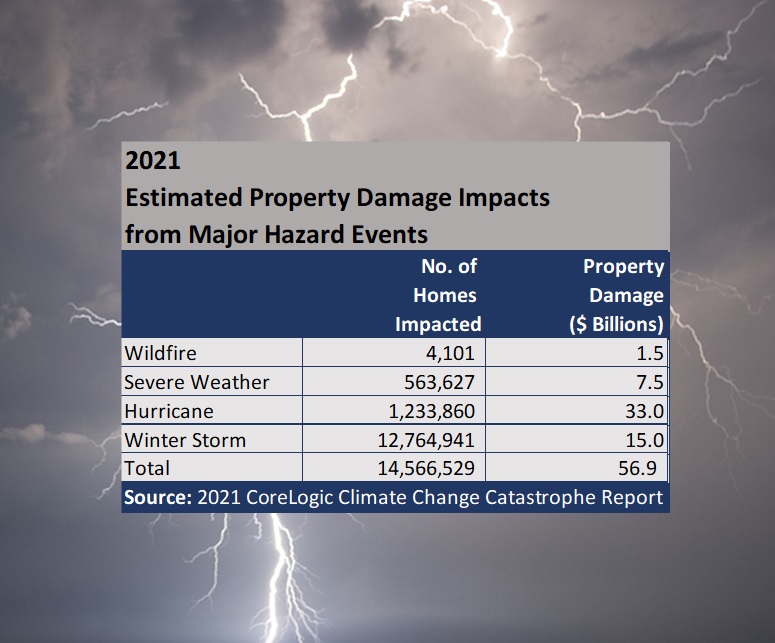

CoreLogic, a property information, analytics and data-enabled solutions provider, reported last week that 14.5 million single and multifamily homes were impacted by the largest natural catastrophe events of 2021.

That translates into 1 in 10 U.S. residential properties, CoreLogic said in a report titled “2021 CoreLogic Climate Change Catastrophe Report,” which also revealed that the 13 major hazard events analyzed by the firm caused $56.9 billion in property damage.

The events included hurricanes and severe weather events, such as tornadoes and hailstorms, as well as wildfires and winter storms.

Using advanced risk modeling technology, CoreLogic analyzed over 120 million residential structures in the U.S. for the analysis.

In addition to providing figures for the total number of homes impacted and property damage estimates—estimates of damage to property and internal contents—the CoreLogic report includes estimates of “reconstruction cost values,” or RCVs, for each of the event categories listed in the chart above.

The report explains that RCVs estimate the cost to rebuild the home in the event of 100 percent—total—destruction of a residential property, but not the cost to replace the property’s internal contents. The absence of an internal contents valuation and the assumption of full destruction distinguish RCV from the property damage values listed above. For example, CoreLogic shows an RCV figure of $395.4 billion for 100 percent destruction to all the properties that were impacted by 2021 hurricane events, which is more than 12-times higher than the property damage value of $33.0 billion reflecting partial destruction of building and contents.

The RCV is also not to be confused with property market values or new construction cost estimation, the report says.

Property impact varies by event, CoreLogic said in a media statement about the report, noting that while a wildfire has the potential to consume an entire property, there may also be damage caused by smoke, ash and odor to the neighboring structures that remain standing.

For the two wildfire events analyzed by CoreLogic—the Caldor Fire from August 14 to October 21, and the Dixie Fire from July 13 to October 25—the modeler estimated that more than 4,000 properties were damages at a cost of $1.5 billion. The RCV associated with the events, excluding contents damage, was $0.7 billion.

While risk comes in various degrees, any sort of property damage can have a compounding effect on the homeowner and economic stability, the statement continued.

Natural disasters are increasing in frequency and severity, impacting regions underprepared to handle an economic disruption, job displacement and the destruction of real estate assets, the statement said, noting that community members are often unable to pay their mortgages or afford reconstruction costs. Providing an example, the report noted that in Houma, La., which was hit head-on by Hurricane Ida in August, mortgage delinquencies rose to 13.3 percent in September compared to 7.4 percent before the Category 4 storm.

In addition to the two wildfires and Hurricane Ida, other events included in the analysis were:

- Southeast tornadoes on March 24 and 25, and Eastern severe weather on March 27 and 28

- Texas hailstorms from April 12 to 15

- Texas and Oklahoma severe weather on April 27 and 28

- Southern tornadoes from May 2 to 4

- Ohio Valley hail storms on June 17 and 18

- Central U.S. severe weather from June 24 to 26

- Central U.S. severe weather from July 8 to 11

- North central severe weather from Aug. 10 to 13

- Kentucky tornado on Dec. 10

- Flooding in the Northeast on Sept. 1 and 2

- Central U.S. freeze from Feb. 10 to 19

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec