer than expected are partially to blame as satisfaction dropped at a greater pace among digital users than non-digital users, J.D. Power said.

Overall satisfaction among customers reporting their claim digitally is 903 when the claim is settled in less than three weeks, but that score fell to just 727 after 31 days.

“Insurers are offering digital tools and managed repair partners to help streamline the process, but these efforts are met with mixed results,” Garrett said. “Customers still expect things to move along quicker, so expectation management is key.”

Because of rising insurance premiums, when customers have a claim and have to cover $1,500 or more in costs, the study found that satisfaction is negatively affected, even if it is to cover their deductible.

The increasing frequency of catastrophic weather events coupled with policies that often have higher deductibles for this type of weather event (wind, hail, named storms, etc.), means more customers will be paying higher deductibles.

J.D. Power reported a five-percentage-point increase to 28 percent from 23 percent in 2022 among those spending $1,500 or more for either their deductible or out-of-pocket expenses, with satisfaction declining 27 points.

Customers using digital tools to report claims and submit photos tend to have lower severity claims and report faster repair cycle times of 15 days, on average, compared with nearly 28 days among non-digital users.

“No time is more critical than during the initial reporting of the claim,” Garrett said. “The biggest declines in satisfaction are related to explaining the claims process to customers and showing concern for their situation. To navigate this difficult stage, insurers need to redouble their efforts to proactively manage customer expectations and streamline the claims process.”

When multiple insurance representatives are involved in claims handling, consistency of service is an important driver of satisfaction, J.D. Power noted.

“From sharing information so the customer does not need to repeat themselves to reps having similar knowledge and soft skills is critical in delivering very consistent levels of service,” the study noted.

Among the 27 percent of customers who report that level was not achieved, satisfaction dropped 200 points.

More Paid Time Off Keeps U.S. Workers From Quitting: Study

More Paid Time Off Keeps U.S. Workers From Quitting: Study  Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud

Carriers See Higher Claims Severity Amid Medical, Social Inflation and Growth in AI‑Generated Fraud  Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates

Marine Insurers Cancel War Risk Cover as Iran Conflict Escalates  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End