The threat of large-scale cyberattacks and a “deteriorating geopolitical landscape” since the election of U.S. President Donald Trump have jumped to the top of the global elite’s list of concerns, the World Economic Forum said ahead of its annual meeting in Davos, Switzerland.

The growing cyber-dependency of governments and companies, and the associated risks of hacking by criminals or hostile states, has replaced social polarization as a main threat to stability over the next decade, according to the WEF’s yearly assessment of global risks, published Wednesday at Bloomberg LP’s new European headquarters in London. The Davos forum starts Jan. 23 in the Swiss ski resort.

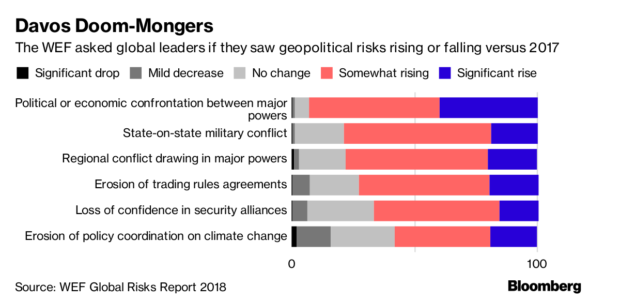

While the economic outlook has improved, nine in 10 of those surveyed said they expect political or trade clashes between major powers to worsen. Some 80 percent saw an increased chance of war.

“Cybersecurity is the issue most on the minds of boards and executives, given the visibility of state-sponsored attacks in an environment of increasing geopolitical friction,” John Drzik, president of global risk and digital at Marsh, which contributed to the study, said in an interview. As companies “invest in things like artificial intelligence, they are widening their attack surface.”

Drzik said recent high-profile security breaches that have fueled this perception include the WannaCry ransomware attack, which infected more than 300,000 computers across 150 countries, and NotPetya, which caused two companies losses in excess of $300 million. The cost of cyber-crime to firms over the next five years could reach $8 trillion, the WEF said.

Similarly, thousands of attacks every month on critical infrastructure from European aviation systems to U.S. nuclear power stations show state-sponsored hackers are attempting to “trigger a breakdown in the systems that keep societies functioning,” the WEF said.

In the preview, which would suggest Davos attendees are in for one of the bleaker forums in recent memory, almost two-thirds of global leaders saw risks intensifying from 2017. Climate change and extreme weather remained the greatest concerns of those surveyed. Economic worries receded as a unified pickup in growth and stocks at record highs suggest the world may finally be recovering from the financial crisis, a decade on.

Trump Visit

Trump’s appearance at the WEF’s annual meeting — the first for a sitting U.S. president since Bill Clinton in 2000 — is sure to dominate proceedings, as well as ruffle feathers. Treasury Secretary Steve Mnuchin has said Trump and his advisers will use the event to talk about their “America First” agenda, arguing that an economy that’s good for the U.S. is good for everyone else.

However “America First” is interpreted, Marsh’s Drzik said “unilateral, protectionist policies and nationalism are another key risk” that Davos attendees have identified, and one that clashes with the WEF’s core philosophy.

However “America First” is interpreted, Marsh’s Drzik said “unilateral, protectionist policies and nationalism are another key risk” that Davos attendees have identified, and one that clashes with the WEF’s core philosophy.

“To address complex issues like climate change, cyber-warfare and food security requires a multilateral response, but the political direction is going in exactly the opposite way,” Drzik said. “Trump is an example of this, but far from the only one.”

The report singled out the U.S. on trade after Trump pulled out of the Trans-Pacific Partnership and sought a renegotiation of the North American Free Trade Agreement. Around the world in 2016, about three-quarters of so-called interventions — such as imposing tariffs, or blocking imports of certain goods to protect domestic jobs — were protectionist in nature, and the trend appears to have continued through last year, the WEF said.

“What would be instructive is to hear from the new U.S. administration that it is interested and understands there are serious risks of the ilk we discuss in the report, and sees an important role for international cooperation,” Richard Samans, a member of the WEF’s managing board, said at a press conference when asked Trump’s appearance at the event.

The Global Risks Perception Survey quizzed 999 business leaders, politicians and academics — of whom 70 percent were male — on 30 potential global risks, ranging from deflation and asset bubbles to natural disasters, terrorist attacks and water crises. They identified trends that could exacerbate those risks, including an aging population and income inequality.

Each year the forum ranks these perceived dangers by impact and likelihood. While weapons of mass destruction retained their place as the most destructive risk, their use was judged the least likely to occur. Extreme weather events and other natural disasters were the next most impactful, and were also rated the most likely to occur. The next most likely: cyberattacks, mass data frauds or thefts, and a failure to slow climate change.

Drone Pirates

The report also delineated some more far-fetched dangers, including fleets of AI-controlled pirate drone ships that decimate the ocean’s fish stocks.

Societal polarization — 2017’s headline risk, after the populist wave led to Brexit and Trump’s victory — slipped down the rankings, but remained one of the main destabilizing forces, according to the report. The WEF reiterated that rising income inequality is one of the most important underlying trends determining global events.

The report will provide the backbone for the talks in Davos, whose theme this year is “Creating a Shared Future in a Fractured World.”

That slogan might clash with some of the realities of the $50,000-a-head event, which takes place in a sealed-off Alpine retreat guarded by thousands of soldiers and police. Famed for lavish, booze-fueled, corporate-sponsored parties with tight guest lists that take place after the official meetings are done for the day, the WEF has drawn criticism over whether it’s an appropriate forum to discuss solutions to society’s biggest problems.

WEF founder Klaus Schwab, in the report’s preface, didn’t address this criticism head-on, but said the forum aims to support change for the better of humanity by encouraging cooperation between governments and the private and charitable sectors. That said, even he struck a pessimistic tone.

“This generation enjoys unprecedented technological, scientific and financial resources,” but is “the first generation to take the world to the brink of a systems breakdown,” Schwab wrote.

Optimists, if there are any left, be warned: the Forum also identified several more tail risks.

- Simultaneous crop failures in the world’s bread-baskets.

- Artificial intelligence “weeds” choke the Internet.

- New waves of populism in mature democracies, and nationalism drives tension around contested borders elsewhere.

- Another financial crisis that overwhelms policy responses.

- Bio-engineering and cognition-enhancing drugs for the wealthy entrench the gulf between haves and have-nots.

- State-on-state conflict escalates unpredictably in the absence of international law addressing cyber warfare.

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next