Underwriting losses in U.S. commercial auto have returned to pre-pandemic levels and rate increases have not been enough to keep up with severity trends.

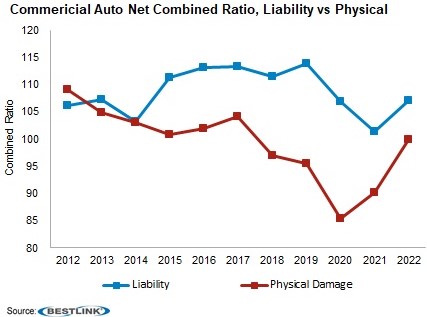

“The liability component has been more problematic than the physical damage component, which is no surprise since adverse loss reserve development, driven by social inflation, tends to be a bigger issue for liability claims, which generally have a longer tail than property damage claims,” said Christopher Graham, senior industry analyst, Industry Research and Analytics, AM Best. “Even with that, though, the physical damage combined ratio is deteriorating.”

According to AM Best’s report on the segment, the combined ratio for physical damage has been below 100 since 2018, while the combined ratio for liability has consistently been above 100—getting close to the breakeven point in 2021. However, in 2022, the combined ratio for physical damage jumped 9 points from 2021 to 99.9.

AM Best said higher prices for parts, as well as labor shortages, are creating more difficulties for the troubled commercial auto line as the gap between the combined ratio for liability and physical damage narrows.

The overall combined ratio for commercial auto was 105.4 in 2022, which is lower than a peak of 111.1 in 2017 but AM Best attributed this more to lower expense ratios than any claims improvement.

“The strategies and resources needed to address the claims side of [commercial auto insurers’] underwriting efforts have not had a discernibly positive impact on bottom-line underwriting results,” AM Best said. “Ongoing increases in loss severity are almost certain to have a detrimental effect on underwriting profitability.”

More than 50 percent of 2022’s nearly $3.3 billion underwriting loss can be linked to adverse loss development on older accident years, AM Best said. Price increases of an average 7 percent did not outpace average inflation of 8 percent in 2022. Meanwhile, adverse development added four points to the overall combined ratio. Adverse prior-year development in 2022 was $2.1 billion compared to the average since 2015 of $1.8 billion. AM Best said more than half of the adverse development in 2022 is from years 2018 and 2019, “suggesting that more development may be on the way.”

The frequency of traffic fatalities remain elevated, claims severity—aided by attorney involvement and social inflation—is rising faster than economic inflation, and a lack of experienced drivers are all headwinds that are not predicted to ease up on the line in the near term. In fact, these headwinds are strengthening according to early results for 2023, AM Best added.

Top Insurers

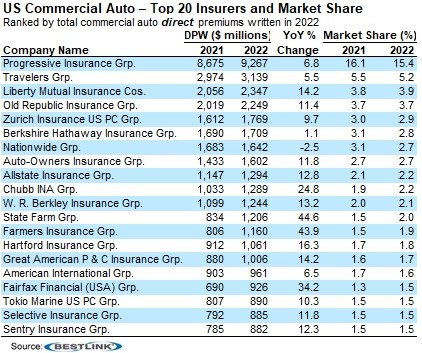

Progressive continues to hold the top spot by a large margin with a 15.4 percent market share, followed by Travelers with 5.2 percent. On average, Progressive combined ratio has been nearly 18 points better than the rest of the industry, AM Best said. Unlike other insurers, Progressive looks at commercial auto as a strategic piece of its portfolio.

Fitch’s Take

Meanwhile, Fitch Ratings likewise said the outlook for commercial auto is bleak. It expects the line to remain unprofitable in 2023, with a combined ratio of more than 106 in 2023.

Citing similar factors, Fitch said the commercial auto segment will see high loss severity.

“More frequent attorney involvement in transportation claims and greater potential for outsized verdicts in several jurisdictions continue to exacerbate commercial auto loss costs, with insurers’ commercial auto litigation risk increasing amid the expanding presence of the litigation finance industry,” Fitch said, adding that the inclusion of ride-sharing in some commercial auto insurers’ books of business have also resulting in underwriting losses in recent years, “driven by inadequately priced business for Uber and Lyft.”

This article was previously published by Insurance Journal. Reporter Chad Hemenway is the National Editor of Insurance Journal.

Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best