With ample capital, Fitch Ratings’ latest annual ‘U.S. Hurricane Season’ report indicates U.S. property and casualty (P/C) insurers and reinsurers can absorb losses if a large hurricane makes landfall this year.

Hurricane Ian was the only storm to touch down in the U.S. in 2022 but brought sizable insured losses totaling $60 billion, turning the year into one of the costliest on record.

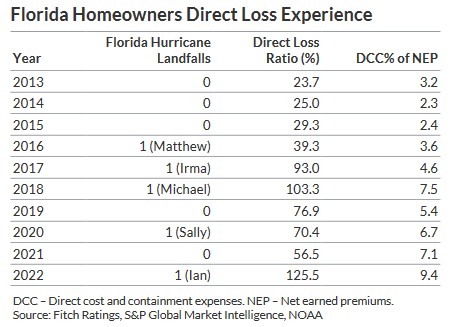

The homeowners insurance market in Florida bore the brunt, with direct loss ratio climbing to more than 125 percent.

“Several of the largest homeowners insurers in Florida have actively reduced policies in force through significant rate adjustments, targeted non-renewals and enhanced underwriting restrictions as a way to manage overall exposure,” said Senior Director Chris Grimes.

In April, the Florida Office of Insurance Regulation levied a 1 percent emergency assessment on all covered lines of business except auto, according to Fitch, in order to secure funds to cover claims payments relating to the liquidation of United Property & Casualty Insurance Company.

Preliminary hurricane forecasts for the year indicate a below average season is expected, “with the probability of a storm hitting the U.S. Atlantic coast comparable to long-term historical averages,” the report stated.

June/July midyear 2023 reinsurance renewals will be challenging for Florida primary underwriters, according to the report, due to increased selectivity and the many companies that have “either partially or completely withdrawn from the property-catastrophe market.”

“Sharp changes in reinsurance pricing and underwriting conditions have improved market profit potential, spurring actions indicative of renewed optimism by several established carriers,” said Senior Director Brian Schneider.

As a result of multiple insurers exiting the homeowners market in Florida, coupled with those that liquidated, Citizen’s Property Insurance Corporation, the state-sponsored insurer of last resort, increased its policies in-force to 1.3 million, representing a 68 percent increase since year-end 2021.

The main source of underwriting volatility remains natural catastrophes, the Fitch report outlined.

Efforts to stabilize the Florida homeowners market, “beset by rapidly growing loss costs and litigation rates on claims,” have come in the form of major reforms signed into Florida law in recent years.

Pro-insurance laws, signed into effect in December 2022, “include the removal of one-way attorney fees, prohibition of the assignment of benefits and limitations on the ability of policyholders to file bad faith claims against insurers,” the report stated.

Policyholder gains from the newly enacted laws include provisions to encourage prompt settlement of insurance claims through faster response time.

Liberty Mutual ‘Shifting from Fixing to Building’ in 2026, CEO Says

Liberty Mutual ‘Shifting from Fixing to Building’ in 2026, CEO Says  Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®

Four Practical, Data-Backed Steps for Preventing Nuclear Verdicts®  How Artificial Intelligence Is Changing Cyber Risk in 2026

How Artificial Intelligence Is Changing Cyber Risk in 2026  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark