Among the insurance-related highlights of Berkshire Hathaway’s annual meeting in Omaha, Neb. was Warren Buffett’s answer to a question about succession planning for subsidiaries.

“There are no tea leaves to read in the fact that Ajit [Jain] is supervising Gen Re from this point forward,” Buffett said, during the afternoon part of a question-and-answer session.

With the comment, Chairman Buffett was getting to the heart of the query, which started with an observation from the questioner that it makes sense for General Re’s next chief executive to report to Jain, the leader of National Indemnity (Berkshire Hathaway Reinsurance Group).

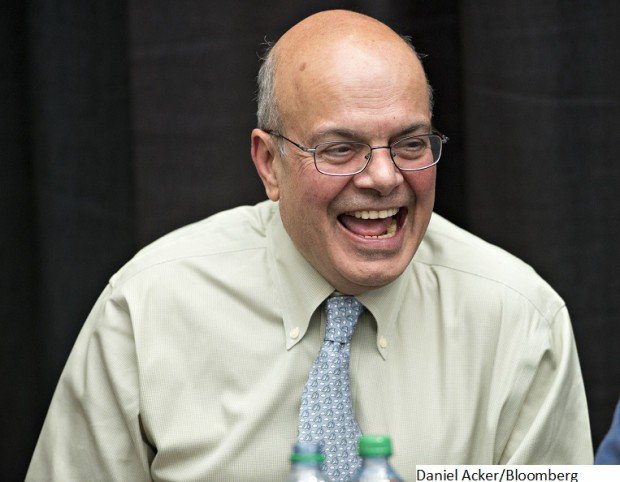

News reports earlier this month revealing that Franklin “Tad” Montross, the CEO of General Re would be step down at the end of the year—and that his successor will report up to Jain instead of directly to Buffett—sparked speculation that Jain might eventually be Buffett’s successor. It also fueled the annual meeting question about subsidiary succession planning, and a related one about whether Jain would now have his plate too full to handle oversight of other insurance operations.

“I have found that really able people can handle so much,” Buffett said. “There’s just no limit to what talented people can accomplish,” he said.

“If I had something in insurance tomorrow that needed doing, I’d probably put Ajit on that too.”

Buffett, actually began his response praising Montross for the “absolutely sensational job” he has done for 39 years, and revealing that he tried several times to get Montross to stay on longer. “General Re was a problem child for a while…some brought on by itself and some external,” he said, repeating observations he has made in the past about the issues as Gen Re before Montross took the helm.

Moving on to discuss Jain’s responsibilities, Buffett gave a special shout-out to one of the companies that Jain oversees currently: Wilkes-Barre, Penn.-based GUARD Insurance, a national writer of workers compensation policies for small businesses. “We bought it a couple of years ago and it’s doing terrifically,” Buffett said.

“Ajit started a specialty operation a couple of years ago under Peter [Eastwood] that’s going gangbusters,” he added, referring to commercial specialty insurer Berkshire Hathaway Specialty Insurance..

“That’s one of the reasons we’re not announcing any names,” he said. “Who knows what happens in terms of the time when it [the need to pick a successor] happens, or what happens to the person involved. Maybe their situation changes,” he said, going on to make his statement calling off the tea-leaf readers.

Sink or Swim

A separate questioner seemed worried about the prospect of Jain’s situation changing at some point. She began her question by citing an often-quoted Buffett remark about Jain (which appeared in the chairman’s 2009 annual letter): “If Charlie, I and Ajit are ever in a sinking boat—and you can only save one of us— swim to Ajit.”

“What if we can’t get to him in time?” she asked. More specifically, what would be the impact on National Indemnity and Berkshire? Is Jain replaceable, she wanted to know.

No, there’s not another Ajit in the house, and the loss would be “very significant,” Buffett admitted. “And that would be true of some other managers in some other subsidiaries” also, he added, noting that others, including GEICO’s Tony Nicely, have created billions of dollars of value too.

“Having a fantastic manager that has a large potential business available, and who makes the most of it, is huge over time,” he said, going on to draw parallels to other great leaders—including Tom Murphy and Daniel Burke of Capital Cities Television (which acquired ABC in the mid-1980s) and Amazon’s Jeff Bezos.

“Think of the value of Jeff Bezos to Amazon. It wouldn’t have happened without him,” Buffett said, noting that he and Berkshire Vice Chair Charlie Munger seek to align themselves with “really outstanding managers” that feel the same way about the company as they do.

“If we do that, we have an enormous asset—and we do have [that] in Ajit,” he said.

Munger interjected, “Ajit has a longer shelf life than we do,” prompting a Buffett follow up.

“Let’s not give up. I reject such defeatism,” Buffett said.

As for the question of successions for individual subsidiaries, Buffett said: “We don’t feel the need to follow any kind of organizational common view of ‘you do this,’ and ‘only so many people can report to you.'” At Berkshire, for “every decision that comes up, we just try and figure out the most logical thing to do at that time,” he said.

“We don’t have some grand design in mind like an army organizational chart…and we never will.”

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists