Arch Capital Group reported a huge jump in fourth quarter net income, thanks in part to rate hikes and new business. But the Bermuda-based carrier’s insurance business experienced an underwriting loss, thanks, in part to a dip in the travel business and heavy natural catastrophe events.

Arch booked $533.1 million in net income for the 2020 fourth quarter, or $1.30 per share, versus $316 million, or $0.76 per share, in the 2019 fourth quarter.

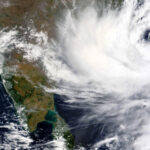

Pre-tax current accident year catastrophe losses for Arch’s insurance and reinsurance segments, net of reinsurance and reinstatement premiums reached $156.4 million in Q4, of which $400,000 was COVID-19-related losses.

Arch’s net investment income reached nearly $88 million during the quarter, compared to just under $120 million in the 2019 fourth quarter.

Here are insurance and reinsurance Q4 result highlights:

- Insurance gross premiums written surpassed $1.2 billion and net premiums written came in at $837.8 million. That compares to $1 billion and $688.7 million, respectively, in the 2019 fourth quarter. Gross premiums written jumped 19.6 percent and net premiums written soared 21/6 percent, due largely to rate increases along with new and expanded business accounts. Decreased travel business related to COVID-19 served as a counterbalance.

- The insurance combined ratio landed at 101.7 in Q4 2020, compared to 102.1 in Q4 2019.

- Arch’s insurance unit reported a $12.6 million underwriting loss, compared to a nearly $13.9 million underwriting loss in the same, year ago quarter.

- Q4 reinsurance gross premiums written were booked at $537.9 million, and net premiums written were nearly $490.9 million. That compares to $432.2 million and $338.9 million, respectively, a year ago. Gross premiums written jumped 24.4 percent, and net premiums written spiked nearly 45 percent.

- The reinsurance combined ratio was 91.3 in Q4, compared to 93.8 in the 2019 third quarter.

Source: Arch Capital Group

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?