Reinsurers reported “a robust increase” in their capital base, improved underwriting profits as well as higher returns on equity and investment income, according to a Gallagher Re report.

The reinsurance industry’s underlying ROE improved markedly, which has been building on the gradual recovery seen over the past three to four years, said the report, noting that average ROE is now well above the industry’s cost of capital.

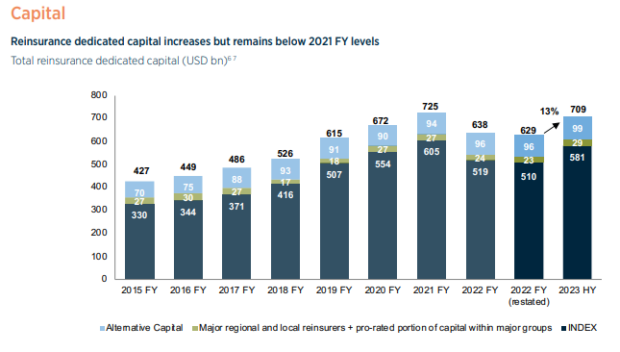

Capital dedicated to the global reinsurance sector totaled $709 billion at half-year 2023, an increase of 13 percent versus the restated full-year 2022 base, continued the report. Dedicated reinsurance capital still remains below full-year 2021 levels, Gallagher confirmed.

Gallagher’s Reinsurance Market Report tracks the capital and profitability of the global reinsurance industry. (Editor’s note: The year-end 2022 capital has been restated from $638 billion to $629 billion due to late filers and restated capital for IFRS 17 reporters. The figure of $709 billion includes alternative capital. See related chart below.)

“The rise in capital was due to strong investment performance and steadily improving underwriting results. There was a notable lack of new capacity despite continued favorable market conditions,” said the broker in a statement accompanying the report.

Gallagher Re noted that total capital inflow amounted to a relatively modest $7 billion.

To compile its report, Gallagher Re analyzes 41 reinsurers listed in as “INDEX” companies, which contribute more than 80 percent of the industry’s capital.

INDEX capital increased by 14 percent to $581 billion from $510 billion (restated) for full-year 2022. “Just over three-quarters of this increase was due to unrealized investment appreciation, most of which was attributable to National Indemnity,” the report said, explaining that without NI’s gains, the INDEX capital increased by 5 percent.

Revenue growth slowed but remained strong during H1 2023 at 8.7 percent, which was supported by rate increases, the report said. (This year’s revenue growth was down from 13.5 percent in H1 2022.) “Whilst there were significant rate increases for property reinsurance and commercial insurance business, volume growth was muted as a result of increasing attachment points and portfolio management actions.”

The combined ratio improved on a reported basis to 87.6 (HI 2022: 89.2, restated for IFRS 17), “despite conservative reserving, a moderate increase in the natural catastrophe load (from 5.3 percent to 6.0 percent) and a slight decrease in the support from reserve releases (from 1.8 percent to 1.5 percent).”

On an underlying basis the combined ratio improved to 95.4 from 97.7. Gallagher Re said the underlying combined ratio, in particular, was the strongest underwriting performance achieved over the 10 years the broker has conducted this analysis.

Return on Equity

The reported ROE increased strongly to 19.3 percent in H1 2023 from 4.4 percent in H1 2022, while underlying ROE increased to 13.4 percent from 10.2 percent in H1 2022.

Gallagher attributed the increase in the underlying ROE to improved underlying underwriting margins and higher running investment income, the report said. “For a second year in a row, the underlying ROE is now well above the cost of capital, after an elongated period of sub-par returns.”

“Global reinsurers have shown strong performance in the first half of this year, reporting increased capital alongside improved underwriting profitability and ROEs. On an economic basis, capital adequacy also remained robust and indeed generally improved,” commented Tom Wakefield, CEO, Gallagher Re, in a statement. “Higher interest rates and rate increases booked at renewals YTD provide a tailwind and the potential for reinsurers to improve ROE further.”

Preparing for an AI Native Future

Preparing for an AI Native Future  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book