One of Warren Buffett’s top deputies has amassed a stake in Berkshire Hathaway Inc. valued at more than $100 million.

Ajit Jain, the insurance executive who was named a vice chairman of Buffett’s conglomerate earlier this month, disclosed the holdings in a regulatory filing on Thursday. A large portion of the stake is held by a foundation and trusts in his family’s name, and his wife also owns some of the shares. Jain directly controls about $22 million of the stock.

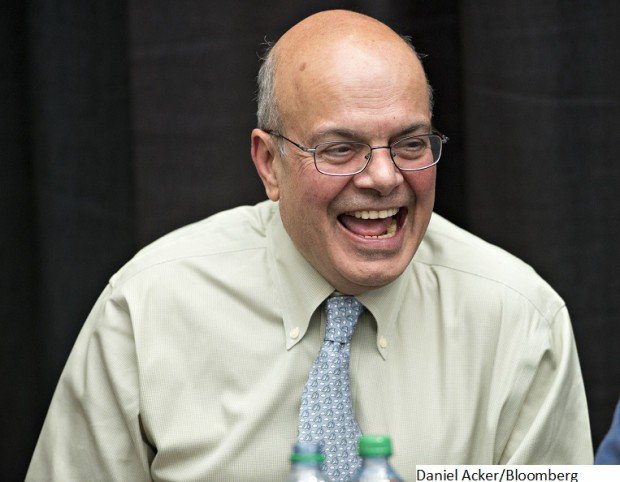

The disclosure offers a glimpse into the finances of one of Berkshire’s most important executives. Jain, 66, joined the Omaha, Nebraska-based conglomerate three decades ago and led a push into the reinsurance industry. Eventually working from an office in Stamford, Connecticut, he built a business that has supplied billions of dollars for investments and acquisitions. Buffett, 87, has said repeatedly that Jain probably made more more money for shareholders than he has.

Last week, the billionaire Berkshire chairman and chief executive officer promoted Jain and Greg Abel, the CEO of Berkshire’s energy unit, to newly created vice chairman roles. Jain will be in charge of the company’s insurance operations, which include Geico, Gen Re and a handful of other carriers. Abel, 55, oversees the other businesses, which range from railroad BNSF and Fruit of the Loom to Duracell and Dairy Queen. Buffett said the promotions were part of a “movement toward succession.”

Subsidiary Compensation

Even with Jain’s prominent role, his wealth has been hard to pinpoint. His pay hasn’t historically been included in Berkshire’s proxy filings, though some of the company’s insurance subsidiaries disclose what they pay him. National Indemnity said he received $11.8 million in 2015, for instance.

Abel’s compensation has been easier to follow. Berkshire Hathaway Energy, the business he ran, regularly disclosed his pay. (It was $17.5 million in 2016.) Abel also owned a stake in the unit that could be converted into more than $400 million of Berkshire stock, according to a regulatory filing last year.

Buffett has said his eventual successor as Berkshire’s CEO will earn more money than he could possibly need. Still, the billionaire has said the person who follows him shouldn’t be motivated by “ego” or “avarice” to “reach for pay matching his most lavishly compensated peers.”

For decades, Buffett has earned an annual salary of $100,000. Most of his wealth derives from his ownership of Berkshire shares, which he built from a struggling textile maker into a business now valued at more than half a trillion dollars.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers